Nvidia (NVDA) cemented its place as the market's favorite bet on artificial intelligence (AI) three years ago and it shows no signs of letting up.

Indeed, the company has become so important to investors that Nvidia's earnings report helps set the tone for trading for the broader market.

To recap: OpenAI's ChaptGPT kicked off the AI frenzy at the end of 2022. Seemingly insatiable demand on the part of AI hyperscalers for Nvidia's graphics processing units (GPUs) propelled NVDA stock past $1 trillion in market capitalization midway through 2023.

It took only about eight months for yet another blowout quarterly earnings report to push Nvidia stock past the $2 trillion mark.

Cut to early 2024 when Nvidia's over-the-top first-quarter earnings – plus a NVDA stock split and a dividend hike – pushed its market cap past $3 trillion.

As of this writing, Nvidia, which replaced Intel (INTC) in the Dow Jones Industrial Average in late 2024, is the world's largest publicly traded company. Indeed, it became the first company to top $4 trillion in market cap in July 2025. Four months later, Nvidia briefly exceeded $5 trillion in market cap before shares eased back.

But then, long-time shareholders should be used to such outsized rewards and risks by now.

That's because volatility has always been the price of admission to this long-time market beater. True, Nvidia, a highly cyclical semiconductor stock, has vastly outperformed the broader market since going public at the end of the last century.

Quite naturally, it has done so with several vertiginous ups and downs along the way.

After losing half its value in 2022, NVDA stock more than tripled on a price basis in 2023, vs a gain of 24% for the S&P 500.

And as for 2024? Nvidia stock gained more than 170% vs a 25% rise in the broader market. The stock once again led the broader market in 2025, albeit by "only" 21 percentage points.

Nvidia's market-beating ways go much farther back than most folks might know, however. In fact, few stocks have done more for investors over the past few decades than Nvidia.

From its initial public offering at $12 a share in January 1999 through December 2020, NVDA stock created $309.4 billion in shareholder wealth, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Indeed, per Bessembinder's findings, which account for a stock's increase in market value adjusted for cash flows in and out of the business and other factors, Nvidia was one of the 30 best stocks over that 30-year time frame.

Looked at another way, over its life as a publicly traded company, Nvidia stock generated an annualized total return of 37.1%. The S&P 500, with dividends reinvested, returned an annualized 10.8% over the same period.

Importantly, most of the shareholder wealth generated by Nvidia came over just the past few years. That's because back in the day, the primary market for Nvidia's chips consisted of PC and console video game enthusiasts.

Happily for Nvidia, it just so happens that the company's powerful GPUs and related intellectual property are indispensable to the fields of artificial intelligence, professional visualization, cryptocurrency mining and more.

As noted above, NVDA processors are in demand for use in data centers – and especially data centers that power generative AI. Indeed, the company is struggling to keep up with orders from hyperscalers such as Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN) and Alphabet (GOOGL).

Few blue chip stocks offer so much exposure to so many emerging endeavors, which helps explain NVDA stock's amazing returns over the longer haul. AI has been NVDA's afterburner.

But as remarkable as the company's business may be, it doesn't quite get to the heart of what NVDA stock has meant to long-term shareholders and their brokerage statements. For that, consider the following facts about Nvidia stock.

The bottom line on Nvidia stock?

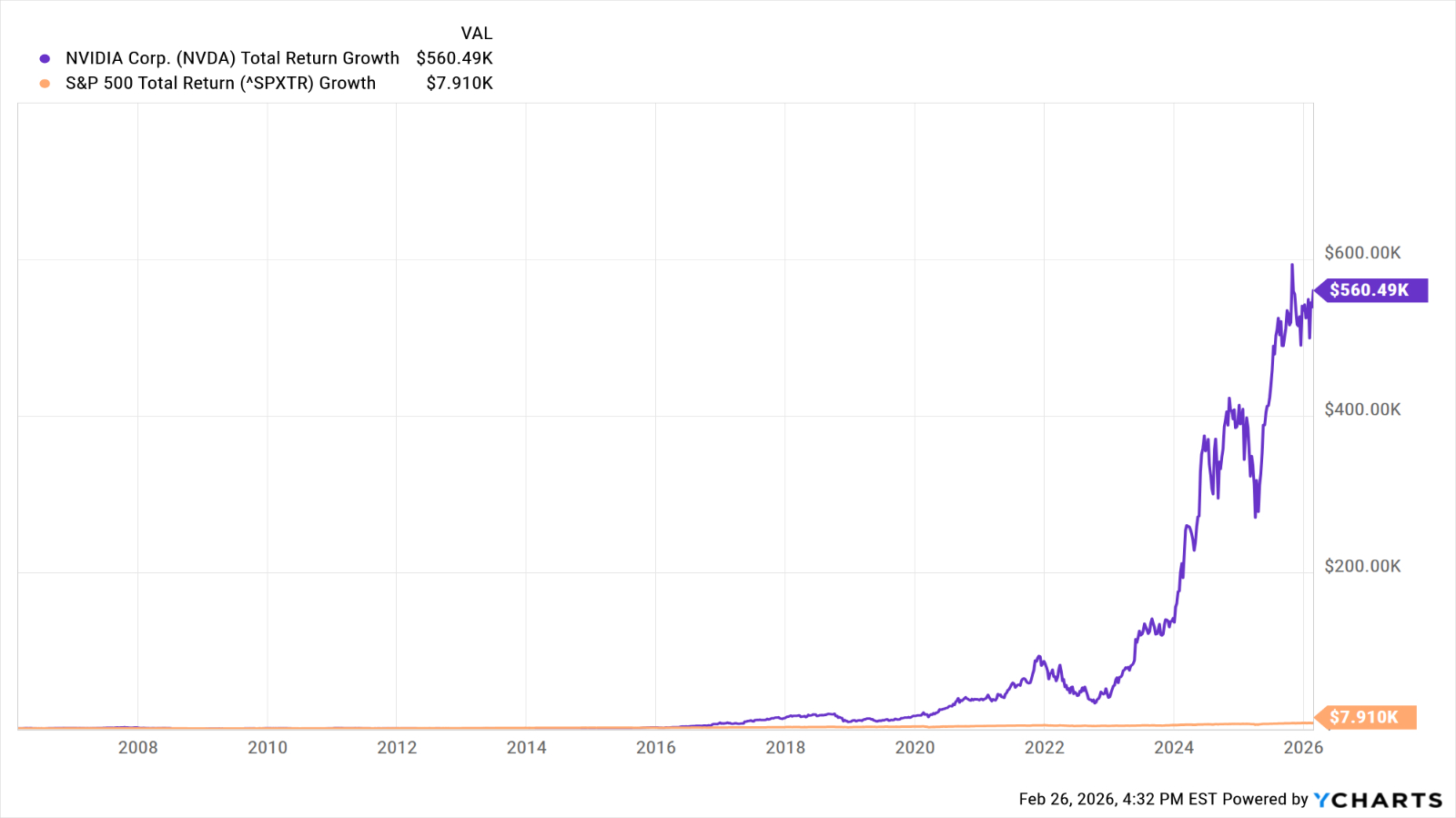

Over the past two decades, Nvidia stock generated an annualized total return (price change plus dividends) of 37.2%. The S&P 500, by comparison, generated an annualized total return of 10.9% over the same span.

What does that mean in dollar terms? Have a look at the above chart and you'll see that if you invested $1,000 in Nvidia stock 20 years ago, it would today be worth more than $560,000. The same amount invested in an S&P 500 index fund would theoretically be worth not quite $8,000 today.

As for adding to NVDA at current levels, the Street remains bullish even after the stock's incredible run. Indeed, NVDA rates as a top Dow Jones stock to buy.

Of the 63 analysts issuing opinions on Nvidia stock surveyed by S&P Global Market Intelligence, 49 rate it at Strong Buy, 11 say Buy, two call it a Hold and one has it at Strong Sell.

That works out to a rare consensus recommendation of Strong Buy. Indeed, Nvidia ranks among analysts' top S&P 500 stocks to buy now.

Speaking for the bulls, Oppenheimer analyst Rick Schafer says the AI build-out is still in its early days.

"Nvidia has transformed from a graphics company to a premier leading full stack AI solutions platform company," notes the analyst, who rates NVDA at Outperform (the equivalent of Buy.) "Compute continues to chase demand. NVDA ubiquitous AI platform best positioned to win."

Just remember that NVDA is ultimately a chip company, and the semiconductor industry is cyclical. As exciting as the AI build-out may be, Nvidia's growth prospects could still one day change.