Netflix (NFLX) stock is notoriously volatile. Shares lost about a quarter of their value over the second half of 2025 alone. And that was before the streaming giant made its $83 billion bid (including debt) for Warner Bros. Discovery (WBD).

While some nimble traders have surely used NFLX's gut-wrenching swings to their advantage over the years, plenty of punters with less fortunate timing have just as assuredly had their faces ripped off.

Happily for the company's truly long-time shareholders, they're in another class entirely.

Those who bought stock in the streaming media giant two decades ago – and then held and held and held through NFLX's many vertiginous ups and downs – have enjoyed outstanding returns vs the broader market.

As successful as Netflix has been – and may continue to be – it remains at its core a somewhat insecure business model. (Just look at NFLX stock's volatility for proof.)

On the plus side, Netflix is the king of on-demand streaming entertainment, serving TV series, films and games via 300 million paid memberships in more than 30 languages and 190 countries. It furthermore lays claim to arguably the best brand in the industry.

On the downside, Wall Street puts relentless pressure on the company to grow its subscriber base. As a consequence, Netflix must spend tens of billions of dollars on content to attract and retain viewers.

Competition from the likes of Walt Disney (DIS), Apple (AAPL), Paramount (PSKY), Amazon.com (AMZN) and others have forced Netflix to splurge on efforts to acquire, license and produce content over the past several years.

After peaking at $17.7 billion in 2021 – a whopping 50% increase vs the previous year – Netflix managed to cut spending on content.

The company spent about $13 billion on content in 2023, another $16 billion for programming in 2024 and plans to spend $18 billion in 2025.

Investors are counting on the company to keep leveraging those investments into the kind of outsized subscriber growth NFLX enjoyed at the tail end of last year.

After all, nothing hurts NFLX stock like losing subscribers. Recall that in April 2022, shares plunged after Netflix reported its first loss of subscribers in more than a decade. The company shed in excess of $50 billion in market value overnight.

It's also worth recalling that Netflix stock was already in a steep decline at that point. Sluggish subscriber growth and rising costs had long knocked it off its perch. Indeed, shares topped out above a post-split peak of $69 back in November 2021 before plummeting below the $20 price point by mid-2022. (Netflix underwent a 10-for-1 stock split in November 2025.)

The bottom line on Netflix stock?

Which brings us to what you would have today if you had invested $1,000 in Netflix stock 20 years ago.

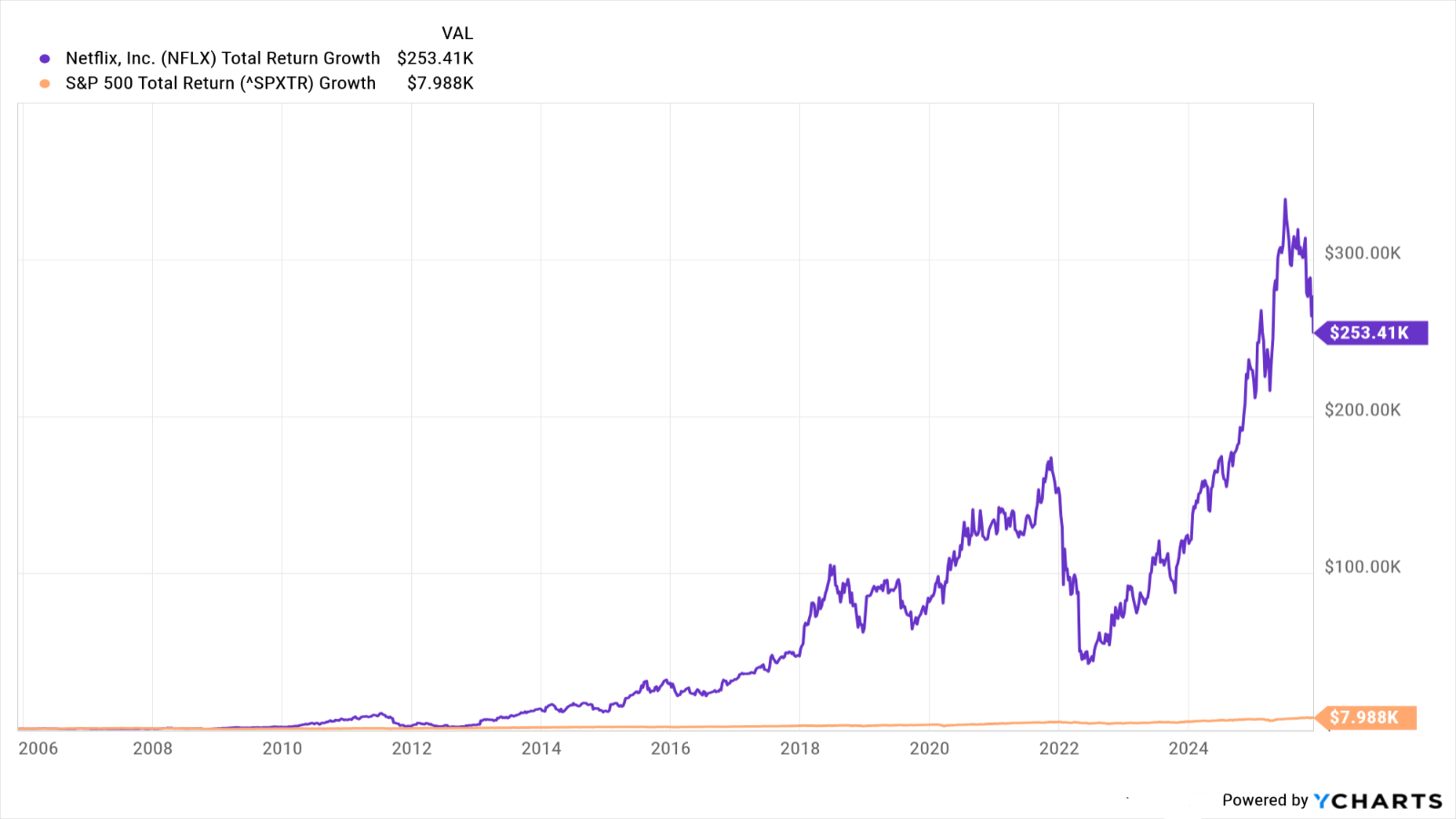

The good news is NFLX stock has clobbered the broader market over the long term, generating an annualized total return of 31.9% over the past two decades vs 11% for the S&P 500.

Netflix stock also outperforms the broader market over every standardized time frame past one year.

To see what these sort of returns look like on a brokerage statement, check out the chart below.

If you put $1,000 in NFLX stock 20 years ago, today it would be worth about $253,000.

By comparison, $1,000 invested in the S&P 500 over the same time frame would theoretically be worth about $8,000 today. (The broader market's return includes dividends, which Netflix doesn't pay.)

As for where Netflix goes over the next 12 to 18 months, the Street's consensus recommendation on this communication services stock is highly bullish.

Of the 45 analysts issuing opinions on NFLX stock surveyed by S&P Global Market Intelligence, 23 rate it at Strong Buy, eight say Buy, 12 call it a Hold, one rates it at Sell and one says Strong Sell. That works out to a consensus recommendation of Buy, with high conviction to boot.