Imagine a company that's enjoyed overwhelming success in its key markets for ages and also claims one of the most valuable and recognizable brands in the world.

This company was so important to both its sector and the broader economy that it was a component of the Dow Jones Industrial Average for nearly a quarter of a century.

One would expect this blue chip stock to have been an outstanding buy-and-hold bet. To be fair, for a good long while, it was.

That was then. This is now.

Unfortunately, the former Dow Jones stock we're talking about is Intel (INTC).

Shares almost doubled in 2023, helped by a multibillion-dollar cost-cutting campaign and the generalized euphoria surrounding all things artificial intelligence (AI). Intel bulls harbored hopes that the year marked an inflection point for the long-time market laggard.

It hasn't worked out that way. Intel fell as much as 60% from its late 2023 peak before climbing back to about breakeven today. Heck, shares remain about 33% below their all-time high.

It's hard to believe now, but once upon a time, INTC was one of the best stocks on the planet. Cut to the present, and it's not clear if the company can reclaim its glory days.

Intel still dominates the markets for central processing units (CPUs) for PCs and servers, but it's been losing share to rivals at an accelerating rate for some time. Nvidia (NVDA) and Advanced Micro Devices (AMD) are just a couple of its formidable competitors.

Where the semiconductor company really went wrong — apart from execution missteps and manufacturing delays — is the way it missed some of the biggest changes in technology. Intel famously whiffed on mobile, and now Nvidia is running away in generative AI.

There's a reason Nvidia replaced Intel in the Dow Jones Industrial Average in 2024.

It's been a curious ride for INTC investors. Thanks to its dot-com era heyday, Intel was one of the 30 best stocks in the world from 1990 to 2020.

In those three decades, INTC stock generated more than $340 billion in wealth for shareholders, or an annualized dollar-weighted return of 16%, says Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

However, the past two decades of that 30-year span have been another story.

The bottom line on Intel stock?

If you go all the way back to Intel's debut in the early 1970s as a publicly traded company, it beats the broader market handily. The chipmaker's annualized all-time total return stands at 14.4%. The S&P 500's annualized total return comes to 10.8% in the same span.

If you look at pretty much any other standardized period, an investment in INTC has been a major dud.

Intel stock trails the broader market by distressingly wide margins in the past five-, 10- and 20-year periods. Indeed, its five-year annualized total return is negative.

What does this sort of performance look like on a brokerage statement? Nothing short of ugly.

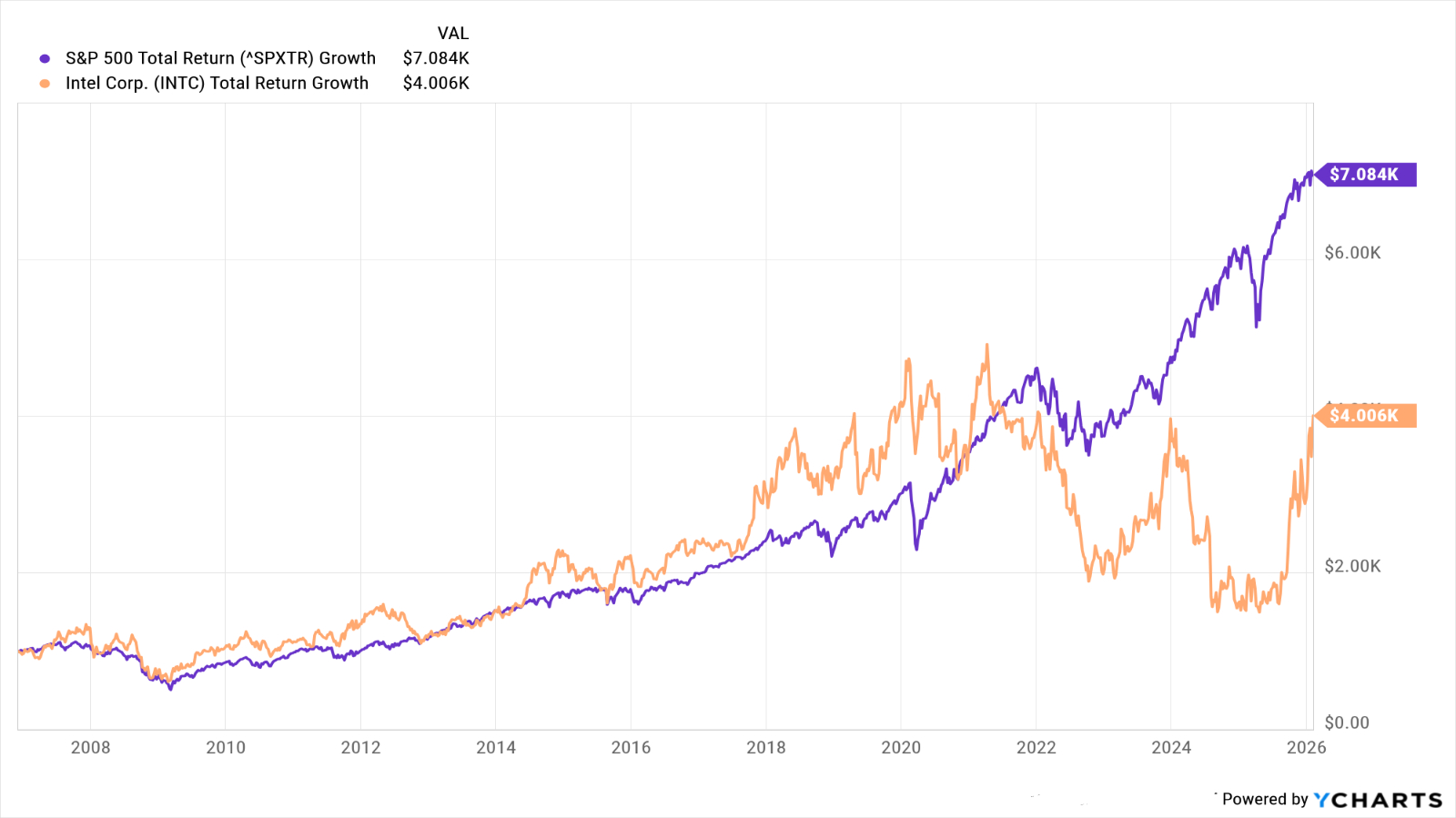

Have a look at the above chart, and you'll see that if you invested $1,000 in Intel stock 20 years ago, today your stake would be worth about $4,000, or an annualized total return of 7.4%.

The same amount invested in the S&P 500 would theoretically be worth about $7,000 today. That's good for an annualized total return of 11%.

As illustrious and iconic as the Intel brand might be, Intel stock has been nothing but a sinkhole of opportunity cost for buy-and-hold investors for a very long time.

So where does INTC stock go from here? Wall Street is mostly sitting on the sidelines, giving it a consensus recommendation of Hold. Of the 47 analysts covering Intel surveyed by S&P Global Market Intelligence, eight call it a Strong Buy, one says Buy and 32 have it at Hold. Four analysts rate INTC at Sell, while two say it's a Strong Sell.

Among their worries: the company is in the midst of a major restructuring as it struggles to right its floundering foundry business. True, the federal government took a 10% equity stake in 2025, and that's given INTC stock a boost. However, the foundry business continues to generate operating losses and is having difficulty lining up outside customers, among other issues.