Amazon.com (AMZN) stock is underperforming the broader market by a wide margin so far this year, but it's been a remarkably remunerative bet for long-term shareholders.

Indeed, truly patient investors in Amazon stock have enjoyed astonishing returns over the decades.

Amazon, which joined the Dow Jones Industrial Average in February 2024, suffered some profound sell-offs over the years. At one point during its history, from peak to trough, Amazon stock lost over half its value, wiping out more than a trillion dollars in market value.

But, hey, that's just the price of admission to one of the best stocks of all time.

An analysis by Hendrik Bessembinder, finance professor at the W.P. Carey School of Business at Arizona State University, found that AMZN was one of the 30 best stocks in the world over three decades.

Between its initial public offering in 1997 and December 2020, Amazon stock created nearly $1.6 trillion in wealth for shareholders, according to Bessembinder's model, which includes cash flows in and out of the business and other adjustments.

Amazon started out as a modest website for book buyers. Today, it's the nation's largest e-commerce company. But that's only part of the story behind its extraordinary wealth creation. The firm is a giant in cloud-based services and artificial intelligence (AI), and a leader in streaming media and digital advertising.

Amazon has a massive footprint in the analog world too. It owns the Whole Foods grocery store chain and maintains sprawling logistics operations. The latter comprise a vast assemblage of distribution centers and fleets of commercial aircraft and trucks, among other capital-intensive assets.

The bottom line on Amazon stock?

Which brings us to what $1,000 invested in Amazon stock 20 years ago would be worth today.

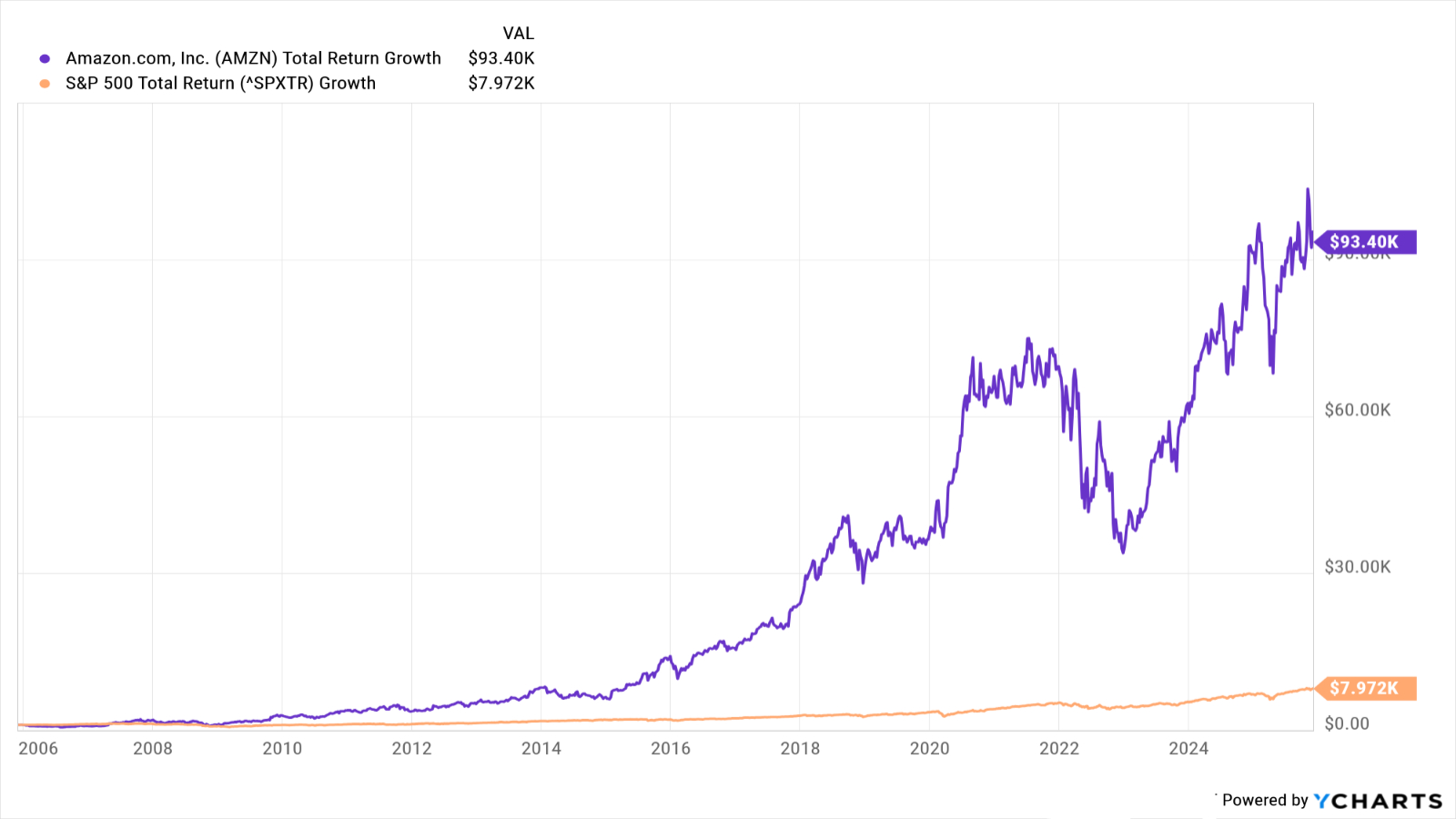

As you can see in the chart below, if you had invested $1,000 in Amazon stock a couple of decades ago, it would today be worth about $93,000. That's good for an annualized total return of almost 26%.

By comparison, the same sum invested in the S&P 500 over the same time frame would theoretically be worth about $8,000 today. That comes to an annualized total return (price change plus dividends) of 10.9%.

If past is anything like prologue, Amazon will continue to outperform the broader market at a healthy clip. For its entire history as a publicly traded company, Amazon stock generated an annualized total return of more than 31%. The S&P 500's annualized total return comes to 10.8% over the same span.

Put another way, Amazon stock has more than tripled the performance of the broader market since it went public. The way things are going, bulls are probably feeling pretty confident about Amazon keeping its streak alive.

Wall Street sure thinks it can – at least over the next 12 months or so. Of the 66 analysts issuing opinions on Amazon surveyed by S&P Global Market Intelligence, 47 call it a Strong Buy, 16 say Buy and three have it at Hold.

That works out to a rare consensus recommendation of Strong Buy, and with high conviction to boot. Indeed, Amazon makes the list of analysts' best Dow Jones stocks, as well as the Street's top S&P 500 stocks to buy now.

"Amazon.com is one of the few large-cap companies benefiting from the secular shift to e-commerce," notes Oppenheimer analyst Jason Helfstein, who rates shares at Outperform (the equivalent of Buy). "The Whole Foods acquisition created another leg of growth. Finally, AMZN's Web Services segment is now the global leader in cloud computing and has significant value."