Nvidia (NVDA) -) became Wall Street's favorite artificial intelligence stock pick after posting record first-quarter earnings this year. On the heels of that report, which highlighted growth in the generative AI space, the semiconductor company jumped beyond a trillion-dollar market cap, becoming one of the largest companies by that measure in the world.

And then, when the second-quarter earnings came around, Nvidia did it again, blowing past Street expectations and cementing itself as a Big Tech giant in the age of AI.

Related: Here's What Companies Nvidia Is Joining In the $1 Trillion Market Cap Club

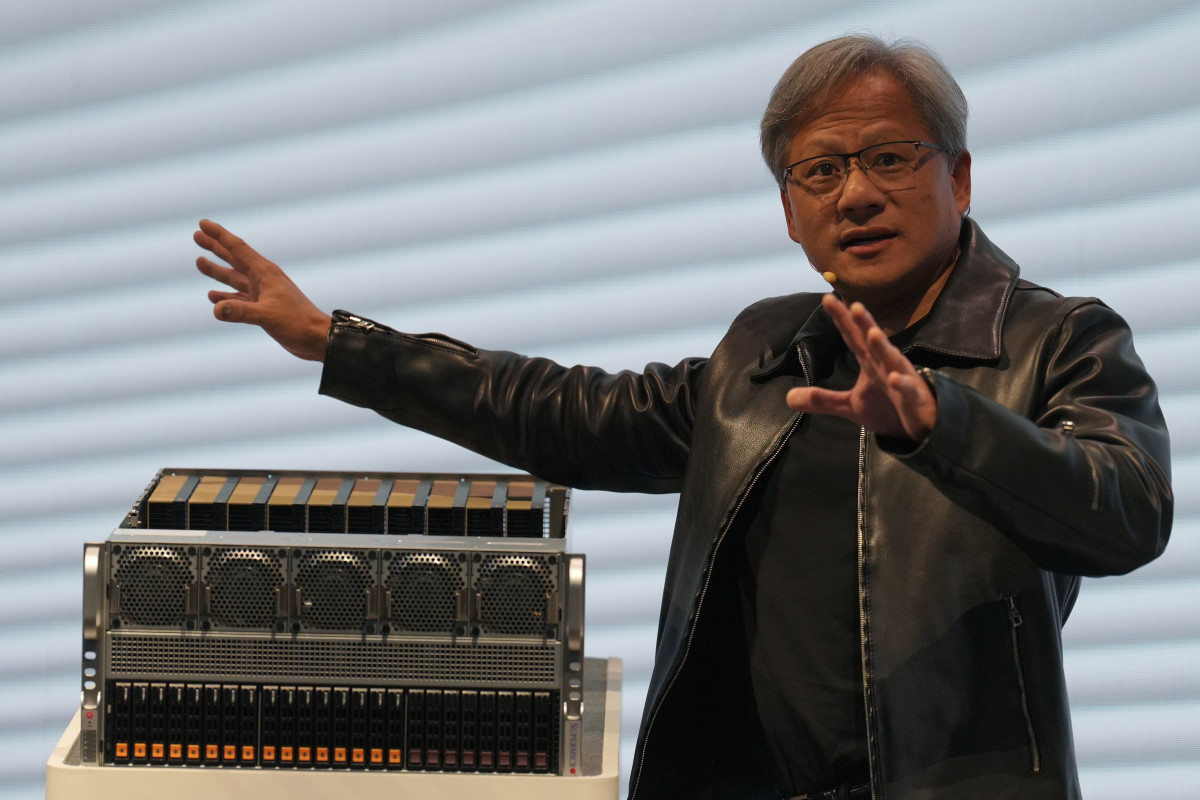

The company, however, isn't some brand-new chipmaking startup. Nvidia was founded by CEO Jensen Huang back in 1993. It began by exploring 3D graphics. By 1999, it had invented the GPU (graphics processing unit), which the company says set the stage to "reshape the computing industry."

The company's most recent area of focus has been providing the computer chips that make artificial intelligence software possible, an endeavor that has led analysts and investors to deem the company the picks and shovels of the AI gold rush.

But unlike such tech giants as Apple (AAPL) -) and Microsoft (MSFT) -), which have boasted enormous (and ever-growing) valuations for years, Nvidia, for a long time, was a smaller player. Debuting on the stock market in 1999, Nvidia didn't break a $10 billion dollar valuation until 2014. 2016 represented the beginning of the first big spike in the company's stock.

Shares of Nvidia spiked again in 2021, pushing beyond an $800 billion valuation before tumbling. Their most recent spike has been its most potent, granting the company a market cap of $1.03 trillion.

But, if given the chance to magically return to his thirties and do it all again, Huang said he wouldn't.

The entrepreneur's trick

Building and running Nvidia, he said, turned out to be "a million times harder" than he expected it would be.

"At that time, if we realized the pain and suffering, just how vulnerable you’re going to feel, and the challenges that you’re going to endure, the embarrassment and the shame, and the list of all the things that go wrong, I don’t think anybody would start a company," Huang said, speaking on a recent episode of the "Acquired" podcast.

"Nobody in their right mind would do it."

That, he said, is the magical, mind-bending trick of the entrepreneur. Not knowing how difficult it will be, they trick their brain into thinking: "'How hard can it be?' Because you have to."

Related: Jim Cramer, trusted analysts are raving over one incredible tech stock

"I’m still enjoying myself immensely and I’m adding a little bit of value, but that’s really the trick of an entrepreneur," Huang said. "If I go taking all of my knowledge now and I go back, and I said, 'I’m going to endure that whole journey again,' I think it’s too much. It is just too much."

The key, he said, to his surviving that journey of entrepreneurship, is that he remains surrounded by people who never once gave up on the company.

"That’s the entire ball of wax," Huang said. "To be able to go home and have your family be fully committed to everything that you’re trying to do, thick or thin they’re proud of you and proud of the company, you need that. You need the unwavering support of people around you."

Nvidia shares, up nearly 190% for the year, dipped slightly Friday.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.