When Hyundai acquired the robotics giant Boston Dynamics in 2021, very few observers thought that using mechanical dogs to spot-check welds in car factories would be the endgame. Today, at CES 2026, Hyundai offered a detailed look at what it really wants to do with robots: make them more humanlike, and then put them to work building cars.

The goal, Hyundai officials said, is simple: better safety, better quality, more durability and reliability, and at lower production costs.

But it doesn't take a robotics expert to know that automating car production at that level could transform the nature of human work, or even put human workers out of a job. And yet, Hyundai officials who spoke to reporters at CES were candid about what could happen to labor if this plan succeeds: things are going to change, just not right away.

"We understand the concerns about job security when you deploy the robotic solutions," said Jaehoon Chang, the Vice Chairman of the Hyundai Motor Group. "But as we have demonstrated for our aspirations of human-centered [robotics], we must do the right thing for people in terms of collaboration. And that means we probably need more jobs."

That will include people, Chang said, to "guide, supervise and maintain" these robots. "We also need to make roles that can build the ecosystem."

Whether that's true or not remains to be seen, and will depend on the company actually succeeding at a goal that feels straight out of science fiction. But as many other automakers turn to "physical AI" to boost productivity and cut costs, the role of labor in a $3 trillion global industry is sure to be upended.

Hyundai's announcement is a bold one: to build "a scalable production system capable of manufacturing" 30,000 robots annually starting in 2028. And that same year, the automaker aims to have Boston Dynamics' humanoid Atlas robot working in its Georgia Metaplant, which currently builds the Ioniq 5 and Ioniq 9.

That will start with small tasks, Hyundai officials said, but by 2030, the plan calls for Atlas robots assembling components—taking on work that humans would find tedious, repetitive and even dangerous.

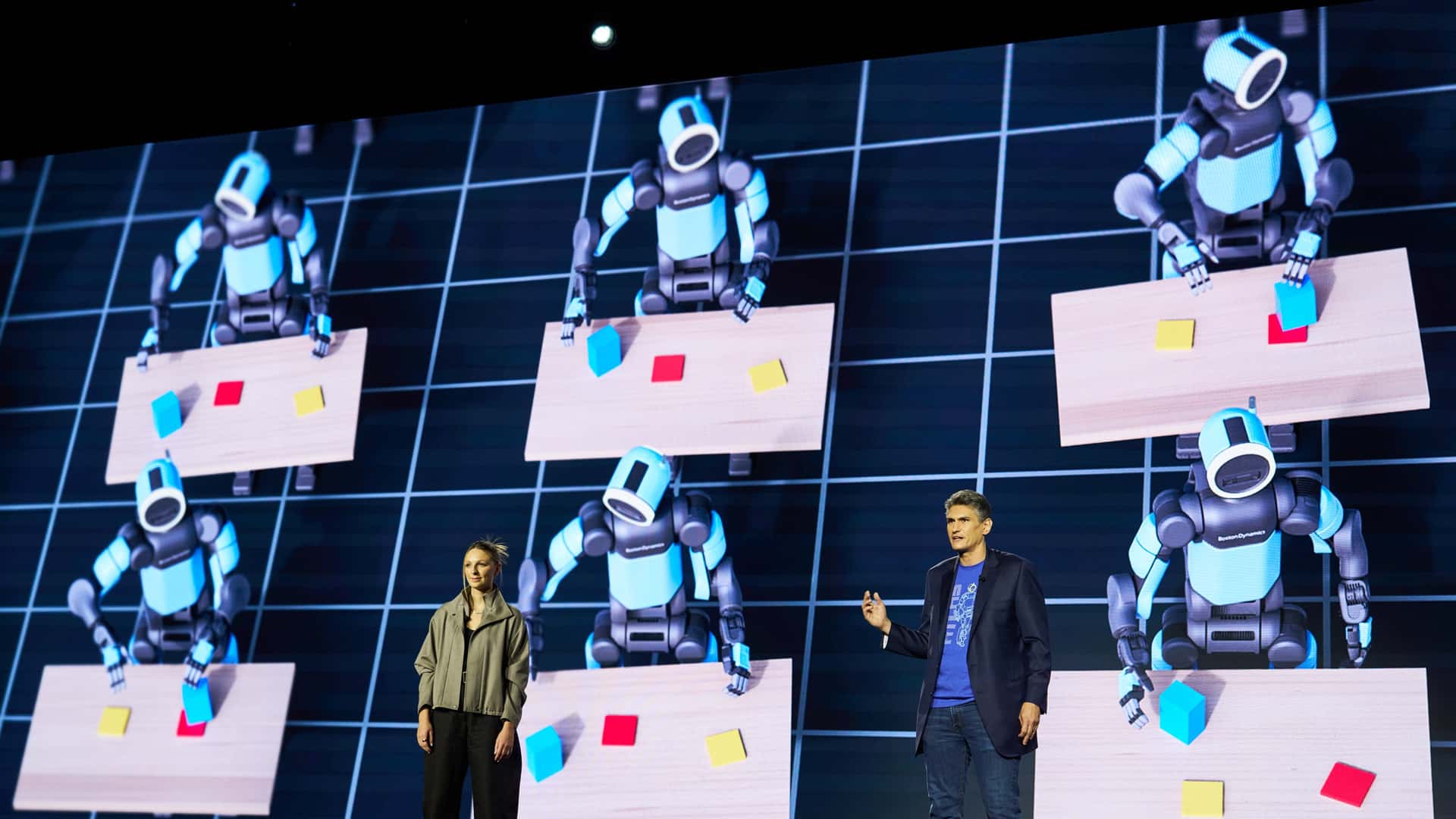

While an Atlas robot danced and posed onstage at CES, and even swiveled its hands, legs and body in ways that humans cannot, Hyundai officials openly admitted that the model was teleoperated by someone backstage. But they said that's merely a prototype; the blue robot that stood stationary next to it is the real deal, and the one Hyundai hopes to deploy in factories in just two years.

That news is sure to make at least some of Hyundai's 250,000 global employees a bit nervous. After all, it implies that fewer of them will be needed on production lines. But Hyundai insists that more advanced automation can "[ensure] safer working environments for factory employees," and allow humans to collaborate with these machines while taking on more complex, higher-paying work.

Moreover, Heung-Soo Kim, an executive vice president who oversees global strategy, added that using robot labor is tied to the company's next-generation factory setup—not its current labor plans.

If Hyundai and Boston Dynamics do successfully automate more of their factories with humanoid robots, Chang said the benefit to consumers would be better quality and consistency, because human error has been removed from more processes. But at a time when more and more buyers are demanding affordability, Hyundai customers should not expect robots to unlock cheaper new car prices.

"Of course, there will be an impact on our customers because of the automation, but the degree of the impact will not be so large," said Juncheul Jung, the automaker's head of manufacturing, through a translator. Jung added that labor at Hyundai accounts for about 5% to 10% of vehicle manufacturing costs.

Hyundai is hardly the only automaker looking to make humanoid robots. Tesla has been developing its Optimus robot for several years and has also said it hopes to employ them in car factories, all while making claims about how the robot could make up most of its value someday. And several Chinese automakers, including Xpeng, have stepped up their efforts to do the same thing.

While CES is no stranger to fanciful dreams, Boston Dynamics CEO Robert Playter said his company has a "commercial maturity" and pathway to monetization that other robotics firms do not. "It's been shocking for us in the last sort of three to five years, just how quickly the number of robot companies has proliferated," Playter said. "Somebody can put together a machine and, using some relatively open source AI, get it to walk."

Under Hyundai's ownership, Playter said the goal is to go beyond car factories and offer Atlas through a "robotics-as-a-service" subscription approach. He said Boston Dynamics aims to sell "a few hundred" of its Spot robotic dogs and generate about $100 million in revenue this year. But he has much more in mind down the line: a humanoid robot from Boston Dynamics could be used in elder care, for example, where spending has dramatically increased in recent years.

Those opportunities, coupled with Hyundai's own manufacturing scale and capital, give the company an edge that others do not have, Playter said. "They're all still doing, for the most part, demos," he said. "That's not our approach."

Contact the author: patrick.george@insideevs.com