Fitch Ratings revealed that Hurricane Milton will push the total insured losses this year to more than $100 billion, marking the fifth consecutive year that insured losses have surpassed this threshold.

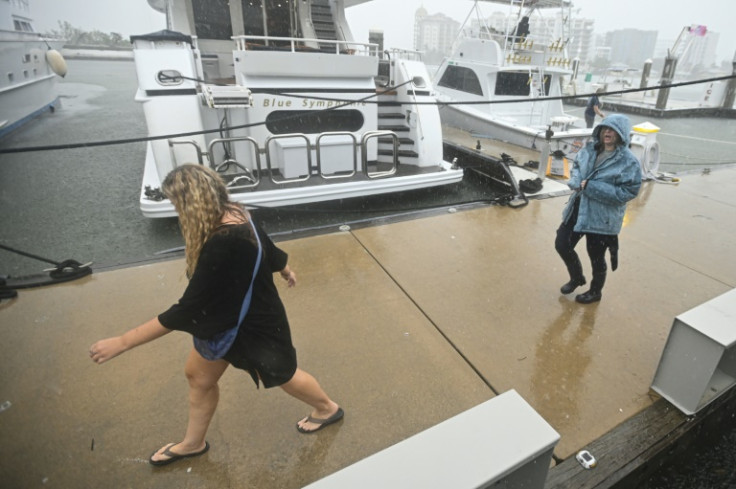

Hurricane Milton made landfall in Florida as a Category 3 hurricane. It then traveled across central Florida, before moving off the east coast as a Category 1 storm.

According to the assessment that Fitch published Thursday, the firm estimate the insured losses from Hurricane Milton in the range of $30 billion to $50 billion. This will be the largest insured loss since Category 4 Hurricane Ian swept through in 2022, causing $60 billion in losses.

Fitch added that higher demand coupled with limited supply of labor and materials needed to adjust claims and repair/rebuild following multiple large-scale disasters can increase insured losses by 20% or more.

In addition, Hurricane Milton is expected to be a significant event impacting fourth quarter and 2024 earnings of insurers with Florida exposure.

"The insurance losses will hit reinsurance attachment points, shifting a meaningful amount of losses to the reinsurance market, particularly from the Florida specialist companies with lower retentions," Fitch further explained.

Hurricane Milton follows closely on the heels of Hurricane Helene, a Category 4 hurricane that devastated the southeast U.S. two weeks earlier.

Reuters reported that analysts mentioned that Florida appeared to have avoided a "worst-case scenario."

"A broad spectrum of insurance companies will be affected by Milton as primary Florida homeowners' writers manage risk accumulations by ceding a large proportion of business to third-party reinsurers," Fitch stated.

Most large national underwriters do not have substantial market share in Florida and have cut their policy liability through non-renewals to manage balance sheet exposure and reinsurance program costs.

Fitch also mentioned that the position of Florida homeowners' insurance market is already precarious and could further weaken with the path left by Hurricane Milton.

The sufficiency of reinsurance coverage is a key concern for Florida homeowners' specialists given relatively low absolute capital levels, limited business diversification and questions as to their ability to raise capital following large loss events.

Meanwhile, Fitch said the property market could see higher premium rates based on the ultimate losses from Milton and the amount of additional catastrophe losses for the remainder of 2024.

It is very likely that the reinsurance programs of domestic insurers would be likely to help absorb losses. However, the state specialists will be exposed if another storm would hit.

"We do not expect Milton's losses to exhaust catastrophe reinsurance protection for most Florida specialists; although individual insurers with unique risk concentrations or meaningful modeling errors may report higher-than-expected gross losses. Insurers remain exposed should an additional storm or storms hit Florida this hurricane season," Fitch added.