The trading week is about to serve up a heavy dose of consumer reality with a trio of earnings reports from the titans of fast food, consumer staples, and beverages. McDonald’s (MCD), Kraft Heinz (KHC), and Anheuser-Busch InBev (BUD) are all scheduled to report within a tight window starting early Wednesday, Feb. 11, providing a comprehensive look at how the American consumer is handling the high-cost economy of 2026.

This cluster of reports functions like a post-Super Bowl feast for analysts, revealing if shoppers are still willing to pay a premium for their favorite brands or if the vibe has shifted toward aggressive belt-tightening. And after what I ate during the big game, the belt-tightening will not be applied literally!

McDonald’s: I’m McLovin’ This Chart

Reports: Wednesday, Feb. 11, before the market opens.

McDonald’s enters this report under heavy scrutiny regarding its pricing power. The critical metrics won’t be the headline numbers, but the traffic trends among lower-income consumers, who previously showed a double-digit decline in visit frequency.

That daily chart below is solid, but I’ve just seen too many pops and drops to think MCD’s price is in the clear. Earnings will likely be critical here.

Kraft Heinz: The Pantry Stress Test

Reports: Wednesday, Feb. 11, before the market opens

Reporting simultaneously with McDonald’s, Kraft Heinz offers a different perspective: the cost of eating at home. Wall Street is bracing for a difficult report, with earnings expected to slide by more than 20% year-over-year and an associated decline in revenue. The primary headwind is North American retail, as shoppers trade down to private-label condiments and mac-and-cheese, the latter being part of Kraft’s most iconic brand.

This chart has the highest upside potential of the three in the near term, in my view. That’s simply because expectations have pressed it lower for nearly 2 years. An earnings beat and a positive forward-looking report from management could prompt a renewed interest in KHC. However, that’s a high risk for a high potential return situation.

Anheuser-Busch InBev: The Celebration Gauge

Reports: Thursday, Feb. 12, before the market opens

Topping off the feast, the world’s largest brewer reports on Thursday morning. This report is particularly interesting because it follows a year where U.S. spirits revenue actually fell. Can it be that consumers are rotating back toward lower-priced categories like beer and premixed cocktails? We’ll find out this week.

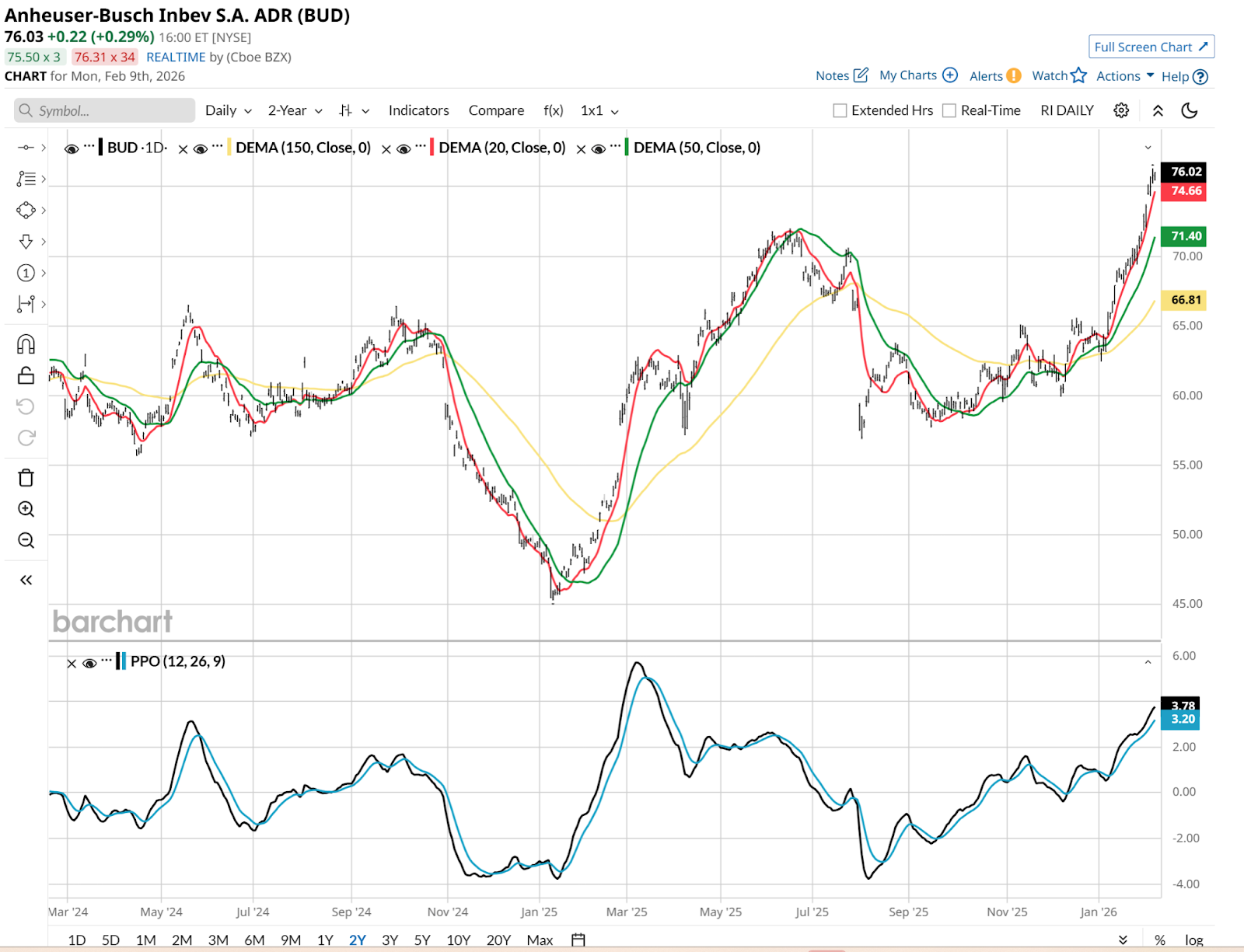

The stock has made the most of this newfound love affair with consumer staples stocks. But when a beer company’s stock price rises by more than 20% in a matter of weeks, it is already getting too rich. Still, earnings could provide another boost, now that BUD has taken out its June 2025 high.

ROAR Score Analysis: MCD Stands Out

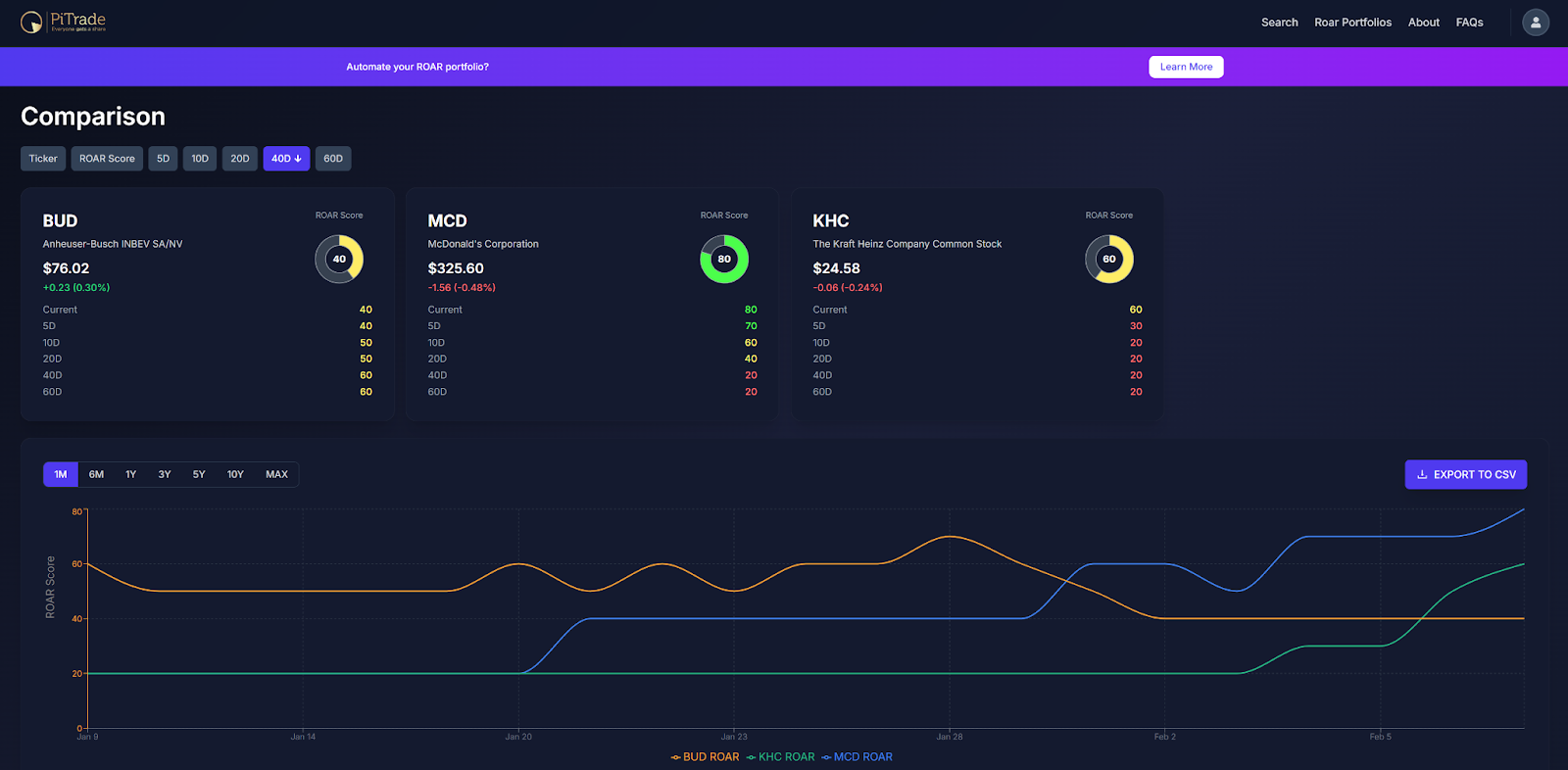

Using my proprietary Reward Opportunity and Risk (ROAR) approach to technical analysis, to complement the chart notes above, here are the three stocks next to each other, from the free research platform recently created to track ROAR scores for nearly any stock or ETF.

The higher the score, the lower the implied risk of major loss. So MCD is best-positioned going into earnings, given its steady climb from 20 to 80 over the past few months. KHC just peeked its head into neutral (average risk) territory, currently at a ROAR Score of 60. And BUD trails the trio at 40, and has not sniffed a score above 50 since about 2 months ago.

Keep this in mind about ROAR or any technical system: Earnings are a total wildcard, a crap shoot, an eternal risk to all stocks. It didn’t used to be that way, but in 2026, and likely beyond, stock prices move around much more wildly. Earnings have become an “event” now, since so many eyeballs are on them. Caution is always advised.

The Strategy for the Feast

This 24-hour block represents the ultimate test for the consumer staples sector in 2026. If McDonald’s misses on traffic while Kraft Heinz misses on volume, it confirms that the “value-seeking” consumer is now a structural problem rather than a cyclical one. Staples are supposed to be a defensive sector. But I’ve seen many times where, following a brief period of market leadership, they went south with the other 10 S&P 500 Index sectors. Even the most defensive stocks are no longer safe from the spending freeze.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app.