On the back of a reasonably successful quarter, AMD has confirmed that its earnings for the past three months surpassed Wall Street expectations, seeing revenue climb to $5.5 billion for the first quarter of 2024.

The California-based chipmaker reported a gross margin of 47%, with operating income reaching $36 million and net income at $123 million.

The total revenue represents a steady 2% increase compared with the same period last year, up from $5.4 billion, but down a considerable 11% compared with last quarter, when revenue stood at $6.2 billion.

AMD revenue is rising steadily

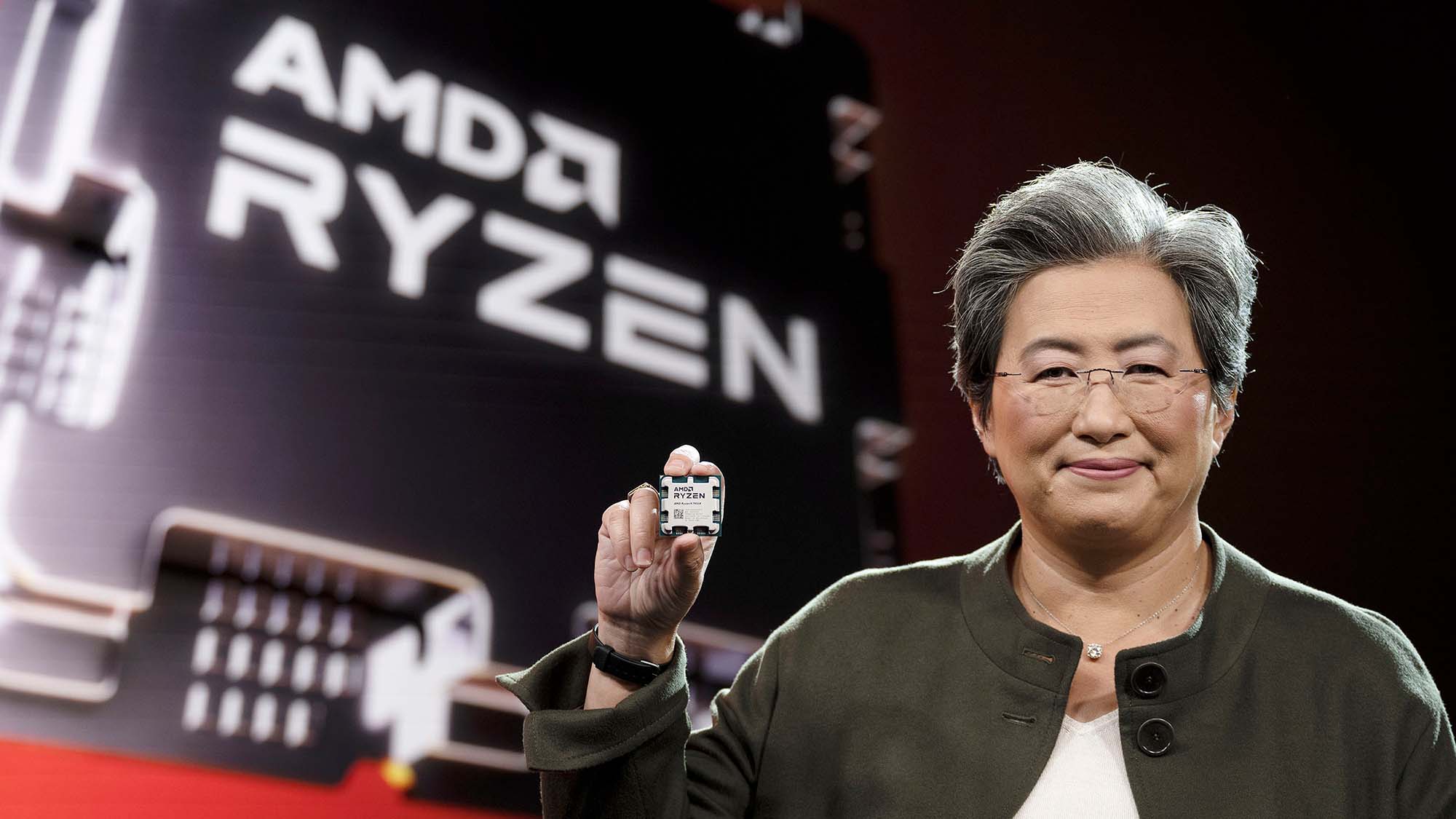

AMD CEO Dr Lisa Su attributed the strong performance to significant growth in both the Data Center and Client segments, each growing by more than 80% year-over-year, “driven by the ramp of MI300 AI accelerator shipments and the adoption of [the company’s] Ryzen and EPYC processors.”

Su added: “We are executing very well as we ramp our data center business and enable AI capabilities across our product portfolio.”

The Data Center segment achieved a revenue of $2.3 billion, up 80% year-on-year and now accounting for around 42% of the company’s total revenue. Client Revenue, up 85% year-on-year, accounted for $1.4 billion in revenue.

During the last three months, the addition of the latest AMD Ryzen Pro chips to its commercial AI PC processor portfolio, optimizations to its AI software ecosystem, and the introduction of Lenovo, Dell and Supermicro servers using the AMD Instinct MI300X accelerators all helped the company get positive attention.

Looking ahead, the company is now predicting between $5.4 and $6 billion in revenue for its second financial quarter, in line with Wall Street’s estimates.

AMD EVP, CFO and Treasurer Jean Hu commented: “Moving forward, we are well positioned to continue driving revenue growth and margin improvement while investing in the large AI opportunities ahead.”

More from TechRadar Pro

- These are the best processors

- Cloud and AI demand push Alphabet and Microsoft earnings to new high

- Fancy an upgrade? Check out the best business laptops and best mobile workstations