Fractionalized art, also known as fractional ownership or tokenized art, refers to the practice of dividing ownership of a single piece of artwork into multiple shares or tokens. Each token represents a fraction of the artwork's value and ownership rights. This concept is made possible by blockchain technology, typically utilizing or other token standards.

Fractionalized art allows individuals to own a portion of valuable artwork without having to purchase the entire piece. It enables greater accessibility to high-value art assets that may otherwise be out of reach for individual buyers due to their high prices. By dividing the ownership, multiple investors can collectively enjoy the benefits of owning the artwork, such as potential price appreciation, access to exhibitions, or the ability to lend or sell their shares.

The fractionalization process typically involves the creation of a special purpose vehicle (SPV) or an art investment platform that acquires the artwork and issues the corresponding tokens. These tokens are then distributed to investors based on the percentage of ownership they hold. Ownership and transactions of these tokens are recorded on a blockchain, providing transparency and security.

Fractionalized art has gained popularity in recent years, driven in part by the rise of NFTs and the increased interest in digital art. It has opened up new possibilities for art investors, collectors, and enthusiasts to participate in the art market in a more flexible and affordable manner.

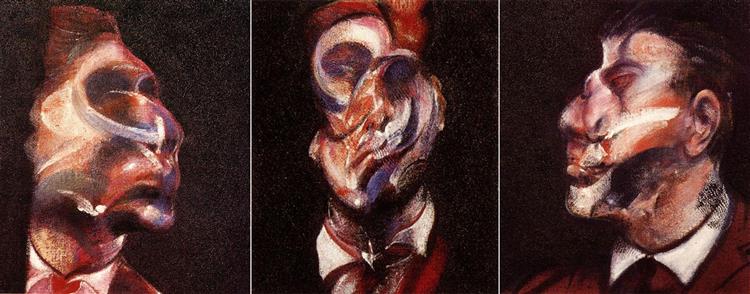

Francis Bacon is the first artist brought to the public by Lichtenstein-based Artex Group. It announced it would offer 385,000 Class B shares of Bacon’s Three Studies for a Portrait of George Dyer through a secondary stock offering.

‘Three Studies for a Portrait of George Dyer’ is one of modern art history's most famous oil-on-canvas triptychs, realized at Francis Bacon’s artistic peak.

The Artex sale takes fractionalized art ownership in a new direction by creating a liquid market for retail investors to own shares in valuable artwork — through a transparent, regulated public exchange instead of private fund-type structures.

Shares in Bacon’s Three Studies for a Portrait of George Dyer will be listed on the Artex Multilateral Trading Facility, or MTF, regulated by the Liechtenstein Financial Market Authority. Shares will be available in the premarket from June 19 to July 19; investors will make commitments by July 20, and trading will start on July 21.

The Artex Group plans to buy only paintings valued at $50 million. This way, they can divide the painting’s value into “regulated, liquid, and tradeable” shares offered to many investors at lower prices.

On the date of publication, Andy Mukolo did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.