Households will see a shake-up to their finances as a result of the mini-budget delivered by Chancellor Kwasi Kwarteng, including a raft of tax cuts.

Here is a look at what it could mean for you.

– Home movers

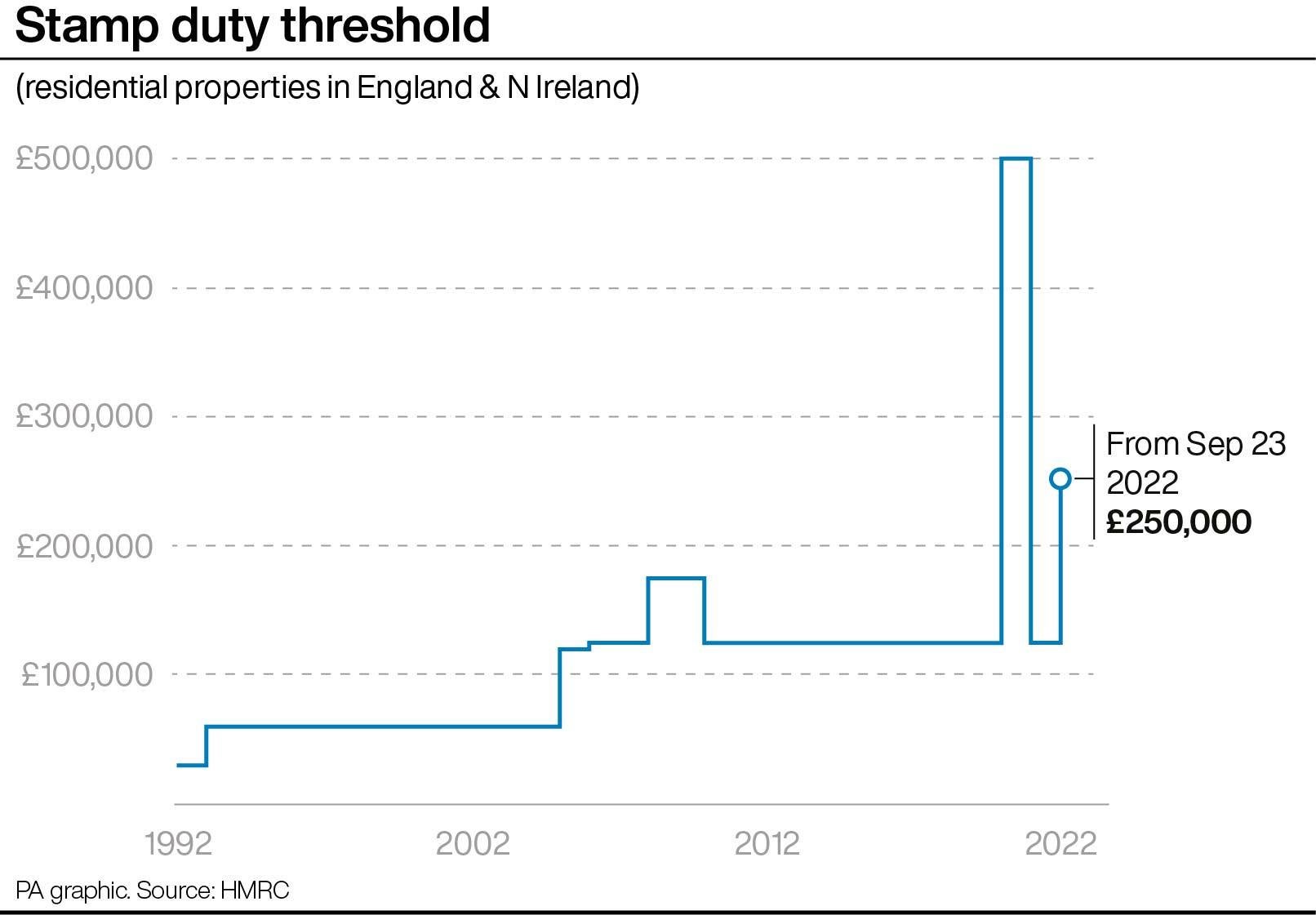

Permanent cuts to stamp duty in England and Northern Ireland could encourage more people on or up the property ladder.

The “nil rate” stamp duty band will be doubled from £125,000 to £250,000.

First-time buyers will pay no stamp duty up to £425,000. First-time buyers will be able to access the relief when they buy a property costing less than £625,000 rather than the previous £500,000.

The measures will reduce stamp duty bills for all movers by up to £2,500, with first-time buyers able to access up to £8,750 in relief.

But would-be buyers still face obstacles from rising mortgage rates and surging house prices, making it harder to raise a deposit.

Taking into account all of the recent Bank of England base rate hikes, a tracker mortgage is now around £210 per month more expensive on average than it was before the rate increases started last December, according to UK Finance figures.

A standard variable rate (SVR) mortgage is now around £132 more expensive per month.

Estate agents Savills said the biggest beneficiaries of the stamp duty changes are likely to be first-time buyers in London and the more expensive parts of the South East of England.

The Government said it will set out further details to increase housing supply in the coming weeks.

Government documents also said the Scottish and Welsh governments “will receive funding through the agreed fiscal framework to allocate as they see fit”.

– Taxpayers

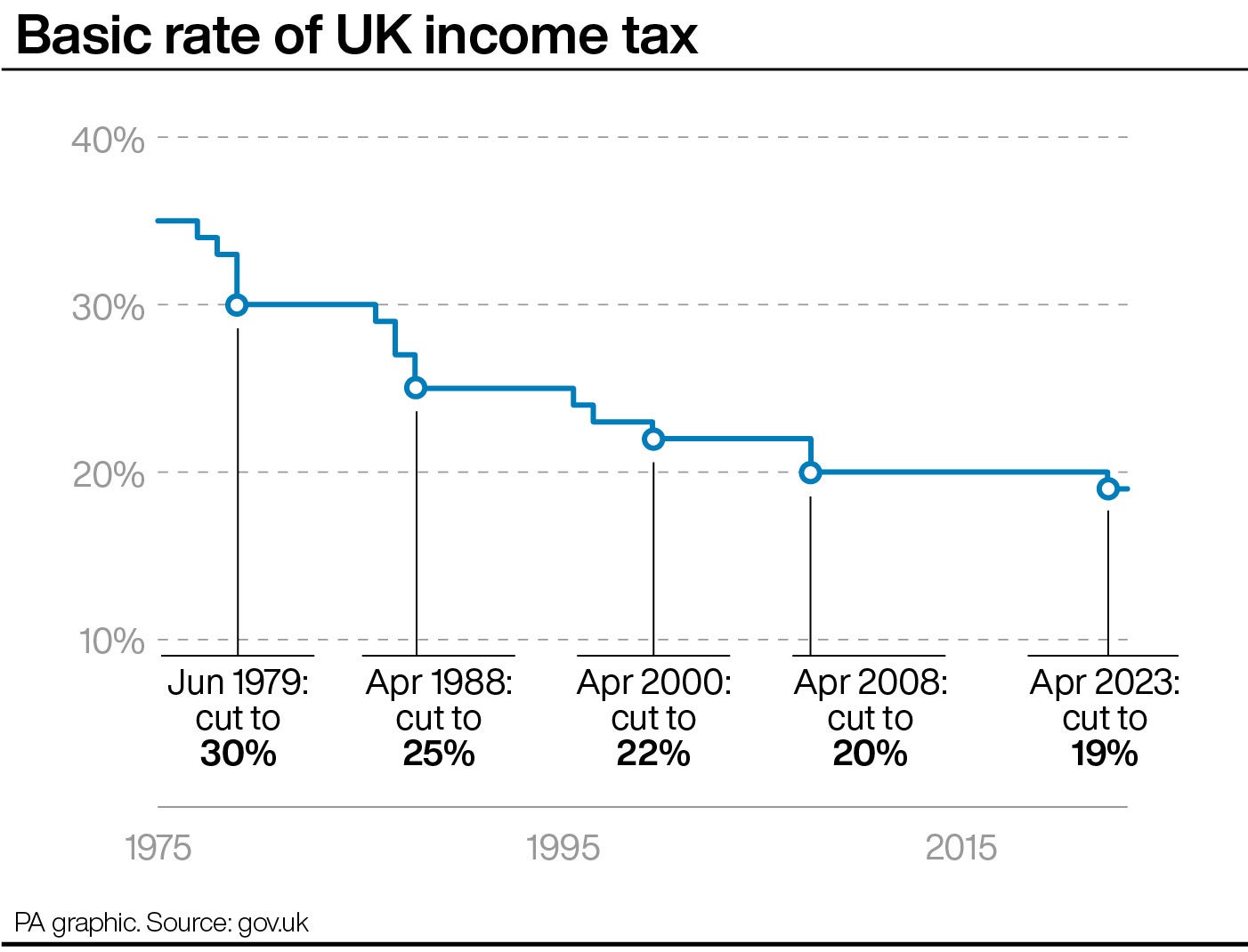

A 1p cut to the basic rate of income tax will take place a year earlier than planned.

From April 2023, the basic rate of income tax will be cut from 20% to 19% and will mean 31 million people will be better off by an average of £170 per year.

The additional rate of tax will also be abolished from April 2023.

Also from April 2023, there will be a single higher rate of income tax of 40%, rather than an additional 45% on annual income above £150,000.

It means that all annual income above £50,270 will be taxed at 40%, the current higher rate of income tax.

The Government said high tax rates damage UK competitiveness.

But some argue the move could fuel inflation.

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown said: “Our research shows that additional rate taxpayers are far more likely to have wiggle room in their budgets, and dramatically more likely to do so as we go through the cost-of-living crisis.

“So those who are the least desperate for help will receive the most.

“Putting money in the pockets of higher earners also raises an inflation risk. If they don’t need this extra cash to fill a hole in their budget, there’s a risk their spending will rise, pushing up prices even further.”

The 1.25 percentage point rise in national insurance contributions, which took effect in April, will also be reversed from November. This means 28 million people across the UK will keep an extra £330 a year, on average, in 2023/24, according to the Government.

– Savers

Those who would have otherwise been additional rate taxpayers will from April 2023 benefit from a tax-free personal savings allowance of £500, in line with higher rate taxpayers. This was not previously available to them.

There is likely to be a flurry of activity amongst Britain’s highest earners looking to make the most of the chance to get tax relief at 45% on their pension contributions— Sir Steve Webb, LCP

The personal savings allowance enables people to earn certain amounts of interest without paying tax on it.

There could also be a dash for higher earners to pile money into their pensions while they can still get relief at 45% on the cost of saving for their retirement.

Former pensions minister Sir Steve Webb, who is now a partner at consultants LCP (Lane Clark & Peacock), said: “There is likely to be a flurry of activity amongst Britain’s highest earners looking to make the most of the chance to get tax relief at 45% on their pension contributions.”

– Energy bill payers

The Government has previously confirmed the energy price guarantee, which will reduce the unit cost of electricity and gas so that a typical household in Britain pays, on average, around £2,500 a year on their energy bill, for the next two years, from October 1.

The £400 energy bills support scheme will be paid across Britain in six monthly instalments from October, with additional support for particularly vulnerable households.

Together, the price guarantee and support scheme will save the typical household at least £1,400 for the next year compared with the October 2022 price cap.

But charities have warned that many households are already in financial difficulty and struggling with bills.

– Workers

Plans include legislation to force trade unions to put pay offers to a member vote so strikes can only be called once negotiations have fully broken down.

Universal Credit claimants who earn less than the equivalent of 15 hours a week at National Living Wage will be required to meet regularly with their work coach and take active steps to increase their earnings or face having their benefits reduced.

This change is expected to bring an additional 120,000 people into the more intensive work search regime, according to ministers.

The Government said average UK real wage growth has been broadly stagnant for 15 years, due in large part to poor productivity growth.

It argues that the only sustainable way to raise living standards and fund vital public services is to unleash growth, including helping the unemployed into work and those in jobs secure better paid work.

To support working families, the Government also said it will bring forward reforms to improve access to affordable, flexible childcare.

– Jobseekers

Jobseekers aged over 50 will be given extra time with jobcentre work coaches, to help them return to the jobs market.

Rising economic inactivity in the over-50s is contributing to shortages in the jobs market, driving up inflation and limiting growth, the Government said.

– Bankers

The Government has said that scrapping a cap on bankers’ bonuses will encourage global banks to create jobs and invest, but critics argue it will see the return of a “culture of greed”.

– Alcohol drinkers

Alcohol duty will be frozen from February 2023.

The tax cut will save the consumer 7p on a pint of beer, 4p on a pint of cider, 38p on a bottle of wine, and £1.35 on a bottle of spirits, according to the Government.

– Freelancers

Some freelance workers will once again have to ensure they are paying the right tax by figuring out their employment status themselves.

Workers providing their services via an intermediary will once again be responsible for determining their employment status and paying the appropriate amount of tax and national insurance contributions— Government

The Chancellor said that he would rip up changes from 2017 and 2021 which transferred this responsibility to employers when a person provided services through their own company or other intermediary.

The changes to the IR35 rules would be repealed from April next year, the Government said.

“From this date, workers providing their services via an intermediary will once again be responsible for determining their employment status and paying the appropriate amount of tax and national insurance contributions,” it said.

“This will free up time and money for businesses that engage contractors, that could be put towards other priorities.”