I never recommend an investment solely for the tax benefits. It must be a good investment and be suitable for the client. If an investment makes sense as part of a diversified portfolio and can provide tax benefits, then it is a win-win.

Real estate is one example. Investors can own real estate in their investment portfolio through a REIT, or a real estate investment trust. REITs can own apartment buildings, student housing, warehouses, data centers, medical buildings, office buildings and other types of real estate.

Like any investment, REITs have their pros and cons. REITs can provide diversification — for example, from 2000-2020, REITs helped improved the performance and diversification of stock-bond portfolios, according to one study by TIAA-CREF. REITs can act as an inflation hedge to protect savings — real estate owners can increase rents. REITs can also have a high distribution yield.

However, REITs are not without risk. They can lose value. But it’s the tax advantages of real estate investment trusts that I want to focus on here. The following is adapted from our upcoming webinar on tax-smart investing.

Return of capital and REITs

A REIT’s dividend or distribution income is ordinary income if held in a taxable account like an ordinary brokerage account (non-IRAs and non-401(k)s). However, REITs can take advantage of tax deductions for depreciation and amortization — a portion of a REIT’s distribution can be classified as a return of capital (ROC), which reduces the amount of the distribution that is considered taxable.

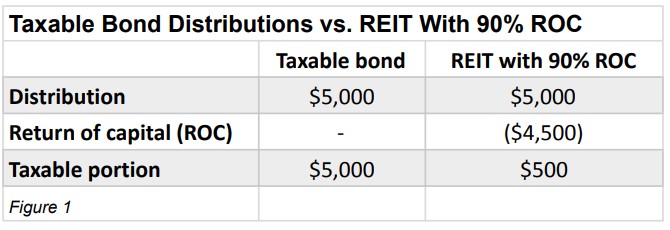

JP Morgan Asset Management found ROC distributions may reduce the taxable portion of REIT distributions by an estimated 60% to 90%, allowing for more of the dividend to be income-tax-free. Figure 1 above compares a taxable corporate bond distribution, which is 100% ordinary income, to that of a REIT with a 90% ROC. Here, the ROC significantly lowers the taxable portion of the distribution.

The downside to ROC is it reduces your cost-basis (the purchase price of the asset). This can trigger a larger capital gain when and if you sell the REIT later. A solution can be employing an aggressive tax-loss harvesting strategy with other money in your portfolio, booking the losses and using the losses to offset the capital gain from selling the REIT. The IRS allows you to offset long-term capital gains with long-term capital losses. Unused losses in the current year can be carried forward indefinitely on your federal tax return (state rules vary). Return of capital is an important tax advantage for REIT investors.

TCJA REIT rate reduction sunsets at the end of 2025

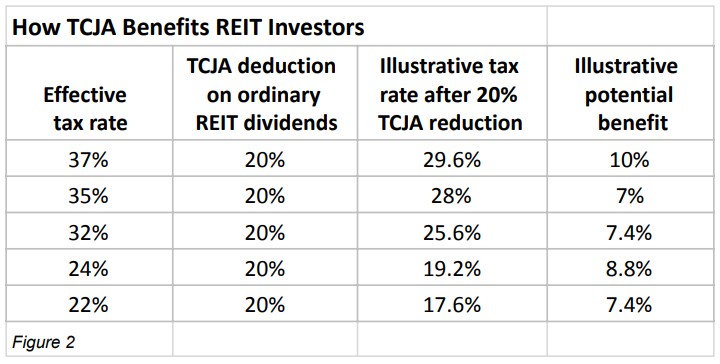

Another tax advantage of REITs was ushered in by the Tax Cuts and Jobs Act of 2017 (TCJA), the REIT rate deduction. TCJA offers a 20% deduction on qualified income for certain non-corporate taxpayers and captive REIT dividend income. For example, under the TCJA, the new maximum individual effective tax rate of 37% coupled with the 20% deduction equates to a 29.6% effective tax rate on ordinary REIT dividends as compared to 39.6% under prior law. (It’s important to note that the 20% rate deduction to individual tax rates on the ordinary income portion of REIT distributions is set to expire on Dec. 31, 2025.) Figure 2 illustrates the potential benefit the 20% rate reduction has on varying tax rates.

Putting it all together

For my clients, I may recommend anywhere from 5% to 15% in real estate investments, though it depends on each investor. As I mentioned earlier, I like REITs for their diversification — it’s another, different asset class to balance a stock and bond portfolio.

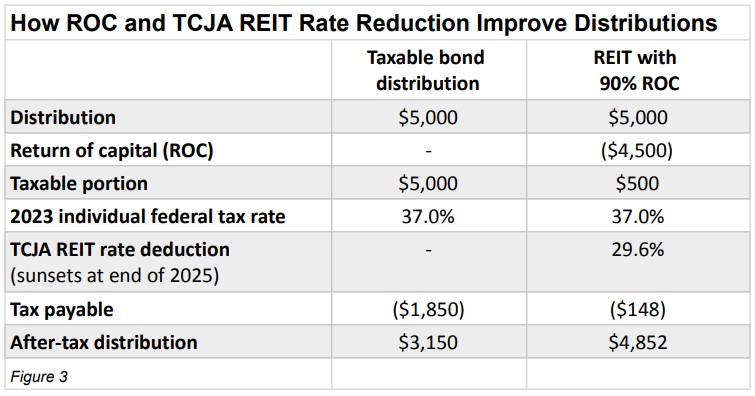

I also like the dividend income, which can get reinvested and help the investment compound over time. Finally, the tax advantages help, too. Figure 3 illustrates how the ROC and TCJA rate reduction for REITs can help improve the after-tax or tax-free distribution.

Some may question, why own the REIT in a taxable account? Why not put REITs in an IRA or 401(k) to avoid current taxation all together? That is a plausible idea and can make sense. However, distributions from IRAs and 401(k)s are 100% taxable as ordinary income. A REIT in a Roth IRA can make sense since qualified distributions are income-tax free. However, if you don’t have a Roth IRA or enough money saved in Roth accounts, owning REITs in taxable accounts may allow you to take advantage of the return of capital and TCJA rate reductions, which can significantly reduce the taxes on distributions.

Taxes aren’t the only consideration, but they’re not something to overlook either. There are many types of REITs and different types of ownership, such as publicly traded REITs vs. non-traded REITs. It’s important to work with a professional who can help you navigate the choices.

For more information consider our upcoming webinar on Tax-Smart Investing.

Michael Aloi is a Certified Financial Planner with 22 years of experience. For more information or a complimentary review of your pension options, please feel free to send him an email at maloi@sfr1.com.

Investment advisory and financial planning services are offered through Summit Financial LLC, a SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Summit is not responsible for hyperlinks and any external referenced information found in this article.