McDonald’s (MCD) is on a tear.

While the stock market has been trading much better lately, the S&P 500 has struggled to break out of its recent trading range.

Currently near 4,125, the S&P 500 was trading at this mark in January and February, in August 2022 and in May 2022. It's not been stagnant, but it hasn’t had a clean run over the past 12 months.

Don't Miss: Regional-Bank Preview: Technical Setup as Earnings Reports Loom

On the other hand, McDonald’s stock has been on fire, hitting an all-time high in six of the past eight trading sessions. The burger giant's stock at last check was 1% higher and is going for its 14th rally in the past 15 sessions.

Not many stocks are hitting new 52-week highs, but McDonald’s is one. Up 9% on the year, the stock is outperforming the S&P 500, which is up about 7.5% in 2023.

From a price-action perspective, this has been one of the strongest names in the market over the past month.

Trading McDonald’s Stock

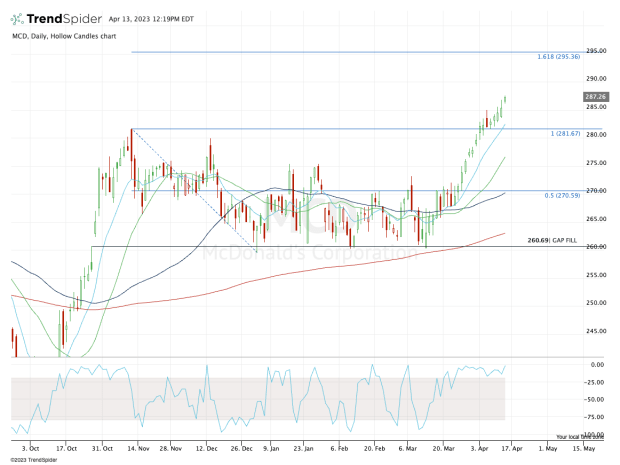

Chart courtesy of TrendSpider.com

This morning would have been a great opportunity for active traders had McDonald’s pulled back into the low-$280s. Not only would that have allowed for a retest of the prior all-time high at $281.67, but also for a test of short-term support via the 10-day moving average.

Didn't happen, though, as McDonald’s stock again pushed to new highs.

At some point, it would be healthy for MCD shares to reset down to short-term support.

Don't Miss: Can Ford Stock Motor Through Resistance? Check the Chart.

Whether that’s via the 10-day moving average or a measure that’s a bit larger — like the 21-day moving average — it will give traders a better risk/reward balance than buying a stock that’s up 14 of the past 15 sessions.

If one of these measures can come into play at the same time as a retest of the low-$280s, then all the better for dip buyers.

Should that area fail as support, then the $275 zone could be on the table.

On the upside, the $295 level is a reasonable target area for longs. But the shares will likely need a rest before climbing that high. That’s why bulls should be looking for a dip to buy.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.