Lyft, Inc (NASDAQ:LYFT) is set to print its third-quarter earnings after the markets close on Monday. The stock has been heavily beaten down since reaching an all-time high of $68.28 on March 18, 2021.

When the mobility service and ride-share company printed a massive second-quarter beat on Aug. 4, the stock rallied over 15% the following day but subsequently continued in its downtrend, which brought Lyft to an Oct. 11 all-time low of $10.83.

For the third quarter, analysts estimate Lyft will print earnings of 7 cents per share on revenues of $1.06 billion.

Lyft guided for third-quarter revenues to come in between $1.04 billion to $1.06 billion.

It should be noted that holding stocks or options over an earnings print is akin to gambling because stocks can react bullishly to an earnings miss and bearishly to an earnings beat.

Options traders, particularly those who are holding close-dated calls or puts, take on extra risk because the institutions writing the options increase premiums to account for implied volatility.

For options traders with weekly calls to profit from Lyft’s potential run higher or drop to new lows, the stock will need to move more than 17.76%, which is the implied move institutions have priced into the calls and puts expiring this Friday.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

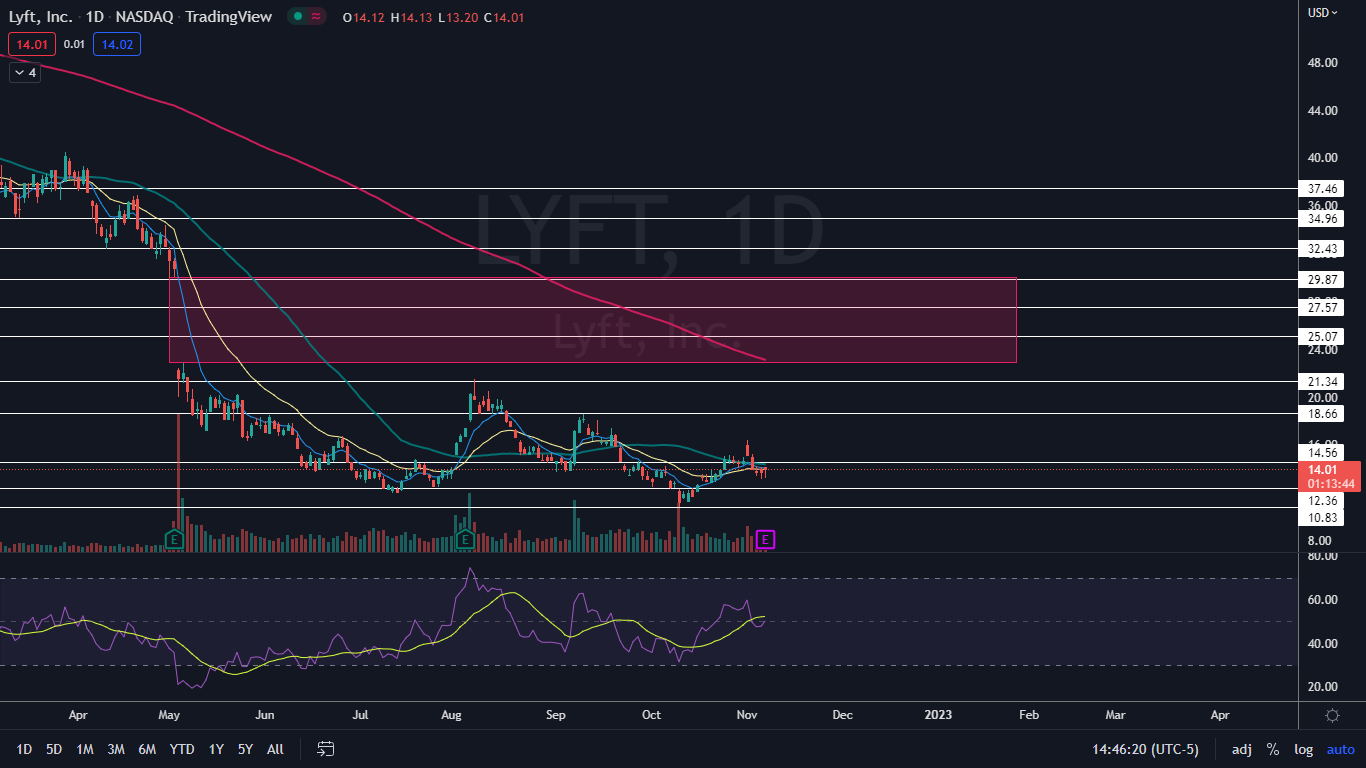

The Lyft Chart: Lyft negated its uptrend on Nov. 2, when the stock printed a lower low under the most recent higher low, which was created on Oct. 28 at $14.29. The stock hasn’t yet confirmed a downtrend is intact by printing a lower high, however.

- Over the last three trading days, Lyft has attempted to regain the eight-day and 21-day exponential moving averages (EMAs), as well as the 50-day simple moving average (SMA), but has failed. If Lyft receives a bullish reaction to its earnings print, the stock will regain all three moving averages, which would be a good sign for the bulls.

- The lower wicks on Friday’s and Monday’s candlesticks indicate there are buyers under $13.60. The buyers at that level have caused Lyft to print two hammer candlesticks in a row, which indicates higher prices could be on the horizon.

- If Lyft rises over the $16.40 mark after the earnings print, the stock will print a higher high, which would indicate the recent lower prices were a bear trap. If Lyft trades lower on Tuesday, Monday’s high-of-day will form the next lower high within a newly confirmed downtrend.

- Lyft has resistance above at $14.56 and $18.66 and support below at $12.36 and $10.83.

See Also: Lyft To Let Go Of 13% Of Workforce, Divest Vehicle Business To Beat Slowdown

Photo: Coutesy of Allie Michelle on flickr