Shares of Microsoft (MSFT) have certainly felt the full fury of the recent stock market carnage. MSFT stock now stands at the lowest level since June of last year. Microsoft has fallen just over 20% in the past four months after reaching the all-time highs near $340 at the end of 2021.

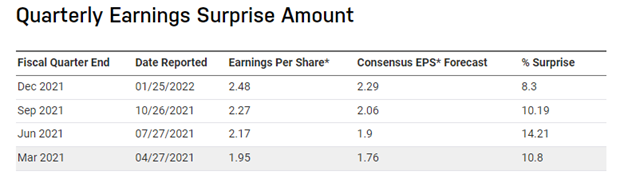

MSFT is a Buy rated stock in the POWR Ratings. The company has handily beaten earnings over the past three quarters, yet the stock price is 12 points lower than it was on July 27 of last year.

The combination of a lower stock price and better earnings makes the P/E ratio much more attractive. The current P/E is now well under 30 and at the lowest multiple in the past 12 months.

MSFT stock is deeply oversold on a technical basis. 9-day RSI just hit 30. MACD is at the lowest readings in the past year. Bollinger Percent B is hovering at the zero line after going negative. Shares are trading at a big discount to the 20-day moving average.

The last time all these indicators aligned in a similar fashion marked significant short-term lows in the stock (highlighted in aqua). MSFT is back at the major support area near $275 which has held in the past.

Implied volatility (IV) in MSFT options is also at an extreme as well. Implied volatility is simply a fancy way of saying the price of the options. This means option prices have become very expensive.

Let’s take a look at how much more expensive.

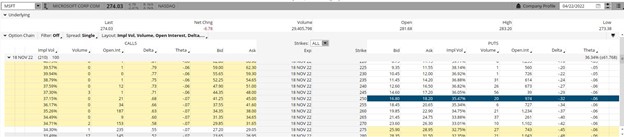

The option montage below shows the MSFT November $250 puts from Friday April 22 close.

Stock price is $274.03. Days to expiration is 210. $250 puts are trading at $17.50 (35.47% implied volatility).

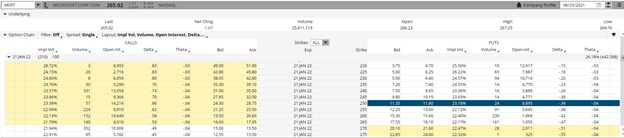

The option montage below shows the January $250 puts from 6/25/2021-the last time MSFT stock was trading around these levels.

Stock price is $265.02. Days to expiration is the same-210. $250 puts are trading at $11.50 (23.18% IV).

Let’s compare the two.

| Date | Stock | DTE | $250 put | IV | Breakeven | Cushion | % Cushion |

| 6/25/2021 | 265.02 | 210 | $11.50 | 23.18 | $238.50 | $26.52 | 10.01% |

| 4/22/2022 | 274.03 | 210 | $17.50 | 35.47 | $232.50 | $41.53 | 15.16% |

| Change | 9.01 | $6.00 | 12.29 | ($6.00) | $15.01 | 5.15% |

The stock price now is 9 points higher than the close from June 25. Days to expiration are exactly the same. The put price now is 6 points higher than the price back in June even though MSFT stock is higher. Normally higher stock prices make put option prices lower-everything being equal.

Everything isn’t equal, though. The reason is the 12-point jump in implied volatility (IV). This huge spike of over 50% makes option prices much more expensive.

Selling the $250 put obligates the seller to be a buyer of MSFT stock at $250. The seller receives the option premium upfront for that obligation. Higher option prices means the seller receives more money.

In our example, the put seller back in June would receive $11.50 for each option sold. Each option sold equates to 100 shares of stock. So the seller of the $250 put would receive $1150 up front. The seller would be obligated to buy 100 shares of MSFT stock at $250 for each put sold if MSFT was below that price at expiration.

Breakeven on the trade is the strike price of $250 less the premium received of $11.50-or $238.50. This provides a downside cushion of $26.52 (June stock price of $265.02 less breakeven of $238.50) or roughly 10%.

Now let’s look at the same scenario now. Selling the November $250 put brings in $17.50 in premium or $1750 for each put sold. $600 more today than back in June.

Breakeven on the trade is now $232.50 ($250 strike less $17.50 premium received). This provides a downside cushion of over 15%.

More money received upfront with a bigger downside cushion. All because IV has exploded higher.

Microsoft is looking more attractive on a fundamental basis with the P/E below 30 and at the lowest levels in the past year. Shares are also looking attractive on a technical basis as it reaches oversold readings that have corresponded to significant lows in the past.

Investors looking to add POWR Buy Rated Microsoft to the portfolio may want to consider taking advantage of the jump in option prices (IV) by selling out-of-the money puts. Get paid now to be a buyer later and lower.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

shares closed at $426.04 on Friday, down $-12.02 (-2.74%). Year-to-date, has declined -10.02%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

How To Get Paid To Buy Microsoft At A 15% Discount StockNews.com