You’ve done a good job saving for retirement, but questions still nag at you.

- Will my actual Social Security benefits meet current projections?

- Can I afford to stay in my home and pay ongoing costs to maintain the house and bring in caregiver services if necessary?

- Will I be able to afford nursing home costs beyond those for a caregiver?

- After these housing and long-term care costs, how much will I be able to leave to my heirs?

All your questions come as a group, not separately. Find your answers the same way, by considering all your assets together and then deciding how they can work together to best help you.

Meanwhile, the retirement world keeps changing

- Something is going to happen in the next 10 years or so with Social Security benefits. The government will have to cut benefits or increase taxes, or a combination, to prevent the Social Security trust fund from running out of money by 2034, at which point, the fund's continuing income is expected to cover 79% of scheduled benefits, according to the Social Security Administration. (Or they could follow my proposal, outlined in my article How to Fix Social Security and What to Do While We Wait.)

- If you are like most Americans over age 50, you are thinking of staying in your home to “age in place” during retirement. The Institute for Healthcare Policy and Innovation says 88% of people age 50 to 80 feel the same way.

- Baby Boomers are more likely to carry mortgage debt into retirement. About 42% of retirees still have a mortgage. That’s double the percentage from 1989, according to the Harvard Joint Center for Housing Studies.

- In this KFF poll, almost every adult preparing for retirement said they were concerned about how to pay for long-term care. The Cost of Care Survey by Genworth Financial shows that a home health aide costs around $6,000 per month, or $200 per day.

- And while your parents may have helped you out as you left the nest, nearly 60% of adults say they are providing financial support to their kids — even at the expense of their own finances.

- You may have other concerns that you hope to anticipate. Half of solo agers worry about needing help with daily activities. That raises questions about everything from managing health care services to managing the home or the retirement plan itself.

In my article How to Create a Retirement Plan That Checks All Your Boxes, I described the elements of an All-Asset Plan for Retirement Income that integrates your assets to provide the balance among the three L’s — lifetime income, liquidity and legacy — objectives most retirees are looking to achieve.

Let’s use Sally as our sample retiree to see how her current plan fared vs a new all-asset plan.

Sally is most concerned about caregiver and other LTC costs

Sally wanted to see how her current and any new plan actually met an unplanned and uninsured expense of long-term care. Sally understood that the care could range from a caregiver coming into her home to her moving into a nursing home. She decided to study the caregiver scenario first as part of her aging-in-place strategy and then to compare her current plan against a new look at an all-assets plan.

An important part of this process was to give her confidence about the flexibility of the plan to cover other circumstances, in addition to long-term care.

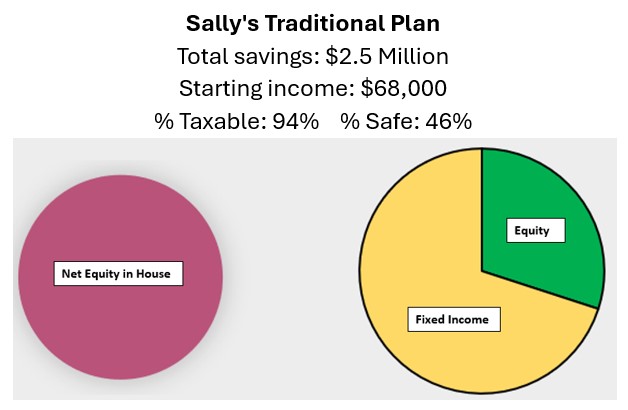

Here’s Sally’s current situation and plan:

- Personal info: Age 70, in excellent health

- Retirement savings: $1.5 million, 30% in stocks, 70% in bonds and CDs

- Investment accounts: 50% in a rollover IRA and 50% in personal (after-tax) accounts

- Additional income: $36,000 in annual Social Security benefits and $26,000 in annual pension

- Value of home: $1 million with no mortgage, not part of income planning

This plan does three things:

- Delivers current income from savings of $68,000 per year growing at 2%

- Maintains some level of retirement savings

- Together with Social Security benefits and pension, it carries the full costs of the home

That’s a start, but after meeting with an adviser, she developed an updated set of objectives:

- Money to age in place: Money for home maintenance and a caregiver. Sally figures on a $37,500 annual caregiver budget for five hours a day for five days a week.

- Income (after tax): $90,000 for all other expenses and gifting

- Liquidity: For unplanned expenses, e.g., nursing home or helping kids

- Legacy: Leave a legacy exceeding current net worth of $2.5 million

- Other: Lower income taxes and lower market risks

That’s quite a wish list, but she wants to “go big.”

Current traditional plan is not meeting all of her objectives

Sally starts at the top and wants to know whether modest caregiver costs of $150 per day for 250 days a year ($37,500 per year) can be met under her current plan, while also meeting all her expenses for home maintenance and her all-other budget of $90,000 a year (after taxes) from all sources. Even though she has $36,000 in Social Security benefits and $26,000 in a pension to meet these goals, she realizes she’ll need to withdraw $37,500 per year from her rollover IRA account.

Sally is also concerned about the taxes she’s paying on each withdrawal and the risk of liquidating her investment accounts in a falling market.

As she analyzes this scenario, she sees that she will be left with a portfolio that is not growing but falling — and failing to meet the objectives of having liquidity if things get worse. She hasn’t even gotten to her financial legacy yet. In a standard scenario, this plan will leave her retirement savings portfolio at zero by age 94 — and with no liquidity since it never accessed the value of the appreciated house. The additional problem is that she is spending down her investment portfolio, and in the early years, she’s paying a very large tax bill of $22,000 per year.

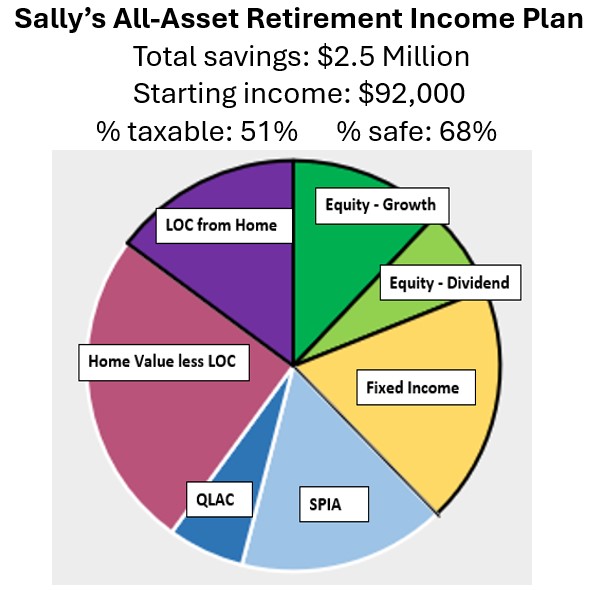

A new All-Asset Retirement Income Plan

So, Sally explores an All-Asset Retirement Income Plan that shows how to allocate her total savings among investments, lifetime annuities and the value of her house to produce the results that will best meet her goals of lifetime income, liquidity and legacy.

An all-asset plan also considers how to reduce market risk and taxes. Only 51% of the first-year income is taxed (vs 92% for the current plan), and 68% is safe (vs 46% for the current plan).

When she compares her current plan to the all-asset plan, here’s what she finds:

- No need to withdraw $37,500 per year from her rollover IRA account for caregiver costs

- Taxes under the all-asset plan are just $9,000, vs $22,000 under her current plan — for a $13,000-per-year savings

- Liquidity under the all-asset plan at age 90 is $1.7 million vs $.4 million under the current plan

- Legacy under the all-asset plan at age 90 is $2.9 million, made up of the value of the house and investment portfolio, vs $2.6 million solely from the value of the house. That advantage grows as she ages.

Thus, she can meet all of her current needs, and she also has more money for, say, the cost of a nursing home stay or a health crisis. And she is leaving a larger legacy.

(Note: The caregiver cost in this illustration is covered by the all-asset plan that integrates H2I, or HomeEquity2Income, meaning a large percentage of the income is safe and thus lifetime. However, withdrawals from the rollover IRA account or additional HECM drawdowns for larger LTC costs may create risks. Thus, the withdrawal schedule should be tested by your adviser.)

Get your complimentary plan and talk to a Go2Income specialist. Make sure your plan reflects basic information (spouse, savings, etc.) and talk through refinements that make it fit your objectives. Then consult with your own qualified adviser for ultimate peace of mind.