How is the smart money coping with Wall Street's funk? For ideas about how to navigate through a fearsome bear market, check out Sharon Hill of Vanguard.

Hill is an active fund manager. That's a relative rarity at Vanguard. The popular fund complex is best-known for its brigades of passively run index funds. And as a stock picker, Hill can pick the brains of Vanguard's battalions of researchers.

Hill runs a portion of $50 billion Vanguard Equity-Income Fund (VEIPX). Another portion, or sleeve, of the fund is run by Matthew Hand. Hand is with subadvisor Wellington Management. Hill and Hand independently manage their respective sleeves.

In addition, Hill runs two similar Vanguard funds outside the U.S. One is available to U.K. investors, the other to investors in Canada.

At a group level within Vanguard, Hill is head of Alpha Equity Investments within Vanguard's Quantitative Equity Group (QEG).

Her team manages active equity global and income-oriented mandates using quantitative methods. Put more simply, she uses computers and programs to find stocks that produce income as well as growth.

Vanguard Fund Managers

Vanguard is well-known for its passively managed, low-cost, index-tracking portfolios. But in aiming to satisfy a diverse marketplace, the famous fund family based outside Philadelphia also offers actively run funds, such as Hill's.

Vanguard's QEG manages 20 U.S. funds and 10 outside the U.S.

In a complex renowned for benchmark-hugging funds, Hill's overall mandate is the opposite. Her job is to find outperformance even if it's not within a single benchmark. The fund owned 192 holdings as of June 30.

The Investor share class of her Equity-Income fund was down 2.89% this year through July's end vs. a 12.58% tumble by the broad market in the form of the S&P 500 and a 6.4% setback by her fund's large-cap value direct rivals tracked by Morningstar Direct.

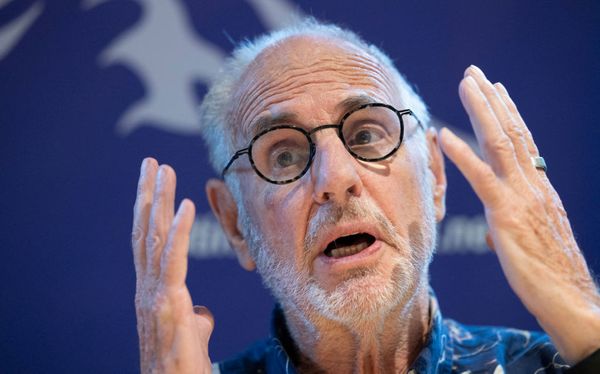

The 51-year-old Hill talked about her investment approach from her Vanguard office in Malvern, Penn.

Finding Leaders Beyond Her Benchmarks

IBD: Describe your job, please, Sharon.

Sharon Hill: First, let me express my pleasure that you know that Vanguard does active management. We are a smaller piece in Vanguard. But we are completely active and are permitted to go outside of our benchmarks and are encouraged to.

IBD: The word "quantitative" in your group's title suggests that computer programs play a role in your group's stock picking. How do you describe it?

Hill: Essentially, we do what a good fundamental manager does. A stock picker looks at a company's balance sheet. We code that all up into a model. And our model produces an opinion on every stock we follow every night. And we use an optimizer to construct a portfolio that meets certain criteria. You can almost think of it as automating what a good fundamental manager would do.

IBD: But the stock picking is not left to computers, right?

Hill: Humans make final decision on portfolios. But those humans are doing it in a systemized fashion.

How Dividends Underpin Success

IBD: Why is it that many funds industrywide topping the market are focused on strong dividend stocks? Is that because consistent dividend payers tend to be financially strong companies, which stand good chances of surviving tough times and tough markets?

Hill: It's a great time to be a dividend investor. It's finally the case after seeing highflying growth stocks do well for so many years.

Not only are we looking for dividend payers, but we're looking for strong dividend payers that have solid payout ratios, strong balance sheets, strong cash flows, strong long-term records of raising their dividends. And that should help us weather this environment.

That gives us companies that have a very strong commitment to their dividend. Companies that haven't cut their dividends in 20 years are very unlikely to do so. So it's a good time to be in that type of company.

Stronger Vanguard Holdings

IBD: What are some of your stronger holdings?

Hill: I don't want to cherry-pick good ones. But one I like would be MGIC Investment. (MTG's two top fund owners are Vanguard funds: $262.1 billion Total Market Index (VTSMX) and $41.3 billion Small Cap Index (NAESX), per analysis by MarketSmith. Neither is part of QEG. Nor was MTG in Hill's VEIPX as of March 31.). It's a mortgage insurance company. It got hit as rates started to rise. But it has a growing dividend (yield of 2.3%), a good payout ratio and a stable, solid return on equity (14%). Oh, and it's got a reasonably attractive valuation, especially after the rate rise gave (its share price) a bit of a pause.

IBD: What's another good example of a stock your process highlights?

Hill: As a quant investor, we tend not to think of single stocks. Typically quants just think of things in broad factor exposure. But nonetheless, think about something like a Kroger. (Grocery-store chain) Kroger has never cut its dividend. It's just been humming along for years. And it also has a decent valuation.

It's not the sexiest stock, right? But it fits in with our process, given its stability, given its dividend history.

IBD: Is your fund doing anything to capitalize on rising interest rates?

Hill: Good companies are basically trying to get the last call at the bar. They're borrowing left and right before rates rise too much to finance dividends and buybacks.

IBD: Got an example?

Hill: Kroger is a stock with a strong buyback record. It has a long record of returning capital to shareholders, in addition to actively buying back its stock. Its dividend growth exceeds 10%. And it has a solid payout ratio.

IBD: What part of your strategy should help you cope with inflation and a possible recession?

Hill: Our process is good at choosing stocks. But we don't necessarily believe we can pick sectors at this juncture. So we tend to be fairly neutral on sectors. And as you're coming in and out of an inflationary environment, perhaps a recession in an inflationary environment, sectors tend to gyrate. So we believe that sector neutrality will help us avoid risk over this time period.

IBD: The Ukraine war is awful for individuals. As an investor, what if anything are you doing in reaction?

Hill: The impact on humans goes way beyond the portfolio. There's unthinkable violence.

As an active manager, when the war began there was talk about sanctions. We sold positions that had exposure to Russia. So my portfolio doesn't have any emerging markets exposure.

In our global developed market fund we still have exposure to Russia through Evraz, a company that trades in London, a steel producer. We traded out of it. (After consulting her portfolio optimization model, Hill replaced Evraz with Steel Dynamics.). But my index fund friends who sit down the hall (at Vanguard) couldn't trade out of it. Their index hadn't taken it out.

IBD: Has the fund made any other moves related to the war?

Hill: You can argue that alternative energy companies are able to benefit from that.

IBD: With such a highly automated process, what are some improvements that Vanguard expects to debut within the next 12 to 24 months?

Hill: We had the same (computer) model across most of the quant group portfolios. About three months ago we launched the equity-income specific model. This is a model for stocks that pay dividends.

Right now, the way we run our models is by having humans choose the factors. But now we're using machine-learning techniques to choose the factors that go into our stock-picking models.

Follow Paul Katzeff on Twitter at @IBD_PKatzeff for tips about retirement planning and actively run portfolios that consistently outperform.