In the 19 months since lending platform Upstart’s (UPST) IPO, the stock has taken a wild ride. After debuting at $26.00/per share in December of 2020, the stock rocketed all the way to an all-time high of over $401 in October of the following year — a gain of more than 1260%.

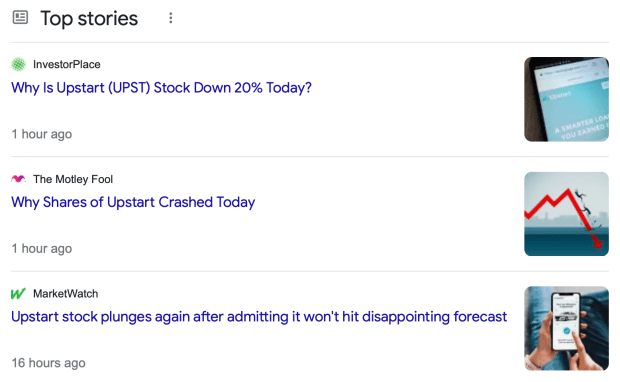

But as the raging bull rally came to a close in 2021, gravity took hold, and UPST’s share price fell back to Earth. As of Thursday’s close, the stock was trading at just $33.74 — more than 91% off it’s all-time high. That was before the company disclosed after hours that it will miss its upcoming earnings target (which it only just guided down in May). As a result, the stock fell another 20% today.

While event-driven traders will likely make trades based on this news after the fact, there is a different class of trader which has been short this name since early last week: technicians.

Ready to start trading the technicals? Try Rebel Weekly. Ride the waves of market momentum with two actionable trade ideas designed to capture technical break outs and break downs — delivered to your inbox every week.

Inside Market Rebellion’s Momentum Trading Strategy: Upstart

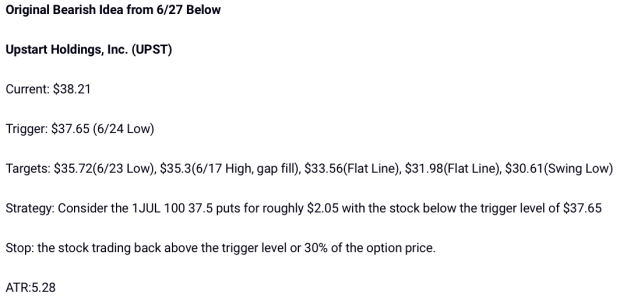

We’re about to give you inside access to Market Rebellion’s technical analysis driven options trading newsletter, Rebel Weekly. This trade idea, initially released on June 27th, highlighted bearish signals in (UPST) when it was trading at $38.21.

Upstart was pinned down as a bearish trade idea far ahead Thursday’s early-earnings warning for its weak technicals and bearish chart patterns — something that Chartered Market Technician Ryan Mastro is skilled at identifying. Not only has Upstart been in a downtrend since its October all-time high, the pace of the fall has increased over the past steadily three months.

Before we get into how the trade performed, let’s break down some of the terms in the trade idea above.

Market Terms Every Technical Trader Must Know

Trigger: Many technical traders use critical price levels, often referred to as triggers, at specific levels of support and resistance. This is the level at which traders will enter a trade once the stock makes a sustained move past the trigger.

- Targets: These are technical levels where traders may choose to roll or close their position to lock in profit.

- Rolling: Rolling is an option trading strategy where a trader sells their current position for another position that takes the same directional thesis in the same equity. In Rebel Weekly, rolls are most commonly used to secure profit (selling your option for an option that is further-from-the-money) and to add time (selling your option for an option that is at a further expiration date).

- Strategy: This is the initial option contract, when to trade it, and at what price.

- Stop: This is your trade’s escape hatch — you’ll know this trade isn’t working out if either of these two instances take place (in this case, it’s the stock trading back above the trigger level, or the option losing 30% of its value).

- ATR: ATR, or average true range, is a measure of a stock’s average price variation within a given time period.

Combining technical levels with measures like the ATR help technicians tell the difference between a stock that is just starting to make a big move, and one that has already exhausted itself for the day. If a stock crosses through a crucial level, and there’s still plenty of room left in the average true range, technical traders know it’s time to pounce.

That’s exactly what happened in Upstart.

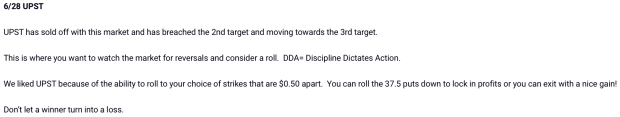

6/28 — Upstart Cruises Through Downside Levels

By market open on the day following the original trade idea, Upstart had already breached the first two downside targets — filling a gap, and moving toward the third. With Upstart making a big move in our favor, Chief Option Strategist Ryan Mastro alerted traders to levels where they could consider rolling their option down to lock in some profit while maintaining bearish exposure to the trade.

That would prove to be a good move.

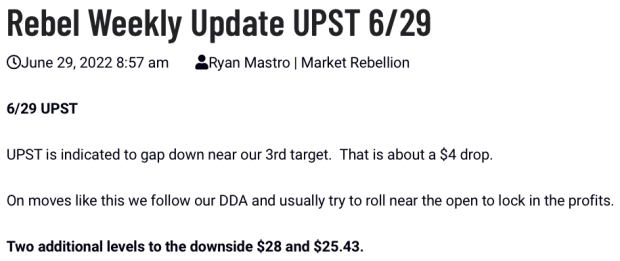

Upstart Bears Go Three-For-Three

Another gap down, another level soon to be broken — and another roll. Outside of gaining time and locking in profit, rolling is an excellent way to right-size positions. When a position is getting too large, rolling lets you adjust your risk.

That continued to be an effective trade. By the afternoon after this trade update was posted, Upstart had pierced through all five original technical levels, bouncing off the $30 level.

Disciplined traders who continued to roll in wait for the next downside target would be rewarded once more the following Friday…

On July 8th — the final day of the next nearest expiration, Upstart fell as much as 22.5%, breaking through the newest $28 level and holding near the final, lowest level.

Technical Analysis is King

It’s often tough to predict how the market will react to specific news. Predicting what that news will be, when it will strike, and having nimble-enough reaction time to catch the price movement can be even tougher. That’s why traders like Ryan Mastro, and Rebel Weekly members rely on technical analysis to craft their option trades.

Equally important is using defined entry and exit points. It can help disciplined traders minimize losses when a trade thesis becomes invalid. Whether you’re trading with a service like Rebel Weekly, or trading on your own, the terms defined and the strategies used in this article are crucial for any technical option trader to understand.