Meta (META) shares are soaring more than 25% on Thursday after the social-media stalwart reported earnings.

Interestingly, Meta actually whiffed on earnings, missing analysts’ expectations. But revenue topped expectations and guidance was solid.

Daily active users crossed about the 2 billion mark, while a $40 billion buyback really got the stock moving. As of yesterday’s close, Meta stock had a market cap of about $400 billion, to give some perspective on the size of this buyback.

I keep saying this and I will keep saying it as long as it remains pertinent: Wall Street is giving a pass to tech stocks with poor earnings results and/or outlooks and giving massive rewards to those that exceed expectations.

That said, the market has undergone a rather large rally over the past few days, so we’ll see how that approach shakes out — especially with Apple (AAPL), Amazon (AMZN) and Alphabet (GOOGL) (GOOG) earnings on deck later today.

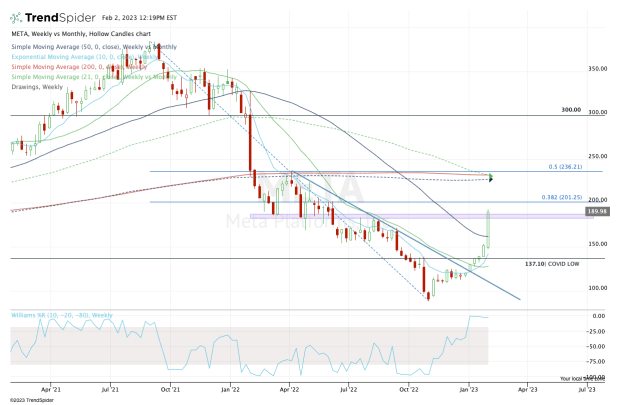

As for Meta stock, let’s look at the charts.

Trading Meta Stock on Earnings

Chart courtesy of TrendSpider.com

I love the action in Meta today. The shares gapped up into a very key zone near $180 to $185.

In a tough bear market, this stock had every reason to fade from this area. Instead, it’s powering through it.

This zone was major support in the first half of 2022, then resistance in the third quarter, before Meta stock fell apart in October.

From here the roadmap is simple, but that doesn’t mean the journey will be. While that's not timeless wisdom, it applies quite nicely to the chart.

Even after the robust rally — Meta shares have more than doubled (up 121%) from the fourth-quarter low — they're still down 49% from the highs.

But the path forward is clear: Above $185-ish and the door opens to $200. Above $200 and the $225 to $230 zone is in play.

That area contains a number of notable measures, including the 21-month, 50-month and 200-week moving averages. If and when Meta stock gets there, we’ll need to reevaluate.

On the downside the bulls would love to see Meta stock find support in the low $180s.

This has proved to be a pivotal area for the stock, and if it acts as support, it is that much more constructive on the longer term charts.