So long as there has been art, there has been pornography. From Paleolithic-era cave drawings to the Ancient Greeks' dishware, salacious images are a historic universality -- and that was before the invention of the internet.

Unsurprisingly, adult entertainment has been at the forefront of internet technology. The porn industry has been a pioneer in revolutionary technology like videotapes, streaming video, virtual reality, and online payment transactions. But despite being at the forefront of digital financial service tech, sex workers still struggle to find institutions that will take their money.

DON'T MISS: A New State Law Could Make It More Difficult For Users To Access Adult Websites

The Gentrification of the Internet

It's been dubbed "the gentrification of the internet" by digital sex work advocacy site hacking//hustling. Major online platforms are making online adult entertainment less accessible. Whether it's through social media visibility or financial services, it's a dangerous problem. When sex workers are unable to get paid digitally, they become reliant on more dangerous in-person alternatives.

Digital payment processors like PayPal and Venmo were, for a time, a viable alternative for sex workers to process payments from clients. But even those services are closing accounts thanks to SESTA/FOSTA, a series of laws aimed at holding online platforms liable for illegal sex trafficking.

The threat of liability has caused payment processors to enforce stricter rules surrounding content and proof of income -- leaving perfectly legal adult content creators without critical financial services. And it isn't just financial services -- credit card companies and banks discriminate against sex workers, too.

Nearly Half of Adult Performers Have Lost Financial Services Accounts

The internet created a safer space for sex workers to entertain clients and a way to get paid that wasn't cash. Adult entertainment helped make internet payments successful, but today many who work in the industry experience financial discrimination.

According to a 2022 Free Speech Coalition survey of adult performers, 46% of creators/performers have lost financial services accounts like PayPal, Venmo, and others, in the past year. As for bank accounts, 36% of adult businesses have lost one. And a whopping 50% of those surveyed were denied a loan due to adult work.

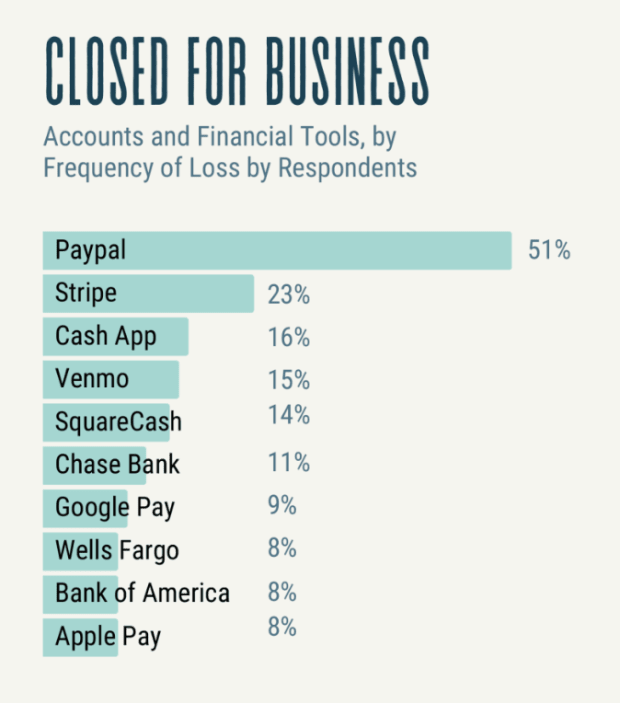

When it comes to financial services, banks aren't the biggest culprits. A little over half of survey respondents said that PayPal (PYPL) had closed their accounts. Other services like Venmo, Stripe, and Block Inc (SQ) services CashApp and SquareCash came in behind PayPal, but still behind every major U.S. bank.

To make things more difficult, many who work in this marginalized industry also experience discrimination due to other factors. In a recent sit-down with TheStreet, Lindsey Swanson, a CFP and the mind behind Stripper Financial Planning, explained that many of her sex worker clients are often "stigmatized by other factors as well," whether they are "disabled, people of color, [or they] present differently in terms of gender."

Everyone Needs Access to Their Money

Without a steady, provable income, think of all the things a person can't do. Applying for a loan, buying a home, getting medical insurance -- without a stable financial service, these important services aren't attainable. Particularly for sex workers looking to move out of the industry.

Professional dominatrix Savannah Sly told The Boston Globe that “merely being affiliated with sex work is the type of scarlet letter that can follow you.”

“I understand the pressure on online platforms and banks to ‘do something’ about sex trafficking, but it pushes sex workers out of these institutional platforms. It drives the sex trade further into the shadows," she said.

We reached out to PayPal and Block Inc. -- they have not responded to requests for clarification on policies regarding legal sex work accounts.