(Please enjoy this updated version of my weekly commentary published April 27th, 2022 from the POWR Options newsletter).

Microsoft (MSFT), the number two stock by market cap, rose almost 5% following an earnings report that was solid across the board

Good, but not great for MSFT. Revenue beat by the smallest margin since 2018. Earnings were a minor beat as well at $2.22 per share versus expectations of $2.19. Guidance was in-line.

The fact that Microsoft (MSFT) shares rose so strongly on rather tepid numbers highlights that the selling may have gotten overdone for both MSFT and markets overall.

SPY is trying to cling to the lower end of the trading range as it closed just above the critical $415 area.

Shares are deeply oversold and at technical readings that have corresponded with significant short-term lows in the past.

The NASDAQ 100 (QQQ) paints a similar picture. Shares held the crucial $315 level after getting to oversold readings as well.

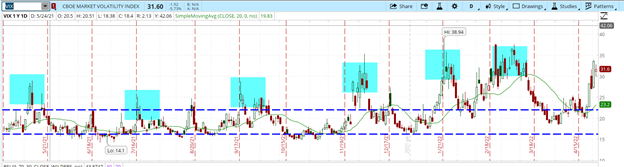

VIX finally softened after exploding higher. Previous spikes in the VIX have corresponded to short-term market lows. See if that holds true once again.

The 10-year yield continues to consolidate just below the 3% yield area. The Fed meeting on May 3-4 will be crucial for the direction of longer-term rates and the equity market in kind.

My viewpoint remains pretty much the same—big range no change. Stocks will continue to ping-pong back and forth day-to-day while going nowhere month-to-month.

That makes stock selection even more crucial. The power of the POWR Ratings can help navigate these tumultuous times.

We closed out three positions over the past week. We realized a nice quick gain in 5 days on the PLL puts. Our pairs trade also worked out well with an overall net win.

Look for new trades over the coming days, especially if the market finds some semblance of sanity and VIX (which is just another way to say the price of options) drops.

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings, where we show you how you can consistently find the top options trades.

If that appeals to you, and you want to learn more about this powerful new options strategy, enjoying a +89.1% return since launching in November 2021, then click below to get access to this vital investment presentation now:

How to Trade Options with the POWR Ratings

SPY shares were trading at $421.98 per share on Thursday afternoon, up $4.71 (+1.13%). Year-to-date, SPY has declined -10.88%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

How Microsoft May Have Just Saved the Stock Market StockNews.com