The semiconductor group has become a bellwether industry to watch for stock market investors. As such, Nvidia (NVDA), Advanced Micro Devices (AMD) and others are now at the forefront of many investors’ trading screens.

AMD and Nvidia did a tremendous job bucking the bear market in the fourth quarter, surging to all-time highs. Eventually, the selling caught up with them though.

Shares of AMD came tumbling down in January, ultimately bottoming near $100 in late January. This was a robust support zone, not just because of it being psychologically relevant, but because it was a big breakout level for AMD.

Since then, we’ve seen dips down to the low-$100s in February and March. However, each rally from this support zone seems to lose steam.

It’s got investors wondering if a potentially larger dip could be in store.

For now though, it continues to hold. AMD stock traded down to $101.71 this morning and is now trying to bounce. Despite the fundamental strength behind these companies’ businesses, investors are focused on something else at the moment: Fear.

Trading AMD Stock

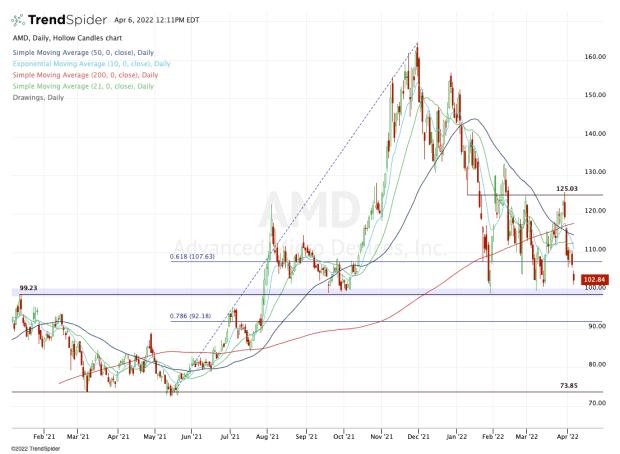

Chart courtesy of TrendSpider.com

AMD has been a hot stock lately. So have many semiconductors. That doesn’t mean they can’t come under pressure though.

On Tuesday, I noted the importance of last week’s low at $106.10. If AMD were to lose that level, it would open the door down to the $100 support area.

Notice on the daily chart — which spans about 15 months — just how critical this area has been. It was resistance in January 2021, then a major breakout zone in the summer. When AMD finally cooled off, this former resistance mark was significant support.

That paved the way for AMD stock to surge to record highs.

Now struggling to regain momentum, keep a close eye on this zone. If it fails, it could open the door down the low $90s. Further, its failure at $100 would not be a great signal for Nvidia and other semiconductor stocks.

On the upside, let’s see how AMD stock handles the $107.50 area. That’s roughly the 61.8% retracement of this entire range, but also comes into play around the low for the past few sessions.

Back up through that area and the short-term daily moving averages will be in play. All in all, $125 continues to act as resistance.