With a market cap of $55.1 billion, Valero Energy Corporation (VLO) is a leading global manufacturer and marketer of petroleum-based and low-carbon transportation fuels, operating across North America, the U.K., Ireland, and Latin America. The company runs refining, renewable diesel, and ethanol segments that produce a wide range of fuels and related products sold through wholesale markets and branded retail outlets.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Valero Energy fits this criterion perfectly. Valero also operates renewable diesel and ethanol plants under its Diamond Green Diesel brand.

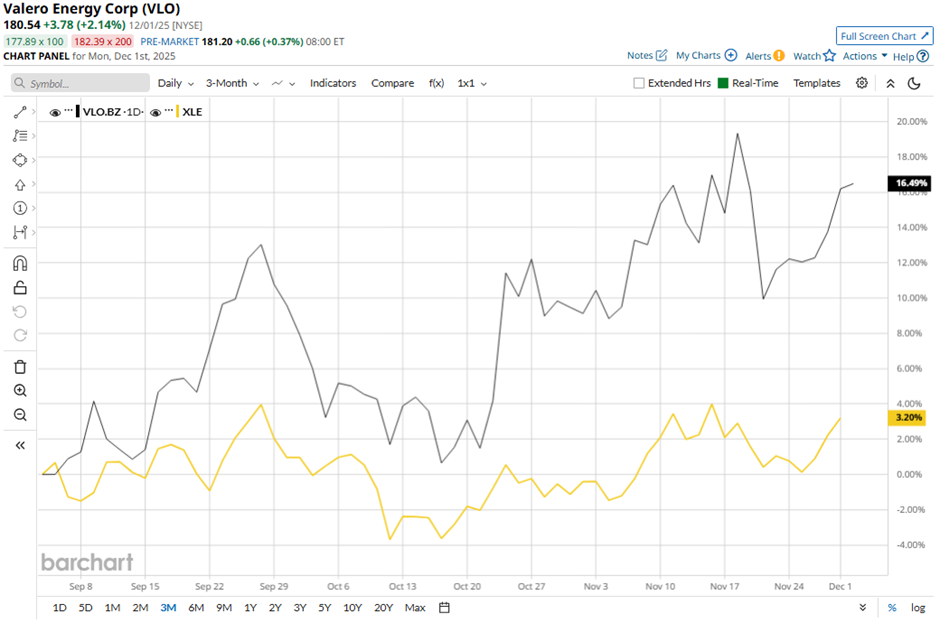

Shares of the San Antonio, Texas-based company have fallen 2.7% from its 52-week high of $185.62. VLO stock has increased 18.8% over the past three months, outpacing the Energy Select Sector SPDR Fund’s (XLE) over 1% rise over the same time frame.

Longer term, VLO stock is up 47.3% on a YTD basis, surpassing XLE's 6.6% gain. Moreover, shares of the oil refiner have surged 29.8% over the past 52 weeks, compared to XLE’s 4.4% drop over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day and 200-day moving averages since early May.

Shares of VLO jumped nearly 7% on Oct. 23 after the company reported stronger-than-expected Q3 2025 adjusted EPS of $3.66. The company also beat revenue expectations with $32.17 billion and reported a major rebound in refining performance, including a 44% surge in refining margin per barrel to $13.14 and throughput utilization of 97%.

In comparison, rival Marathon Petroleum Corporation (MPC) has lagged behind VLO stock. MPC stock has climbed 40.6% on a YTD basis and 25.6% over the past 52 weeks.

Despite the stock’s strong performance over the past year, analysts remain cautiously optimistic on VLO. It has a consensus rating of “Moderate Buy” from the 20 analysts in coverage, and the mean price target of $187.61 is a premium of 3.9% to current levels.