/United%20Parcel%20Service%2C%20Inc_%20logo%20on%20truck-by%20100pk%20via%20iStock.jpg)

Valued at a market cap of $81.2 billion, United Parcel Service, Inc. (UPS) is a package delivery and logistics provider based in Atlanta, Georgia. It offers domestic and international shipping, freight forwarding, contract logistics, last-mile delivery, and e-commerce fulfilment solutions.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and UPS fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the integrated freight & logistics industry. The company continues to strengthen its competitive position through advanced technology, data-driven route optimization, and automation across hubs and delivery operations.

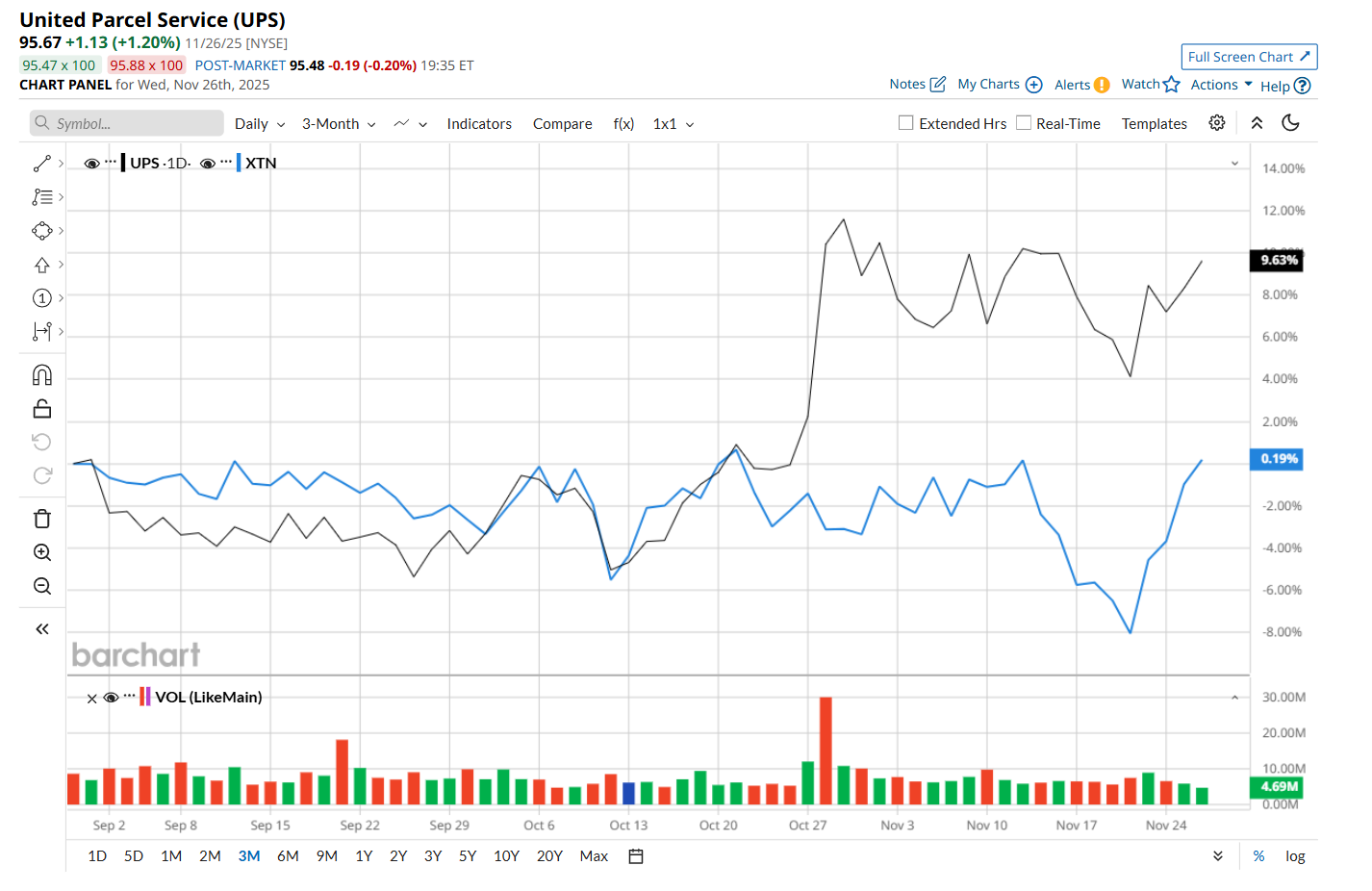

This freight and logistics company is currently trading 30.2% below its 52-week high of $137.10, reached on Nov. 27, 2024. Shares of UPS have gained 9.4% over the past three months, outpacing the SPDR S&P Transportation ETF’s (XTN) marginal drop during the same time frame.

However, in the longer term, UPS has declined 29.1% over the past 52 weeks, considerably underperforming XTN's 8.8% loss over the same time period. Moreover, on a YTD basis, shares of UPS are down 24.1%, compared to XTN’s slight decline.

To confirm its recent bullish trend, UPS has been trading above its 50-day moving average since mid-October. However, it has remained below its 200-day moving average over the past year, with slight fluctuations.

On Oct. 28, shares of UPS surged 8% after reporting better-than-expected Q3 results. The company’s consolidated revenue came in at $21.4 billion, 2.9% ahead of analyst estimates. Moreover, its adjusted EPS of $1.74 declined 1.1% from the year-ago quarter, but handily topped Wall Street estimates of $1.31.

UPS has lagged behind its rival, FedEx Corporation (FDX), which declined 9% over the past 52 weeks and 2% on a YTD basis.

Given UPS’ recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 30 analysts covering it, and the mean price target of $104.17 suggests an 8.9% premium to its current price levels.