/Jack%20Henry%20%26%20Associates%2C%20Inc_%20website%20and%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $13.6 billion, Jack Henry & Associates, Inc. (JKHY) is a financial technology company that connects people and financial institutions through technology solutions and payment processing services. It operates through four segments: Core, Payments, Complementary, and Corporate and Other, offering platforms and services ranging from core banking systems and digital/mobile banking to payment processing, risk management, and hardware solutions.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Jack Henry & Associates fits this criterion perfectly. The company provides a range of products including SilverLake, Symitar, CIF 20/20, Core Director, and the Banno Digital Platform.

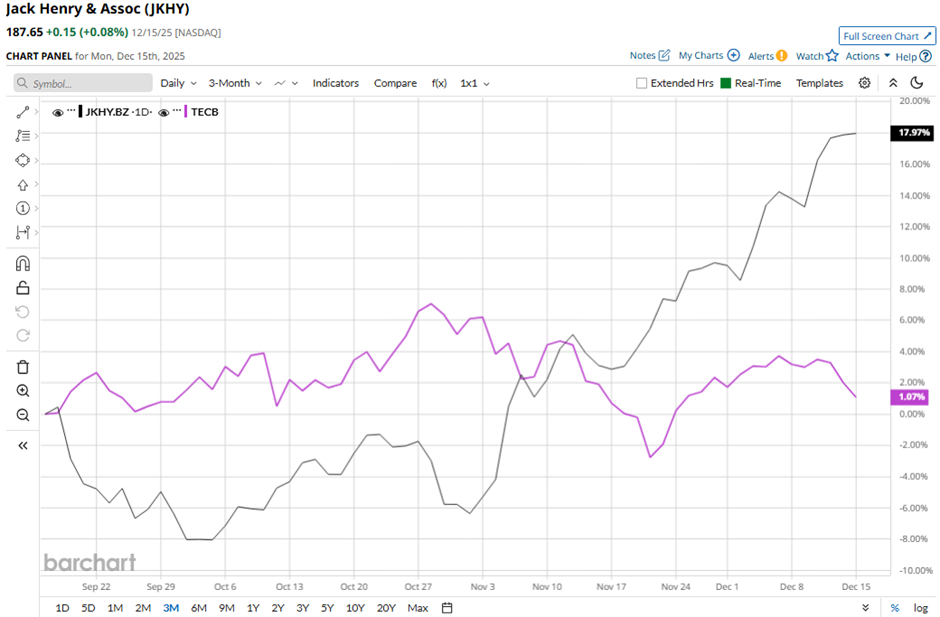

Shares of the Monett, Missouri-based company have dipped 4.3% from its 52-week high of $196. Over the past three months, JKHY stock has increased 18.4%, outpacing the iShares U.S. Tech Breakthrough Multisector ETF's (TECB) 1.1% rise during the same period.

In the longer term, shares of the payment processing company have risen 7.1% on a YTD basis, underperforming TECB’s 13.8% return. Moreover, JKHY stock has gained 4.4% over the past 52 weeks, compared to TECB’s 9.4% rise over the same time frame.

Yet, the stock has been trading above its 50-day moving average since November.

Shares of JKHY jumped 4.9% following its Q1 2026 results on Nov. 4, reporting EPS of $1.97, which beat analyst estimates. Investors reacted positively to revenue of $644.7 million, up 7.3% year-over-year, alongside a 21% increase in net income to $144 million. Sentiment was further boosted by the company raising its fiscal 2026 guidance, projecting revenue of $2.49 billion - $2.51 billion and EPS of $6.38 - $6.49, above its prior outlook.

In comparison, rival Accenture plc (ACN) has lagged behind JKHY stock. ACN stock has declined 21.9% on a YTD basis and 23.4% over the past 52 weeks.

Despite the stock’s outperformance relative to its peers, analysts are cautiously optimistic about its prospects. JKHY stock has a consensus rating of “Moderate Buy” from the 17 analysts covering the stock, and as of writing, it is trading above the mean price target of $181.62.