/Fastenal%20Co_%20truck%20and%20logo%20on%20building-by%20jetcityimage%20via%20iStock.jpg)

With a market cap of $47.9 billion, Fastenal Company (FAST) is a global wholesale distributor of industrial and construction supplies, including fasteners, tools, and a wide range of related hardware. It serves diverse markets such as manufacturing, maintenance, construction, transportation, and government.

Companies valued $10 billion or more are generally classified as “large-cap” stocks, and Fastenal fits this criterion perfectly. Its extensive product portfolio supports customers across the United States, Canada, Mexico, and various international regions.

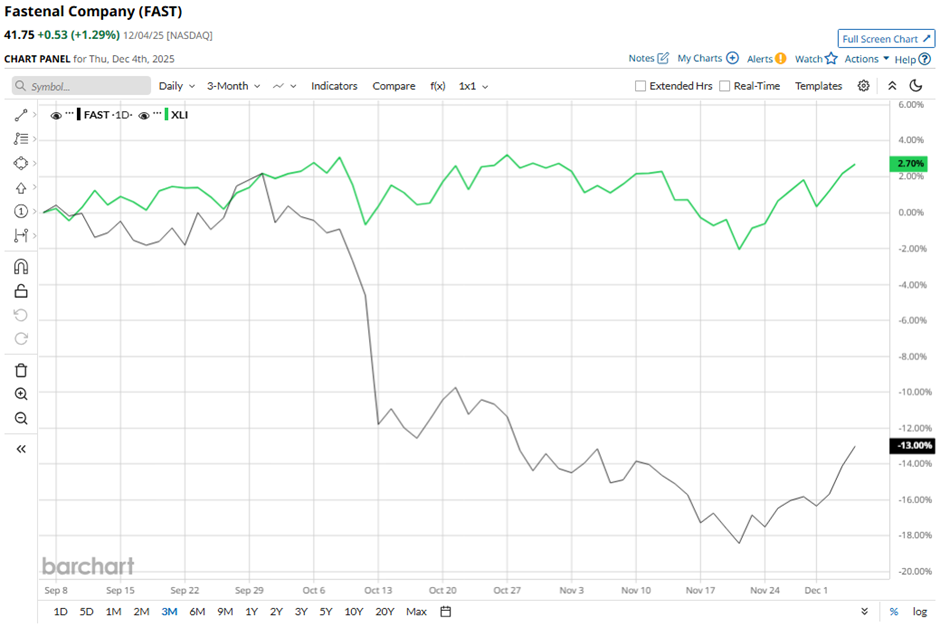

FAST stock has dropped 17.5% from its 52-week high of $50.63. Shares of the company have fallen nearly 17% over the past three months, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 2.3% gain over the same time frame.

In the longer term, FAST stock is up 16.1% on a YTD basis, slightly lagging behind XLI’s 17.7% increase. Moreover, shares of the maker of industrial and construction fasteners have risen 1.6% over the past 52 weeks, compared to XLI’s 8.7% return over the same time frame.

The stock has been trading below its 50-day average since early October.

Fastenal shares tumbled 7.5% on Oct. 13 as the company posted weaker-than-expected Q3 2025 profit of $0.29 and revenue of $2.13 billion. The company also warned of a slight margin squeeze in Q4 after accelerating inventory deliveries ahead of tariffs and facing rising supply-chain costs.

However, FAST stock has outperformed compared to its rival, W.W. Grainger, Inc. (GWW). Shares of W.W. Grainger have declined 18.8% over the past 52 weeks and 8.1% on a YTD basis.

Despite FAST’s better performance relative to its industry peers, analysts remain cautious about its prospects. The stock has a consensus rating of “Hold” from the 17 analysts covering the stock, and the mean price target of $44.92 is a premium of 7.6% to current levels.