Constellation Energy Corporation (CEG), headquartered in Baltimore, Maryland, produces and sells energy products and services. With a market cap of $113.8 billion, the company generates and distributes nuclear, hydro, wind, and solar energy solutions serving homes, institutional customers, public sectors, community aggregations, and businesses.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and CEG perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the utilities - renewable industry. CEG’s growth is driven by its diverse energy portfolio, including nuclear, wind, solar, and hydroelectric assets.

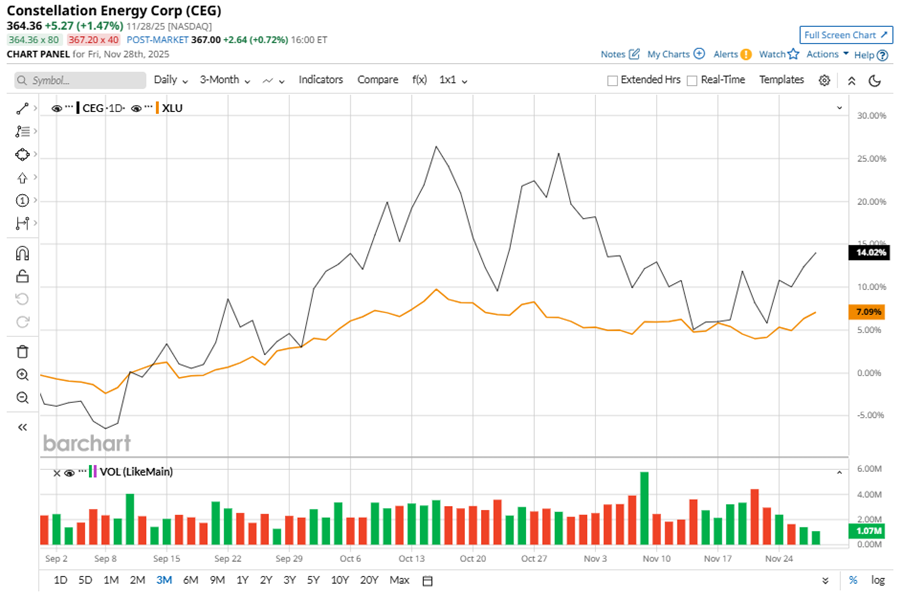

Despite its notable strength, CEG slipped 11.7% from its 52-week high of $412.70, achieved on Oct. 15. Over the past three months, CEG stock gained 14%, outperforming the Utilities Select Sector SPDR Fund’s (XLU) 7.1% gains during the same time frame.

In the longer term, shares of CEG rose 62.9% on a YTD basis and climbed 43.8% over the past 52 weeks, considerably outperforming XLU’s YTD gains of 19.7% and 9.3% returns over the last year.

To confirm the bullish trend, CEG has been trading above its 50-day and 200-day moving averages since early May, experiencing some fluctuations.

CEG excels with the U.S.'s most significant nuclear fleet with a 22-gigawatt capacity. As AI drives energy demand, CEG's nuclear power positions it perfectly, delivering about 58% returns in 2025. The company has secured multiple agreements with AI hyperscalers, notably a 20-year deal with Microsoft Corporation (MSFT), which boosted its shares by over 22% and underscores the company’s strategic positioning in the market.

On Nov. 7, CEG shares closed up more than 2% after reporting its Q3 results. Its adjusted EPS increased 10.9% year over year to $3.04. The company’s revenue stood at $6.6 billion, up marginally from the year-ago quarter.

CEG’s rival, Brookfield Renewable Partners L.P. (BEP) shares lagged behind the stock, with a 25.9% gain on a YTD basis and a 9% rise over the past 52 weeks.

Wall Street analysts are reasonably bullish on CEG’s prospects. The stock has a consensus “Moderate Buy” rating from the 17 analysts covering it, and the mean price target of $401.88 suggests a potential upside of 10.3% from current price levels.