/Amphenol%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Headquartered in Wallingford, Connecticut, Amphenol Corporation (APH) designs, manufactures, and markets electrical, electronic, and fiber-optic connectors and systems across the globe.

With a market capitalization of about $169.8 billion, it sits comfortably in “large-cap” territory, supplying interconnect, cable, antenna, and sensor technologies to OEMs and service providers across industrial, automotive, aerospace, data, and communications markets.

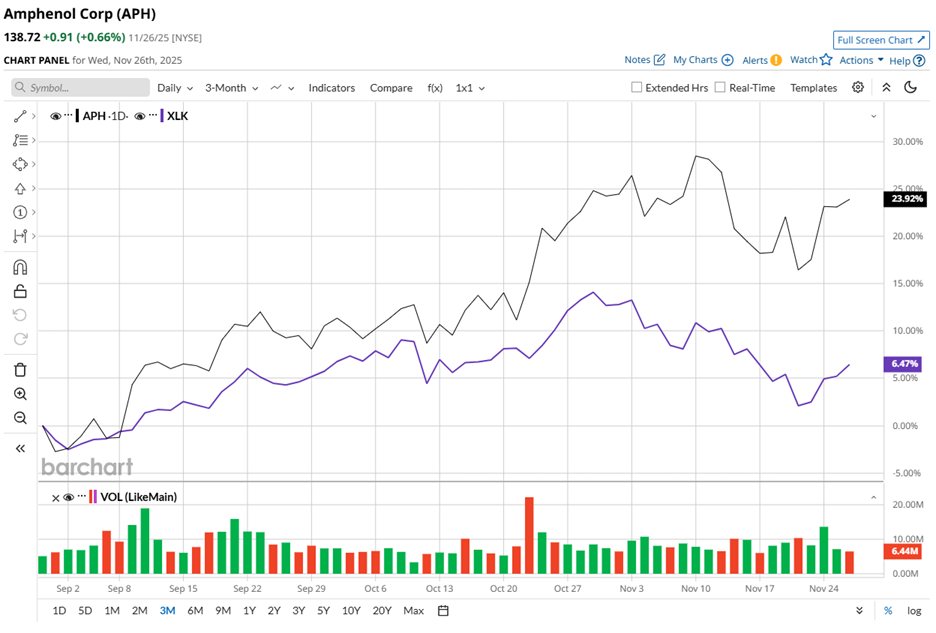

APH stock is currently trading roughly 3.9% below its November high of $144.37, yet the recent trend remains distinctly favorable. The stock has rallied nearly 26.2% over the past three months, far outstripping the Technology Select Sector SPDR Fund (XLK), which gained only 7.9% over the same period.

The longer-term performance paints an even stronger picture. APH has surged 89.4% over the past 52 weeks, far outpacing XLK’s 20.9% gain during the period. Year-to-date (YTD), the stock has jumped 99.7%, again beating XLK’s 20.9% rise in the same stretch.

Since May, APH has consistently traded above its 200-day moving average and 50-day moving average, with slight fluctuation, which reinforces that APH’s broader uptrend remains intact.

Fundamental performance has reinforced the trend. Shares pushed higher on Oct. 22, first rising 3.6% intraday, then adding another 5% the next day, after Amphenol delivered a strong Q3 2025 earnings report.

Revenue climbed 53.4% year over year (YoY) to $6.19 billion, comfortably ahead of the $5.48 billion consensus, supported by broad demand for high-technology interconnect solutions, particularly across IT datacom and communication networks. Adjusted EPS rose 86% to $0.93, surpassing the $0.79 Street’s estimate. Plus, management expects the strength to continue. For fiscal Q4 2025, they forecast sales between $6 billion and $6.1 billion, representing 39% to 41% growth over last year, with adjusted diluted EPS projected between $0.89 and $0.91, up 62% to 65%.

For the full fiscal year 2025, Amphenol anticipates sales to be between $22.66 billion and $22.76 billion, and adjusted diluted EPS of $3.26 to $3.28 range, annual increases of 49% to 50% and 72% to 74%, respectively.

Relative performance strengthens the case even more. Corning Incorporated (GLW), Amphenol’s rival, climbed 74.2% over the past 52 weeks and 75.9% on a YTD basis. Yet even the strong gains fall short of APH’s significantly superior performance.

Given the price strength, sector-leading returns, and firm fundamentals, analysts remain constructive. Among 17 covering the stock, the consensus rating is “Strong Buy,” and the average price target of $149.56 indicates upside potential of 7.8% from current levels.