/Agilent%20Technologies%20Inc_%20HQ%20sign-by%20hapabapa%20via%20iStock.jpg)

With a market cap of $42.3 billion, Agilent Technologies, Inc. (A) delivers application-focused solutions for the life sciences, diagnostics, and applied chemical markets worldwide. The company operates through three segments: Life Sciences and Applied Markets; Diagnostics and Genomics; and Agilent CrossLab, offering a broad portfolio of instruments, consumables, software, and laboratory services.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Agilent Technologies fits this criterion perfectly. Agilent distributes its products primarily through a direct sales model, complemented by distributors, resellers, representatives, and e-commerce channels.

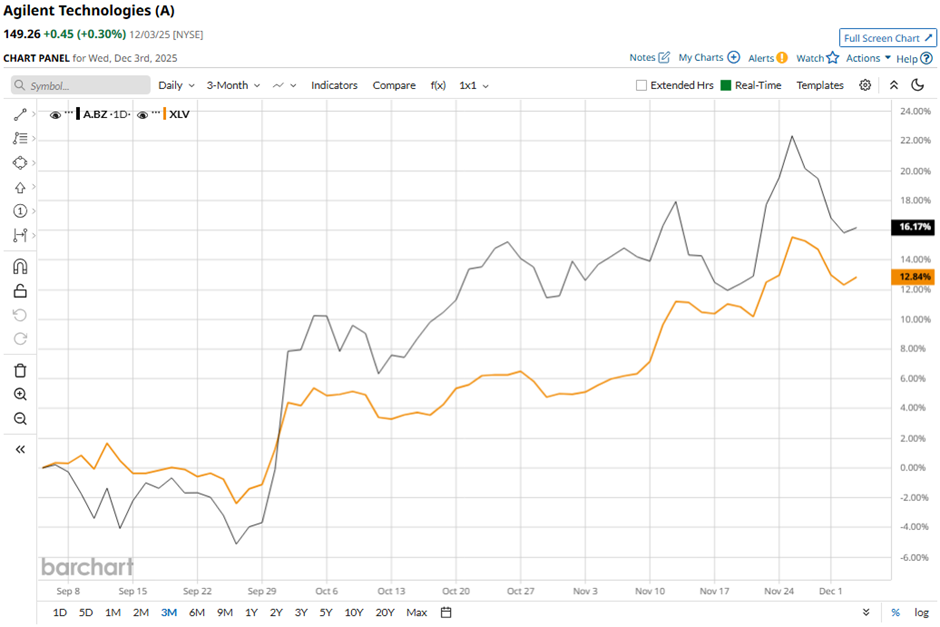

Shares of the Santa Clara, California-based company have fallen 6.9% from its 52-week high of $160.27. Shares of Agilent Technologies have increased 19.2% over the past three months, outperforming The Health Care Select Sector SPDR Fund’s (XLV) 13.3% gain over the same time frame.

Longer term, shares of the scientific instrument maker have risen 7.2% over the past 52 weeks, outpacing XLV’s 5.6% return over the same time frame. However, Agilent stock is up 11.1% on a YTD basis, lagging behind XLV’s 12.7% return.

The stock has been trading above its 50-day moving average since early May. Also, it has moved above its 200-day moving average since late August.

Agilent’s shares rose 2.3% following its Q4 2025 results on Nov. 24, with revenue of $1.86 billion beating estimates and adjusted EPS of $1.59, matching expectations. Investors were encouraged by outperformance in key segments, including Life Sciences and Diagnostics revenue of $755 million and a 7% increase in CrossLab revenue to $775 million. Sentiment was further boosted by Agilent’s confident fiscal 2026 outlook, projecting $7.3 billion - $7.4 billion in revenue and $5.86 - $6 in adjusted EPS.

Nevertheless, rival Eli Lilly and Company (LLY) has outpaced Agilent stock. LLY stock has surged 33.9% on a YTD basis and 27.1% over the past 52 weeks.

Despite Agilent Technologies’ weak performance relative to its industry peers, analysts are moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 17 analysts in coverage, and the mean price target of $169.62 represents a premium of 13.6% to current levels.