Name: Jeremy

Age: 27

City/state: Spring Lake, NJ

Amount of debt: $10,000

Type of debt: credit card

How long it took to pay off: 5 years

Jobs held while paying the debt: Communications professional

Salary: Around $60k

My parents, especially my mother, were fantastic teachers when it came to financial literacy. My mother, especially, taught me to understand the value of an emergency fund and not to overspend. Despite all this, I treated my credit cards and the subsequent debt I incurred after college like it was no big deal, or as if it wouldn’t be a huge issue if I suddenly lost my job or had an emergency.

I got into debt with some very bad spending habits. I used my credit card like it was money that would not accrue interest — because it would "eventually" get paid off. I graduated with a degree in communications and made a fairly average salary for New York City for someone straight out of college. A majority of my paycheck each month went to rent, and the other was used for food, drinks, and household expenses. Unfortunately, the NYC lifestyle catches up quickly if you aren't prudent. And I didn't feel the financial strain of a credit card because it doesn’t prohibit spending what you don't have.

Months in, everything told me my debt was getting bad, but I just kept paying small chunks and letting it run up again. Instead of “taking the debt on,” I let it slide, little by little. I really misunderstood how easily your debt can grow into an unmanageable beast. I would send payments at different times, rather than when they were due and wondered why my interest was so high. I would say things started to get bad when I moved apartments and still hadn't changed my purchasing behavior. I was eating out a lot, spending frivolously on happy hours and just not recognizing that I was not paying off what I’d spend at the rate I should have.

When I started a new job, I was making more money, but still not paying down my debt. My habits were staying the same, but then the pandemic hit. I realized I needed to reduce my cost of living, make a conscientious effort to cook more, stop purchasing things I truly didn't need and establish small financial goals.

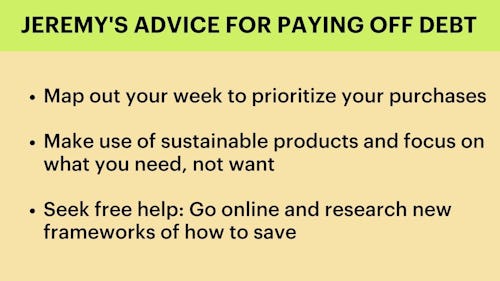

It took small steps, and I focused on making goals for myself. I began cutting the debt down by increments of $1,000, when I could. I didn't consult with any professionals, but I started to research online ways and frameworks to think about saving. I also made a concerted effort to track what I was spending the most on.

I changed a lot about my life, and I started by mapping out my week more. It sounds simple but the way you shop for groceries — whether you get them delivered, what items you decide you “need,” for example — can really change how much you end up spending. I also made an effort to reduce the time I spent shopping for things online and feeling like I "needed" to purchase something, rather than making do with what I had.

Now, my overall confidence has really risen. You don't realize how debt can linger or haunt and dominate your thoughts. I still am vigilant and realize that while it’d be easy to slip back into old behavior, I can’t.

If you’re in my position, start small — you cannot accomplish your goals in one day. Pick a number, a date on the calendar and work towards slowly chipping away at that debt. Find new ways to save money, make use of sustainable products and focus on what you need, not want.