In recent years, fintech has emerged as a powerful force in the financial sector. But what does it mean for populations traditionally excluded from formal financial services?

In this blog post, inspired by Oxford’s Fintech Programme, we'll explore the impact of fintech on unbanked populations, how fintech for unbanked populations has evolved, and the benefits and drawbacks of fintech solutions now and in the future.

The impact of fintech on financial inclusion

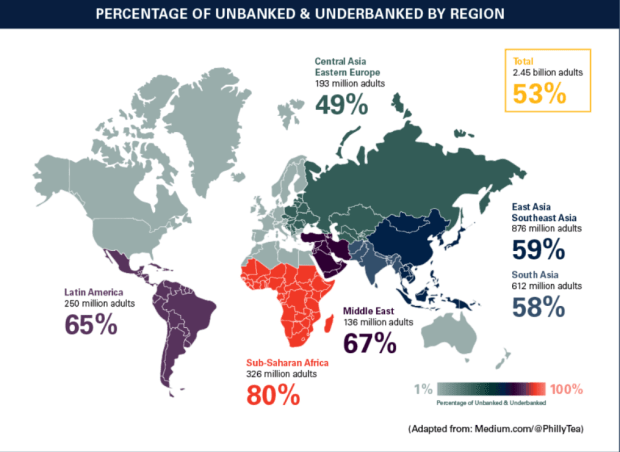

In both emerging markets—particularly Africa, Asia, and South America—and existing markets, reliable mobile wireless access has helped unbanked populations access financial tools and services. As the Global Findex Database 2017 reports (Demirgüç-Kunt et al., 2018):

1.2 billion adults have obtained an account since 2011, including 515 million since 2014. Between 2014 and 2017, the share of adults who have an account with a financial institution or through a mobile money service rose globally from 62 percent to 69 percent. In developing economies, the share rose from 54 percent to 63 percent.

Join Oxford’s Fintech Programme today

Develop a network of professionals pioneering financially-inclusive solutions in Oxford’s Fintech Programme, powered by Esme Learning. Don’t miss out—registration closes on January 31st, 2023.

How has fintech for unbanked populations evolved?

In the early 2000s, when countries like the Philippines and Kenya first started to launch mobile money payments, fintech faced a series of barriers. Governments worried about consumer protection and competition, big banks often used their influence to block fintech-friendly policies, and regulators didn’t know how to address mobile solutions.

Since the early 2000s, however, hundreds of millions of previously unbanked adults have opened accounts for the first time. Many specifically opened accounts to receive digital wage payments or government transfers. In Thailand, nearly one in five banked adults opened their first account to receive government benefits. In Georgia, Uzbekistan, and Kazakhstan, that number was even higher—close to 30 percent.

Now, mobile money accounts have spread from East Africa to West Africa and beyond, dramatically increasing the share of adults who use digital payments. In some countries where mobile money is widespread, like Kenya, more than 90 percent of account owners make digital payments.

Fintech’s benefits for unbanked populations

For historically unbanked populations, fintech can help provide more convenient and affordable access to the global financial system. With fintech apps and services, unbanked adults can gain:

- Easy access to financial services. Mobile banking apps allow users to conduct transactions without visiting a physical bank branch. Apps can help unbanked adults manage their finances without taking the time or spending the money to travel to a long-distance banking location.

- Emergency funds. During Covid-19, governments used digital financial services to disperse quick and secure payments to citizens and businesses in Peru, Zambia, Uganda, and Namibia (Agur et al., 2020). Likewise, fintech can help unbanked individuals rapidly collect money from family and friends in a crisis.

- Improved administrative services. Fintech can digitise government salaries, pensions, and social transfer payments, helping governments like Mexico save upwards of US $1.3 billion per year. Clear online transactions can also help reduce costly errors, overpayments, and government corruption, funnelling money back into important public services.

- New opportunities for small business. Peer-to-peer fintech platforms can make it easy to send and receive money without going through a traditional financial institution. Crowdfunding platforms help low-income founders launch startups, projects, and platforms with help from a broader global community.

Fintech’s drawbacks

Despite fintech’s benefits, unbanked adults are still vulnerable to being taken advantage of or excluded from critical services. When using fintech solutions, they often face risks similar to those they might face in the formal financial system:

- Predatory lending. As discussed in Oxford’s Fintech Programme, unbanked individuals often lack access to strong consumer protection laws. Companies can offer pricey loans through mobile phones, leaving unbanked individuals struggling to pay off their loan balances and landing them in heavy debt.

- Expensive rates. While some fintech offerings are free or inexpensive, others can charge higher lending or payment fees. These higher rates can be written into disclaimers and go unnoticed until the payments are insurmountable.

- UX design flaws. Many fintech products are designed for people who are already comfortable with technology. Poorly designed interfaces or system architectures can put off those who are not as familiar with computers and smartphones and make transactions impossible to complete.

Build fintech solutions for unbanked populations

Want to build fintech solutions for unbanked populations? Esme Learning designs and develops executive education programmes in partnership with leading universities and corporations from around the world. Browse our full list of programmes in artificial intelligence, blockchain, cybersecurity, digital disruption, and digital finance at https://esmelearning.com/collections/all.