Our biggest mānuka honey company has had a presence in China for almost 20 years. Its experience offers a fascinating insight into selling health and food products in this vast, varied, and rapidly-changing market. | Content partnership

In the late 1990s, a health-conscious Chinese businessman called Zhu Guangping was on holiday in Hong Kong and browsing through a pharmacy when he discovered a New Zealand bee product brand he liked.

Comvita was finding a growing clientele among Chinese tourists who bought their mānuka honey, propolis and other bee products in Hong Kong and later, as China’s outgoing travel restrictions relaxed, in New Zealand.

They bought for themselves, for family and friends, even to sell when they got home - an early manifestation of what would become the multi-billion dollar ‘daigou’ personal shopper revolution.

And Zhu, already a Comvita aficionado, saw the potential for the company’s products in his home country. He visited Comvita and its founders in the Bay of Plenty town of Paengaroa, and in 2004 became the exclusive distributor of Comvita’s natural health products in China, with a sales force of two.

Two decades later, Comvita has almost 200 people on the ground in China - the world’s biggest honey market - plus another 74 in Hong Kong. The company's strategy has changed from a distributor model to a subsidiary model, with the New Zealand-based company having full control of its China strategy and building the Comvita brand.

Comvita is the number one brand of UMF mānuka honey in the Chinese market and is in the top five New Zealand employers in China.

The company's Mainland China revenue grew 27 percent in the year to June 2021 to $73 million; ecommerce revenue into China was up 41 percent.

A rapidly-changing market

It’s been an interesting ride in a market that has seen monumental shifts in purchasing power and shopping habits over the last 20 years, says Andy Chen, Comvita’s Asia CEO.

And Chen knows a thing or two about the Chinese market. Born and educated in China, he cut his teeth around foreign brands working as part of the Chinese growth strategy team for massive US retail corporation Walmart between 2001 and 2011.

At that time, Walmart employed 100,000 people in its China workforce.

But a holiday in New Zealand changed Chen’s life. As he stood staring down at the lake in Queenstown “I felt a calmness in my mind I hadn’t felt since I’d graduated from university.”

Chen made the big decision to change pace and domicile, moving to New Zealand and joining tap maker Methven in 2016 and Comvita in 2020.

Chen says his first - and perhaps most challenging - job at Comvita has been to find a world-class leadership team for the Asia division. He loves New Zealand, but it’s not always easy to find other top international experts prepared to work for a 550-person company at the bottom of the world.

The next task is to lead a significant push of Comvita's health-related bee products into the China and wider Asian markets.

The impact of the pandemic

In a strange way, Covid helped the Comvita cause, Chen says.

“Following the start of the pandemic, more consumers are willing to prioritise their personal spend on health-related products and services and want to ensure they choose the best brand. We have three product lines: mānuka honey that consumers use for gut health, propolis for immunity, and olive leaf extract for cardiovascular support. These three health needs - gut, heart and immunity - are fundamental for most consumers, so there’s a massive potential out there.”

“We just need to work harder to tell our stories.” – Andy Chen, Asia CEO, Comvita

At the same time, there’s a big push towards safe, natural products, which plays into Comvita’s founding principles around understanding and proving the healing properties of mānuka honey and other natural products.

“We have a philosophy of believing in nature and using natural ingredients, but we also have science behind our products to prove they are both functional and safe,” Chen says.

“We just need to keep working harder to share the story that sits behind Comvita.”

‘Healthy’ is more important than ‘tasty’ or ‘affordable’

It’s common knowledge that the China market is diverse and complex. It’s also quite different from other markets.

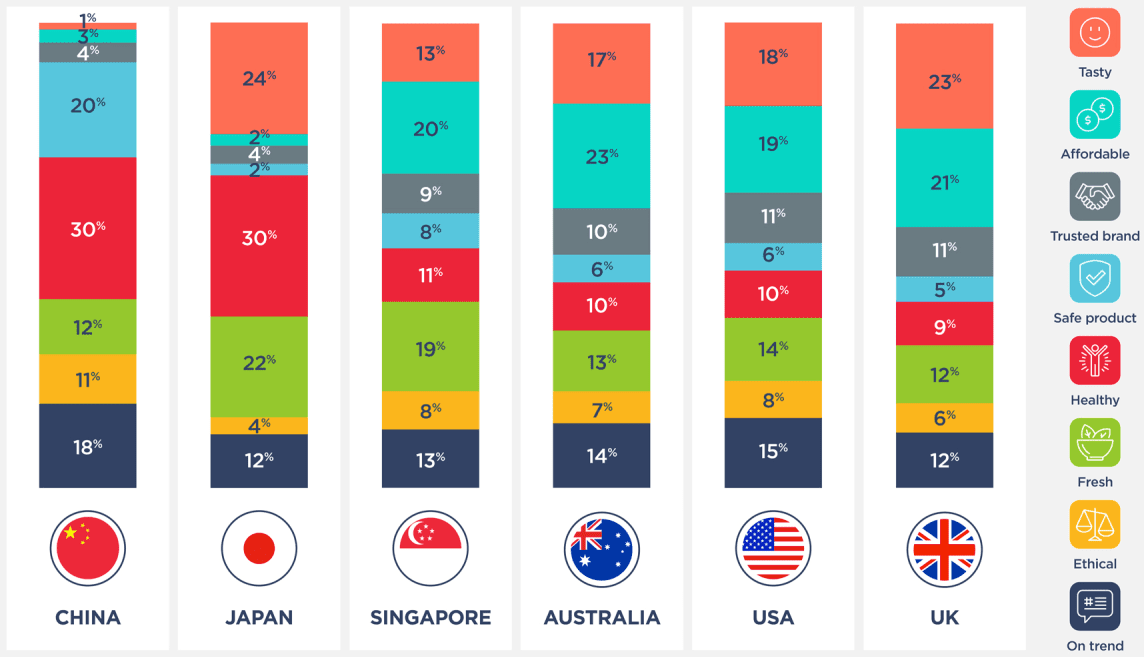

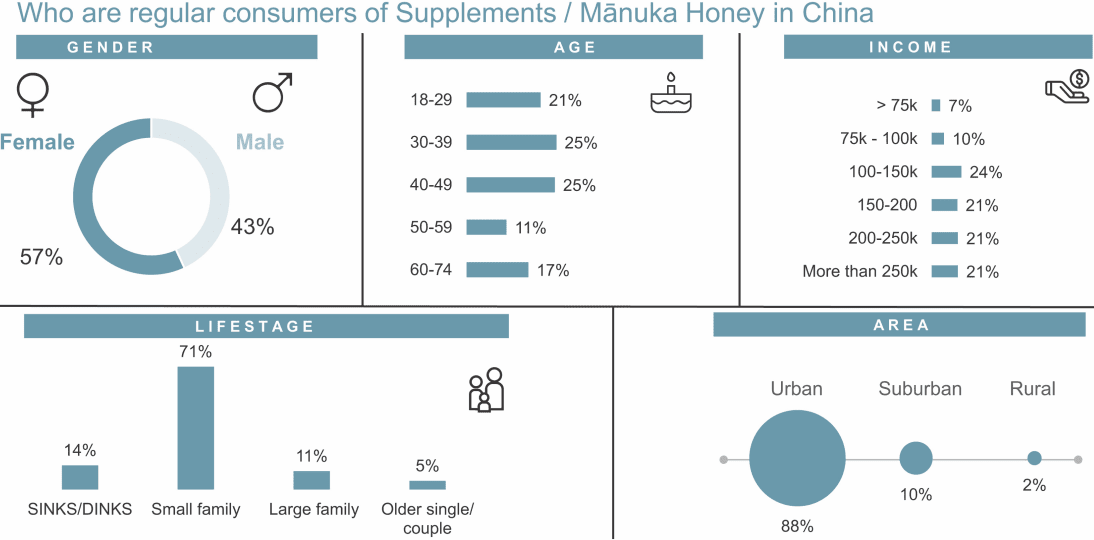

An international survey of 14,000 shoppers in the food and beverage sector conducted by New Zealand Trade and Enterprise and released in December last year shows just how differently Chinese consumers view their food, compared to people in other major markets for New Zealand goods.

While “affordable” and “tasty” are major factors for shoppers elsewhere, in China they just creep onto the chart. Instead “healthy” is of huge importance, followed by “safe” and “on trend”.

Meanwhile, the Chinese consumers surveyed are also more likely to choose an ethical product than people in other parts of the world.

The duel motivators of being trendy and ethical are even more prevalent when it comes to the mānuka honey and supplements market, the NZTE research shows. In that category, 31 percent of shoppers are swayed by “on trend” products when it comes to their spending decisions, and ethical products attract 21 percent.

Only 2 percent are interested in taste and 1 percent in affordability.

The youth market

This is a big change from the China of a decade ago, Chen says, and is particularly important for younger Chinese consumers.

“For Gen Z shoppers [people under 25 or so] the values and stories of a product or a company are important. They are looking for products that look and feel good and resonate with their own philosophy.”

While the NZTE survey suggests a quarter of people buying mānuka honey are 60-74-year olds, Andy Chen says a significant proportion of Comvita’s Chinese customers are under 45.

New Zealand’s honey export volumes reached $425 million in the year to June 2020, according to MPI figures.

Mānuka honey accounted for 76 percent of export volume and 88 percent of export revenue.

Imported honey not necessarily seen as superior

Comvita’s 50-year-old focus on “health and harmony with nature” sets the company apart from many competitors, Chen says, as does its move towards “B Corp” social and environmental leadership certification, and its commitment to being carbon neutral by 2025 and net carbon positive by 2030.

Still, Chinese consumers have a sophisticated palate when it comes to their honey - and a wide variety of home-grown regional specialty honeys to choose from, he says.

“The concept of using honey has been rooted in Chinese culture for 3000-4000 years, and people believe in general, despite a few dilution scandals, that China has the best honey on offer.”

Meanwhile, over the last three years, the government in Beijing has been pushing hard to promote the safety of locally-made products, as well as making big strides to get its environmental house in order, including big reductions in pollution levels.

The magic of 'functional food'

Comvita’s way to differentiate its products is to keep away from the table honey market - and avoid being seen as purely a honey company. Instead it wants to promote its wares in the ‘functional food’ category - products that offer health benefits beyond their nutritional value.

“Chinese consumers are very attentive to their gut health - traditional Chinese medicine teaches that gut health is the source of the overall health of a person.”

The idea of good digestion and boosted immunity resonates well with Chinese consumers, Chen says, although the company has to be careful with its messaging - China has strict regulations around using health-related angles in advertisements for food products.

E-commerce platforms are key

Covid has brought online shopping to the fore everywhere, and Chinese customers have embraced it as much as anyone.

It’s a market Chen and his team are critically aware of - Chinese consumers were more likely to buy mānuka honey online than any other Kiwi export food product, according to the 2021 NZTE research.

Forty percent of the Chinese survey participants bought their honey online, and of that, 60 percent was purchased through one of China’s large e-commerce platforms.

Comvita has been working hard on its online sales strategy, including major promotional pushes during the two biggest Chinese online shopping festivals, 11.11 (Singles Day) and 6.18 (June 18).

Last year, Comvita was the leading mānuka honey brand at 6.18 on both Tmall and JD.com. The company’s festival sales were up 31 percent on the previous year.

“Comvita also made the Tmall Top 10 brands in the healthy food category and was the leading International brand in this prestigious list,” group CEO David Banfield said at the time. “This reflects the fact Comvita is being recognised more and more as a broader lifestyle brand.”

Banfield says Comvita aims to lift digital revenue across all markets from 34 percent of the total to 38 percent this year.

"Delivering a unique world class digital experience will take about another 18 months," he said in the 2021 annual report.

Growth projections

Keeping up with what Banfield calls “the most dynamic market in the world” is never going to be easy, Andy Chen says. But he’s optimistic his new Asia team can meet Comvita’s goals of double-digit top and bottom line growth in China this year. That’s up on sales of $73 million in 2021.

Maybe they can do even better in the future, Chen says. He is lining up new strategic partners to sell and distribute Comvita products in its four main markets - Beijing, Shanghai, Shenzhen and Guangzhou. "Watch this space," he says.

Chen says major plantings of mānuka forest in New Zealand (the company has put in 10 million trees over the last few years) will secure supply for a potential big expansion in the Chinese market, and promote the company’s environmental credentials to its newly eco-conscious consumers.

The potential is mind-blowing, and a little overwhelming, he says.