Newcastle house prices have plummeted 10 per cent in nine months as rising interest rates wipe out some of the gains made in the pandemic boom.

But the city's house values remain 32 per cent higher than pre-COVID levels, compared with only 11.7 per cent across Australia's state and territory capitals.

Latest figures from property analysts CoreLogic show the typical Newcastle and Lake Macquarie house value was $823,000 in December, down from $919,000 in April.

The 10.4 per cent drop in value followed a meteoric 48 per cent rise in the median from $622,000 in March 2020.

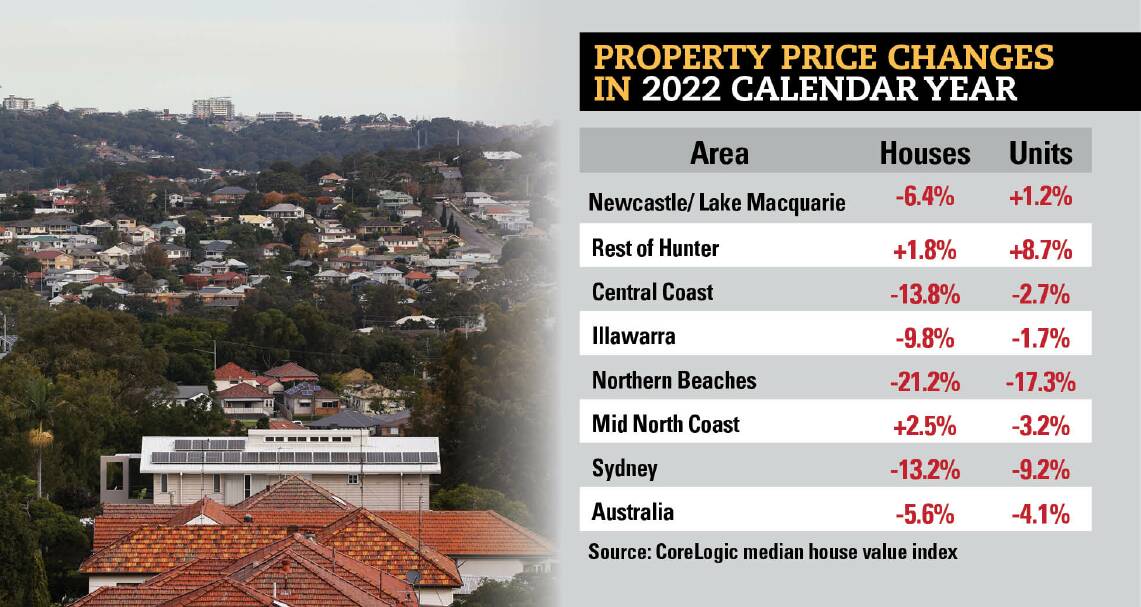

In the 2022 calendar year, the median house value fell 6.4 per cent in Newcastle but rose 1.8 per cent in the rest of the region.

Apartment prices increased 1.2 per cent across the year in Newcastle and Lake Macquarie and 8.7 per cent in the rest of the Hunter.

Newcastle unit prices have dropped $20,000 since their April peak of $674,000 but remain 26 per cent higher than before the pandemic.

Six suburbs drop out of city's million-dollar club

How property prices have changed in your suburb

The steady decline in Newcastle house prices continued in December. The median fell 1.9 per cent compared with November and 4.1 per cent in the quarter.

Median house values rose in many regional areas in NSW across 2022 but plunged in metropolitan areas.

Prices were down 13.8 per cent on the Central Coast, 9.8 per cent in the Illawarra and 21.2 per cent on Sydney's northern beaches.

All of Sydney's more expensive areas experienced double-digit price falls for the year, including the city and inner south (19.2 per cent), Eastern Suburbs (17.3 per cent) and Inner West (14.6 per cent).

The numbers for other metropolitan areas suggest the Newcastle market could have some way to fall in 2023.

CoreLogic's December report shows prices dropped 1.1 per cent across the nation in December and 5.3 per cent in 2022, the first annual fall since 2018 and the biggest annual fall since 2008.

CoreLogic research director Tim Lawless said 2022 had been a year of contrasts as house values rose through the first four months but fell sharply after the Reserve Bank started raising rates.

"Our daily index series saw national home values peak on May 7, shortly after the cash rate moved off emergency lows," he said in the report.

"Since then, CoreLogic's national index has fallen 8.2 per cent, following a dramatic 28.9 per cent rise in values through the upswing."

An owner-occupier on a variable interest rate with a $750,000 mortgage is paying about $1135 more per month than they were before rates started to rise.

The CoreLogic report said housing values remained "well above" pre-COVID levels in most areas.

"Melbourne is the only capital city where the current downwards trend is getting close to wiping out the entirety of COVID gains, with dwelling values only 1.5 per cent above March 2020 levels," Mr Lawless said.

IN THE NEWS

-

Drivers caught for drink and drugs, but only two arrests on New Year's

-

Teenage boy glassed at Dudley on New Year's Eve, three teenagers charged

- King Street Hotel primed for new life as Cambridge replacement

- Aileen Abbott clicks into photography's fun with Shameless Selfie Studio

- The Ukraine exhibition at Madrid's Thyssen-Bornemisza National Museum shows how museums and galleries can do good

WHAT DO YOU THINK? We've made it a whole lot easier for you to have your say. Our new comment platform requires only one log-in to access articles and to join the discussion on the Newcastle Herald website. Find out how to register so you can enjoy civil, friendly and engaging discussions. Sign up for a subscription here.