The head of Rapidus, a semiconductor consortium backed by the Japanese government that was established to leapfrog the world's leading makers of chips, estimates that the cost of its 2nm chips will be a tenfold increase compared to the standard chips made by other Japanese companies today. That makes sense because most chips made in Japan are on older mature nodes that are sold at far less expensive pricing than newer nodes, like 7nm and smaller. Yet, there are companies that are willing to pay such prices when the company expects to start 2nm production in 2027.

2nm chips from Rapidus will be vital for Japan, as some of them will be used for high-performance computing applications that are crucial for national security, whereas others will be used in innovative civilian applications like autonomous vehicles and robotics, Atsuyoshi Koike, chief executive of Rapidus, told Nikkei and TokyoKeizai (according to DigiTimes).

While it is evident that 2nm chips will be significantly more expensive than today's chips made on advanced nodes, a tenfold increase when compared to today's 'mainstream' chips made in Japan is a massive jump. The most advanced process technology that is currently used and made in Japan is probably 45nm, as virtually all Japanese chip designers began to outsource their production at sub-40nm nodes to Taiwanese foundries years ago. Needless to say, it will be significantly more expensive to produce chips on a 2nm node when compared to a 45nm fabrication technology.

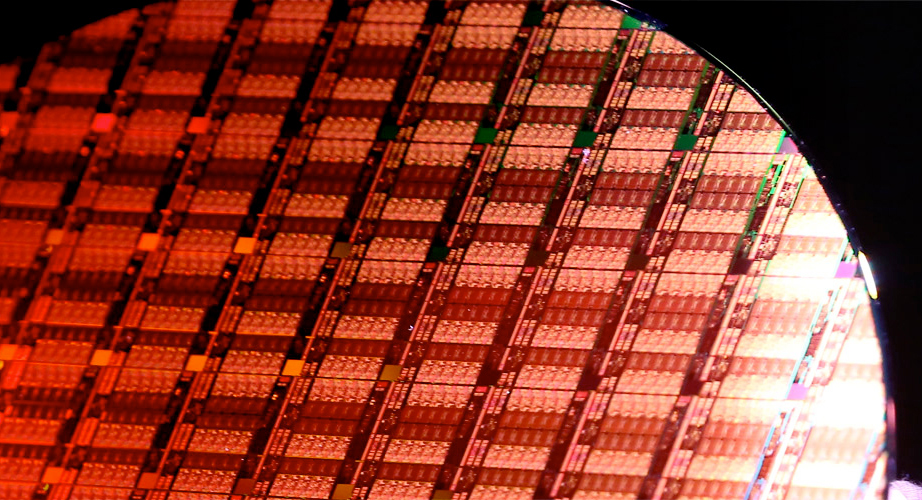

Pilot production of 2nm chips at Rapidus's fab in Chitose, Hokkaido, is slated for April 2025. The production facility is projected to commence trial operations involving water, electricity, gas, and ventilation systems in September 2024, in preparation for tools installation in December of the same year. Mass production lines are anticipated to become operational in early 2027.

When it comes to a workforce qualified to work at leading-edge chip production facilities, Koike assured that Rapidus is not experiencing significant difficulties in recruitment. The company has been successful at attracting Japanese semiconductor professionals who have either returned from abroad or rejoined the semiconductor industry after switching careers.

Rapidus had recruited 100 semiconductor engineers as of April 2023, with plans to double this figure by year-end. The initial group of engineers is currently undergoing training at IBM's Albany NanoTech Complex. The company believes that between 300 and 500 engineers will be necessary for pilot production already in 2025.

The Chitose fab is expected to accommodate three or four phases, which the company calls Innovative Integration for Manufacturing (IIM) units. The IIM-1 unit will manufacture 2nm chips, while IIM-2 will handle processes for chips below 2nm.

It is estimated that Rapidus — which is backed by the Japanese government as well as Denso, Kioxia, MUFG Bank, NEC, NTT, SoftBank, Sony, and Toyota — will need a budget of JPY5 trillion ($35 billion) to progress from R&D to mass production. The Japanese government has agreed to financially support the company with a two-year subsidy amounting to a total of $2 billion. However, other Japanese businesses appear hesitant to invest in Rapidus. For instance, Hitachi is unwilling to invest in Rapidus, but instead chose to offer manufacturing and metrology equipment, along with relevant expertise to aid Rapidus in enhancing its fabrication technologies. As the company will clearly in need a lot of money, its CEO is mulling raising additional capital through an initial public offering (IPO), though for now there is nothing to announce.