Shares of Home Depot (HD) are not trading too well on Tuesday morning, down about 9% after the company reported earnings.

Bulls were hopeful that strong housing trends would propel Home Depot’s top and bottom line. They were also hopeful after Walmart’s (WMT) favorable reaction to earnings last week.

What more could Home Depot do?

Earrings grew more than 20% year over year to $3.18 a share and beat expectations. Revenue jumped more than 10% versus the same period a year ago and also beat analysts’ estimates.

Further, the company boosted its dividend by 15%.

Guidance is likely weighing on the stock as investors now try to reprice Home Depot in a year where management expects “low single digit” earnings growth.

The truth is, the charts were weakening before earnings and now we’re seeing more downside follow-through.

Let’s look at the stock now that earnings are out of the way.

Trading Home Depot Stock

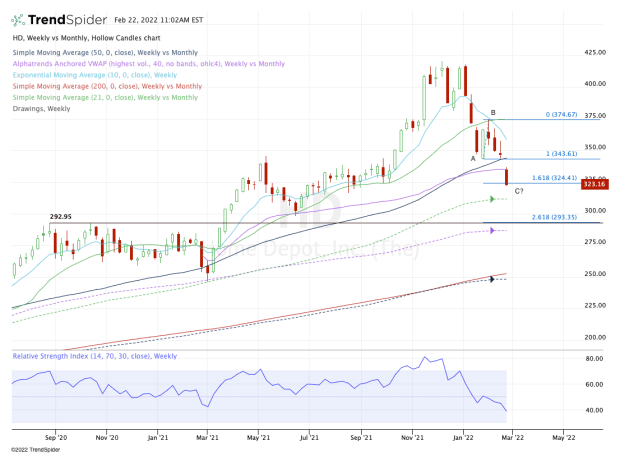

Chart courtesy of TrendSpider.com

I think Home Depot stock is in an “ABC” type correction. While it’s nice to be able to identify these types of corrections, there is not an exact science.

For instance, we’ve already seen the initial decline play out — the “A leg” — and the rally from that low — the “B leg” — has played out as the stock is now fading again.

We’re at the 161.8% downside extension now, near $325.

It’s worth noting that this was a support level in the third and fourth quarters, as well. If the stock can find its footing and start to form a base, bulls can begin to accumulate.

The “not an exact science” part comes into play here though, because we don’t know if this is the low. While the 161.8% extension is a downside measure, that doesn't mean it's the low — we very well could see the stock move lower still.

If that’s the case, keep an eye on the 21-month moving average. Below that puts an interesting area on the table. That’s the $292 to $300 area, which was the former breakout zone, then support in mid-2021.

It’s also where the 261.8% downside level comes into play, with the rising monthly VWAP measure just below this range.

As for the upside, I want to see if Home Depot stock can reclaim today’s high and the weekly VWAP measure. Above those measures puts the 50-week in play, followed by the $343 level, which was pre-earnings support.

Keep in mind, Lowe's (LOW) will report tomorrow morning. That could either help stem the bleeding or accelerate the losses.