Amazon.com Inc. (NASDAQ:AMZN) was trading slightly higher in the premarket Monday, in tandem with the general market, which saw S&P 500 futures trading up about 0.2%.

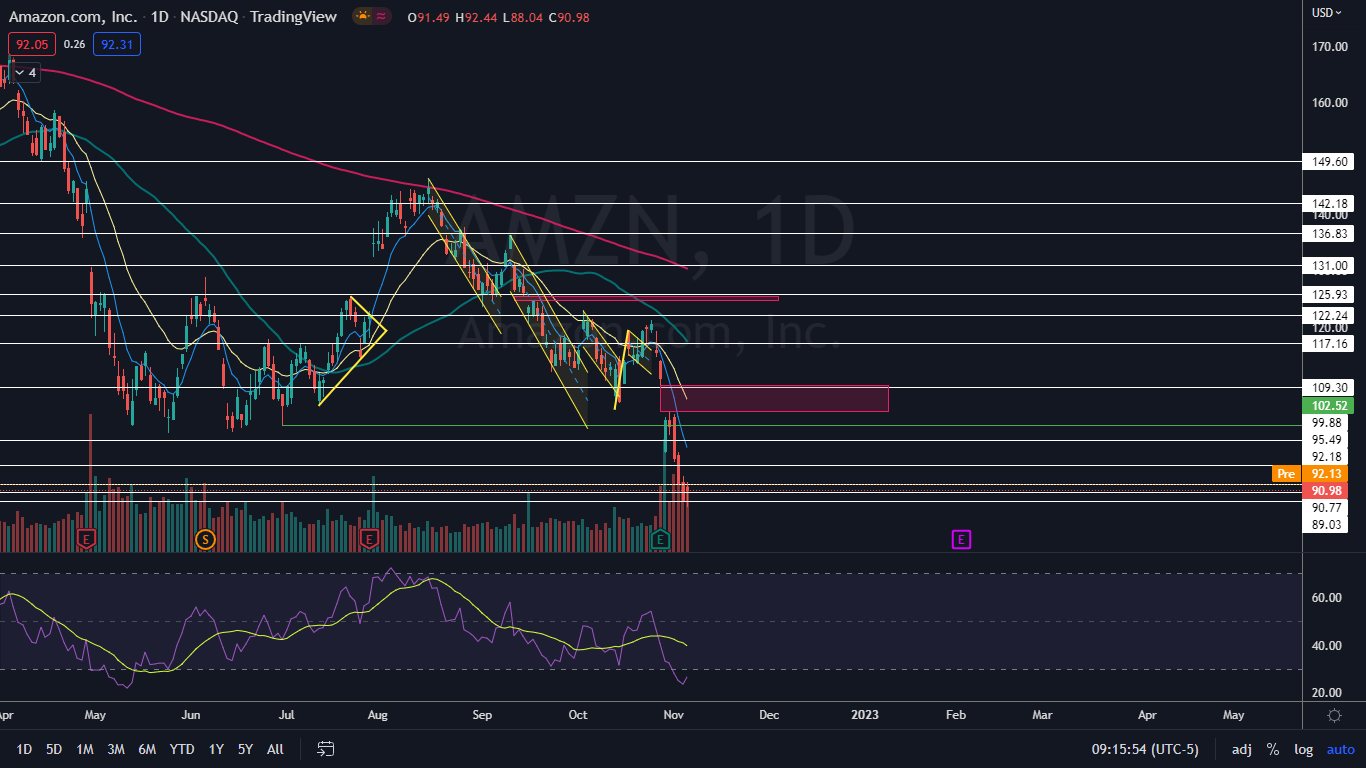

After the e-commerce and streaming giant printed its third-quarter earnings on Oct. 27, the stock dropped under an important psychological support level at $100. Although Amazon closed the Oct. 28 trading day above the area, the stock has been unable to regain $100 since then and on Oct. 31 confirmed a new downtrend.

A downtrend occurs when a stock consistently makes a series of lower lows and lower highs on the chart.

The lower lows indicate the bears are in control while the intermittent lower highs indicate consolidation periods.

Traders can use moving averages to help identify a downtrend with descending lower timeframe moving averages (such as the eight-day or 21-day exponential moving averages) indicating the stock is in a steep shorter-term downtrend.

Descending longer-term moving averages (such as the 200-day simple moving average) indicate a long-term downtrend.

A stock often signals when the lower low is in by printing a reversal candlestick such as a doji, bullish engulfing or hammer candlestick. Likewise, the lower high could be signaled when a doji, gravestone or dragonfly candlestick is printed. Moreover, the lower lows and lower highs often take place at resistance and support levels.

In a downtrend the "trend is your friend" until it’s not and in a downtrend, there are ways for both bullish and bearish traders to participate in the stock:

- Bearish traders who are already holding a position in a stock can feel confident the downtrend will continue unless the stock makes a higher high. Traders looking to take a position in a stock trading in a downtrend can usually find the safest entry on the lower high.

- Bullish traders can enter the trade on the lower low and exit on the lower high. These traders can also enter when the downtrend breaks and the stock makes a higher high indicating a reversal into an uptrend may be in the cards.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Amazon Chart: Amazon printed its most recent lower high within the downtrend on Oct. 31 at $104.87 and the most recent confirmed lower low was formed at the $88.04 mark on Friday. On Friday, Amazon printed a hammer candlestick on the daily chart, which indicates a bounce may be in the cards for Monday, which would confirm the next lower low has occurred.

- A bounce is also likely to come because Amazon’s relative strength index (RSI) has been measuring in under 30% since Oct. 31. When a stock’s RSI falls under that level, it becomes oversold, which can be a buy signal for technical traders.

- Amazon’s daily trading volume has been decreasing over the last four trading days, which indicates the stock may be slowly running out of sellers. Friday’s sideways trading pattern on smaller time frames also indicates the stock has been trading in a period of consolidation, which can indicate a bounce is on the horizon, at least to print another lower high.

- Amazon has resistance above at $92.18 and $95.49 and support below at $90.77 and $89.03.

.jpg?w=600)