Costco Wholesale (COST) is down about 2.5% so far on Thursday, the last trading session of the holiday-shortened week. At the session low, shares were down about 4%.

The decline comes after the retailer reported a mild dip in its March comp-store sales, even as net sales posted a slight increase.

Specifically, year-over-year comp-store sales fell 1.1% overall and 1.5% in the US, even as net sales climbed 0.5% to $21.61 billion.

DON'T MISS: Buy-the-Dip Setup Appears in Salesforce Stock: Here's the Trade

Costco is one of the top retailers in the US, alongside Amazon (AMZN), Walmart (WMT), Target (TGT) and others. The only problem? Retail stocks have been struggling.

While Walmart has traded better lately and Amazon caught a tech-inspired lift, others like Costco and Target continue to struggle.

So far, Costco stock is not reacting well to its latest sales update and the reaction has shares trading below all of its daily moving averages.

Trading Costco Stock

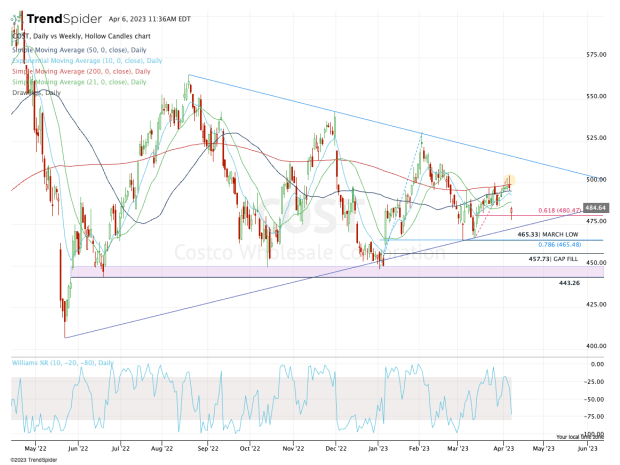

Chart courtesy of TrendSpider.com

Looking at the daily chart above, notice how Costco stock has been trading in a wedge pattern for about a year now. Defined by its higher highs and lower lows, the range continues to tighten.

On Tuesday and Wednesday, shares tried to push above $500 and the 200-day but were rejected both times.

With Thursday’s gap-down, Costco stock is now below all of its daily moving averages. That said, it did hold the 61.8% retracement of the recent range.

RealMoney’s Bruce Kamich said the stock “doesn’t look like a buy” and for the time being, I tend to agree.

Don't Miss: What the Technicals Say for the S&P 500, Nasdaq in the Second Quarter

Costco stock is sort of in no man’s land here. It’s lost its upside momentum, but didn’t sink far enough to stronger support.

If it continues lower, uptrend support could give it a boost, while the March low and 78.6% retracement are both near the $465 level. A bit more weakness could finally force a gap-fill down to $457.75.

Ultimately, the strongest area of support is around $450.

On the upside, even a gap-fill back up toward $495 still leaves quite a bit of concern. That’s as shares ram into the 50-day moving average, while remaining below $500 and the 200-day.

If it can clear all of these measures though, Costco stock could run all the way to downtrend resistance (blue line) and potentially break out to the upside.