It’s not a great day in the stock market and it’s a particularly bad day for Home Depot (HD), with the home-improvement retailer's shares down about 6% at last check following a disappointing quarterly update.

While Home Depot actually beat on the earnings line, it missed on revenue expectations while management’s outlook and guidance disappointed investors.

As TheStreet's Martin Baccardax reported, “Home Depot reiterated that it sees a 'mid single digit' earnings decline, with comparable sales expected to be flat to 2022 levels.”

As a result, the stock is trading at its lowest level since mid-November.

Investors were hoping they’d see a buy-the-dip reaction in Home Depot stock, just as they did in Walmart (WMT).

Instead, here’s where support may come into play.

Trading Home Depot Stock on Earnings

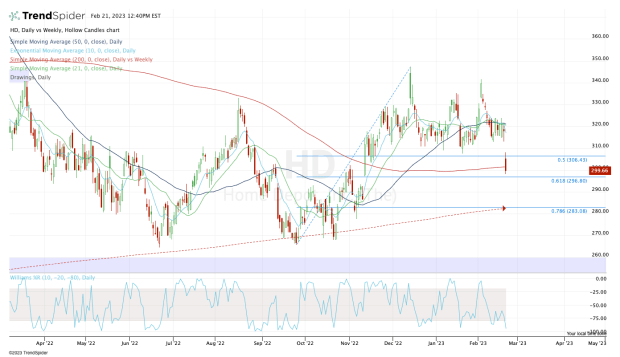

Chart courtesy of TrendSpider.com

Following a rally in November, Home Depot stock has been trading between $310 and $340. With today’s decline, the stock is breaking below this range.

For now, it’s starting to find its footing around the $300 area, as it clings to the 200-day moving average.

If the shares can hold this level and rally, bulls will want to see it reclaim the 50% retracement near $306.50 and take out the post-earnings high of $308. Above that, the stock can begin filling today’s gap.

Ideally for the longs, the shares will find support between the 50% and 61.8% retracement zone.

If, however, the 200-day moving average doesn’t hold as support and Home Depot breaks below $296, we could be looking at a larger correction.

Specifically, it could open the door down to the low- to mid-$280s, where the shares find the 78.6% retracement and the 200-week moving average.

If all these support levels fail, the high-$260s could be back in play. That area has been major support over the past 12 months.

While Home Depot may be a high-quality retailer, the reaction to the earnings has not been good. From here, let’s see whether and where support shows up.

If it does not, it may be time to hold off on a long trade in Home Depot for a bit, at least until we test some larger support zones.