Investors heard from Verizon (VZ) yesterday, and before the open today they heard from AT&T (T), The telecom giant reported fourth-quarter earnings, delivering better-than-expected results.

The stock was up more than 5% at last check as investors cheered AT&T’s earnings beat. Further, the company was firm on paying down debt after meeting its dividend obligations.

As reported earlier by TheStreet's Martin Baccardax: “Key to its dividend pledge, however, is its forecast for free cash flows in the region of $16 billion, a $2 billion improvement from 2022 levels.”

That likely gave investors some reassurance with the stock, which has posted a sharp rebound from a critical support zone just a few months ago.

Even after the rebound, the dividend yields 5.5%. Are the dividend and low valuation — the shares trade at about 7.5 times earnings — enough to attract more buyers?

Let’s see if the charts can lend a hand in that decision.

Trading AT&T Stock

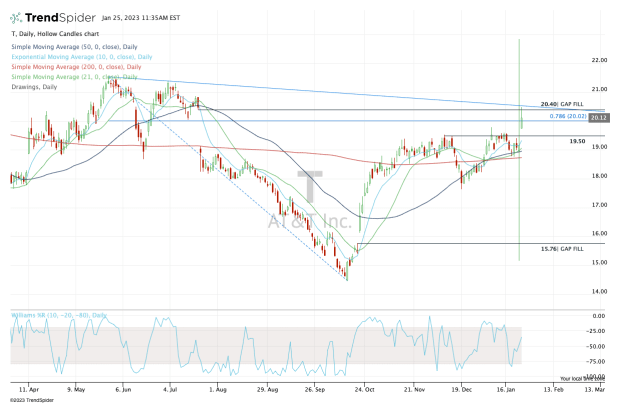

Chart courtesy of TrendSpider.com

Ignoring yesterday’s price action as a result of a technical issue at the NYSE, we can see some pros and cons to today’s action.

First, the positives. It’s good to see a bullish post-earnings reaction, especially in lieu of what we’re seeing from Microsoft (MSFT) and the reaction in Big Tech. Further, AT&T stock is gapping up over resistance, which was at $19.50.

The stock is also above all its daily moving averages, which is a huge positive as it hits a multiquarter high.

On the list of cons, though, traders may notice that AT&T stock is fading from the gap-fill level at $20.40, as well as downtrend resistance (blue line).

From here, I think traders need to hold a bullish bias with AT&T, given how well the stock has been trading and following today’s developments.

At the same time, given the overhead resistance above, this may be one to buy on a pullback rather than at current levels.

If the stock can clear today’s high — which is currently at $20.48 — that would open the door for a rally into the $21.25 to $21.50 zone.

But if AT&T stock pulls back, then the $19.50 level and the rising 10-day moving average could be an area of support.