Electric vehicle makers are navigating through some serious supply chain challenges. Deliveries statistics for March as well as the first quarter are key to gauging their resilience in the face of these shocks.

Will Tesla's China Shutdown Mar Q1? Tesla, Inc. (NASDAQ: TSLA) will release its first-quarter deliveries and production data over the next few days. The company finished 2021 on a strong note, having delivered 936,172 vehicles for the year. The average quarterly pace works out to 234,043 units.

The EV giant delivered 305,840 units in the fourth quarter of 2021, compared with 180,338 a year earlier.

Notwithstanding supply challenges, Tesla reaffirmed its goal of at least 50% volume growth in 2022. This suggests the company could have annual deliveries of at least 1.4 million for the year, translating to an average quarterly pace of 350,000 units.

Tesla's problem, if any, will have to do with supply rather than demand. To make matters worse, the company has had to shut down its Giga Shanghai plant on more than one occasion.

Data released by the China Passenger Car Association showed Tesla delivered a cumulative 116,360 units of Giga Shanghai-made cars in the January-February period. This includes both China sales as well as exports to Europe.

Tesla's China sales typically account for about 20% of the company's overall sales. It has covered most of its bases with its vertical integration and the contracts it has stitched up with its suppliers.

Irrespective of how Tesla fares in the first quarter, the company is in the sweet spot of accelerating EV adoption, with the recent opening of its Giga Berlin and Giga Texas factories and strong competitive positioning.

See Also: Why This Tesla Analyst Thinks This 'One Really Big Item' Could Be Part Of Master Plan Part 3

Nio Could Stoop to Conquer: Nio, Inc.'s (NYSE: NIO) lean run might not last long as the company is positioning itself for a product supercycle, with the recent launch of the ET7 sedan and the imminent launch of a midsize sedan and the ES7 SUV.

The first-quarter deliveries could be in line with recent quarters, with the company calling for deliveries of 25,000 to 26,000 units. This compares to the 25,034 vehicles it sold in the fourth quarter of 2021 and 20,060 in the first quarter of 2021.

The company delivered 15,783 vehicles in the first two months of the year, leaving it to chase a target of 9,217-10,217 units for March.

CEO William Li did not telegraph any serious supply chain issues on the fourth-quarter earnings call. The company, however, has a relatively higher exposure to the COVID-19-hit regions of China.

XPeng Has A Tall Target: XPeng, Inc. (NYSE: XPEV) has guided to first-quarter deliveries of 33,500-34,000 units, below the 41,751 cars it delivered in the fourth quarter, but a sharp increase from 13,340 a year earlier.

For the January-February period, the company sold 15,108 vehicles. XPeng may have to sell more than that combined tally to just hit the low-end of its guidance.

It picked up strong momentum in the second half of 2021, thanks to the launch of the P5 family sedan. Coming into the new year, deliveries took a hit in February, reflecting industry-wide softness in China amid the Chinese New Year holiday.

Can Li Auto Surpass Expectations?: Li Auto, Inc.'s (NASDAQ: LI) first-quarter guidance calls for deliveries of 30,000 to 32,000 units. This compares to the deliveries of 35,221 units and 12,579 units, respectively for the previous quarter and a year earlier.

So far this year, the company has delivered 20,682 units.

EV Stock Price Action: Tesla shares have picked up some momentum in recent sessions, thanks to de-escalation in the ongoing Russia-Ukraine war and the company's plans for a stock split.

The stock was last down 0.34% to $1,090.23.

Shares of Chinese EV manufacturers, however, are still a bit wobbly amid fears of getting delisted in U.S. exchanges and other geopolitical concerns. At last check, Nio was down 5.14% at $21.03, XPeng slipped 2.57% to $27.71, and Li Auto fell 3.94% to $26.06.

Read Next: Nio Analyst Predicts Over 200% Upside For Stock: 'EV Maker Has Clear Growth Prospects In 2022'

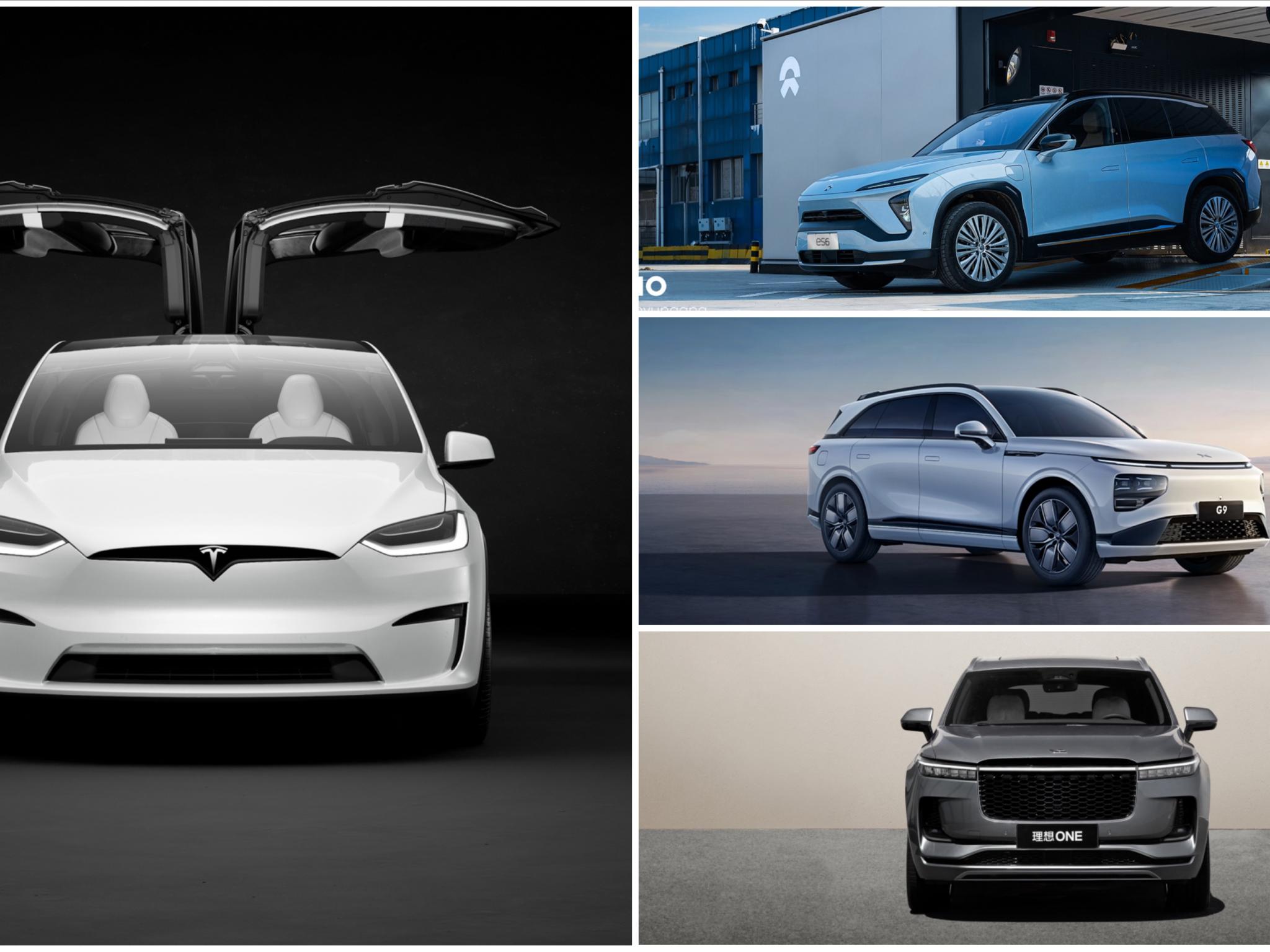

Photos courtesy: Tesla, Nio, XPeng and Li Auto