Newmont Corporation (NEM), headquartered in Denver, Colorado, acquires, explores, and develops mineral properties. Valued at $124.5 billion by market cap, the company produces and markets gold, copper, silver, zinc, and lead. The world’s leading gold company is expected to announce its fiscal fourth-quarter earnings for 2025 after the market closes on Thursday, Feb. 19.

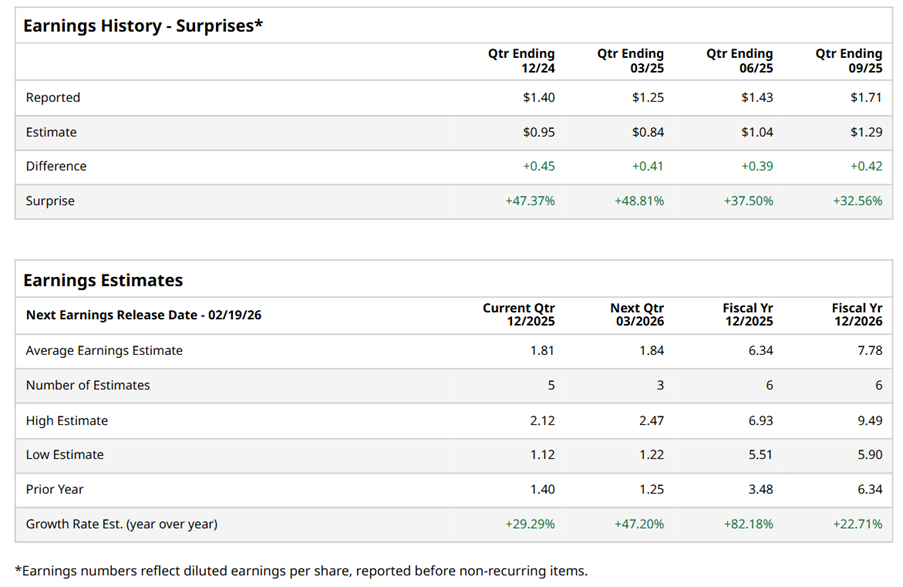

Ahead of the event, analysts expect NEM to report a profit of $1.81 per share on a diluted basis, up 29.3% from $1.40 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect NEM to report EPS of $6.34, up 82.2% from $3.48 in fiscal 2024. Its EPS is expected to rise 22.7% year over year to $7.78 in fiscal 2026.

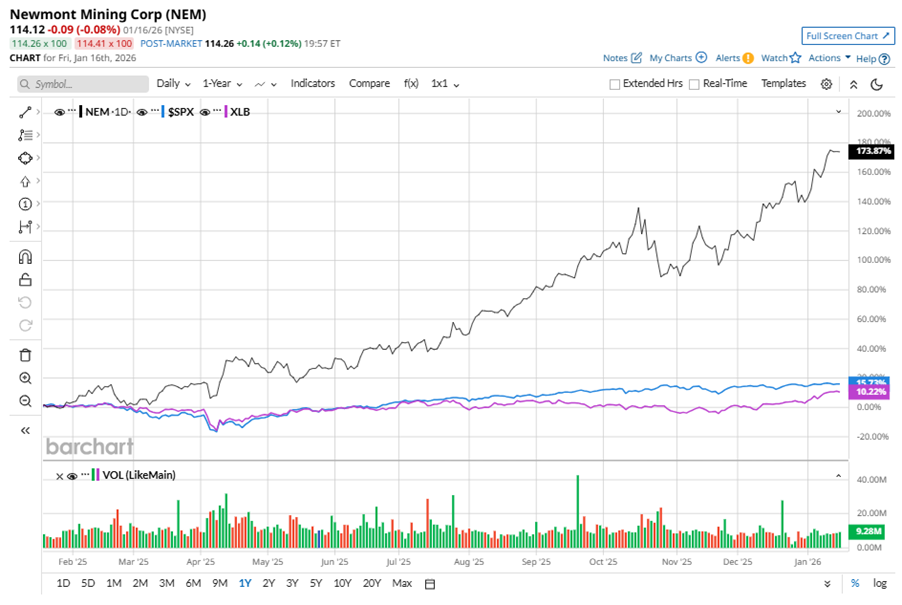

NEM stock has significantly outperformed the S&P 500 Index’s ($SPX) 16.9% gains over the past 52 weeks, with shares up 174% during this period. Similarly, it considerably outperformed the Materials Select Sector SPDR Fund’s (XLB) 10.9% gains over the same time frame.

Newmont's strong performance is driven by a gold price rally, boosting revenues and profit margins. The company's 1.4 million gold ounces production during the quarter supported results, with investors expecting gold to hit $5,000 by 2026.

On Oct. 23, 2025, NEM reported its Q3 results, and its shares plunged over 11.9% in the following two trading sessions. Its adjusted EPS of $1.71 topped Wall Street expectations of $1.29. The company’s revenue was $5.5 billion, exceeding Wall Street forecasts of $5 billion.

Analysts’ consensus opinion on NEM stock is bullish, with a “Strong Buy” rating overall. Out of 21 analysts covering the stock, 15 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and four give a “Hold.” While NEM currently trades above its mean price target of $113.05, the Street-high price target of $130 suggests an upside potential of 13.9%.