/Lockheed%20Martin%20Corp_%20TX%20facility-by%20JHVEPhpoto%20via%20iStock.jpg)

With a market cap of $111.7 billion, Lockheed Martin Corporation (LMT) is a leading aerospace and defense company that provides advanced technology systems and services worldwide. It operates through four segments - Aeronautics; Missiles and Fire Control (MFC); Rotary and Mission Systems (RMS); and Space, offering solutions in military aircraft, missile defense, helicopters, space systems, and cyber security.

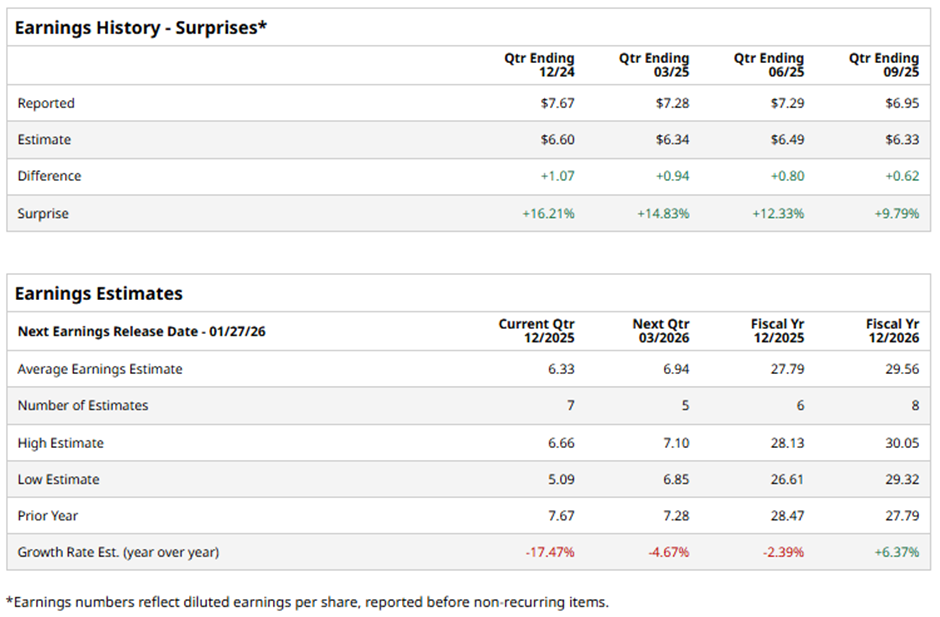

The Bethesda, Maryland-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast LMT to report a profit of $6.33 per share, down 17.5% from $7.67 per share in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts predict the world’s largest defense contractor to report an EPS of $27.79, down 2.4% from $28.47 in fiscal 2024. However, EPS is anticipated to grow 6.4% year-over-year to $29.56 in fiscal 2026.

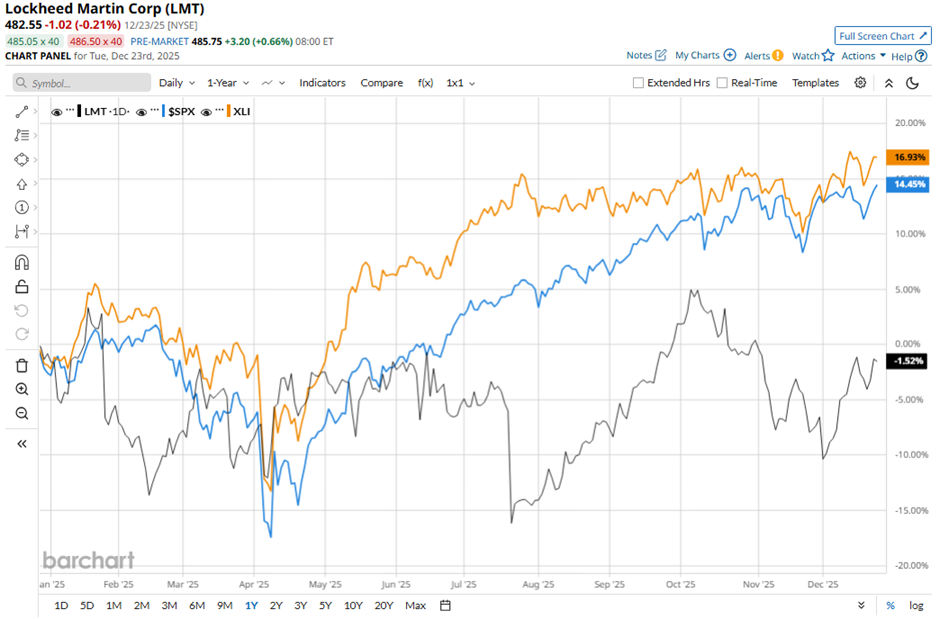

Shares of LMT have declined marginally over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 15.7% gain and the State Street Industrial Select Sector SPDR ETF’s (XLI) 17.9% increase over the same period.

Lockheed Martin reported stronger-than-expected Q3 2025 EPS of $6.95 and revenue of $18.61 billion on Oct. 21. The company also raised its 2025 outlook, increasing its EPS forecast to $22.15 - $22.35 and lifting the lower end of its revenue guidance to $74.25 billion. Nevertheless, the stock fell 3.2% on that day.

Analysts' consensus view on Lockheed Martin’s stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 23 analysts covering the stock, seven recommend "Strong Buy," 15 suggest "Hold," and one advises "Strong Sell." The average analyst price target for LMT is $524.05, suggesting a potential upside of 8.6% from current levels.