Valued at a market cap of $31.4 billion, EQT Corporation (EQT) is a major energy company primarily involved in natural gas exploration, production, gathering, and transportation. It is headquartered in Pittsburgh, Pennsylvania and is one of the largest natural gas producers in the United States, with a strong operational focus in the Appalachian Basin, notably the Marcellus and Utica shale formations.

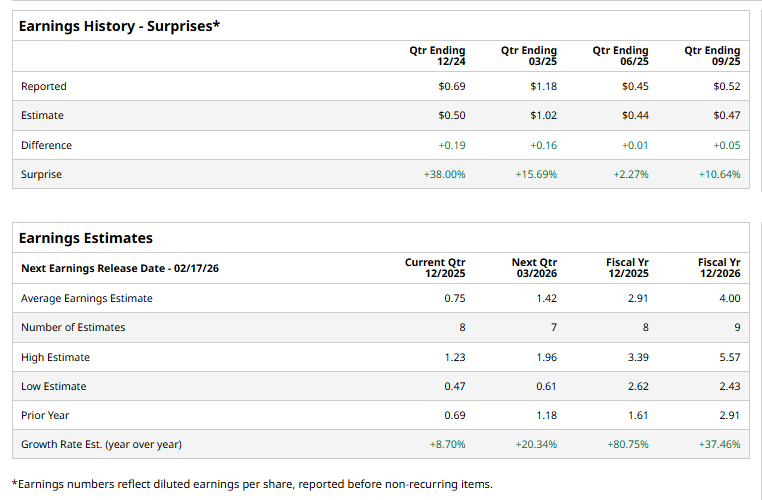

The energy titan is expected to announce its fiscal Q4 earnings for 2025 soon. Before this event, analysts expect this energy company to report a profit of $0.75 per share, up 8.7% from $0.69 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters.

For FY2025, analysts expect EQT to report a profit of $2.91 per share, representing a notable 80.8% increase from $1.61 per share in fiscal 2024. Furthermore, its EPS is expected to grow 37.5% year over year to $4 in fiscal 2026.

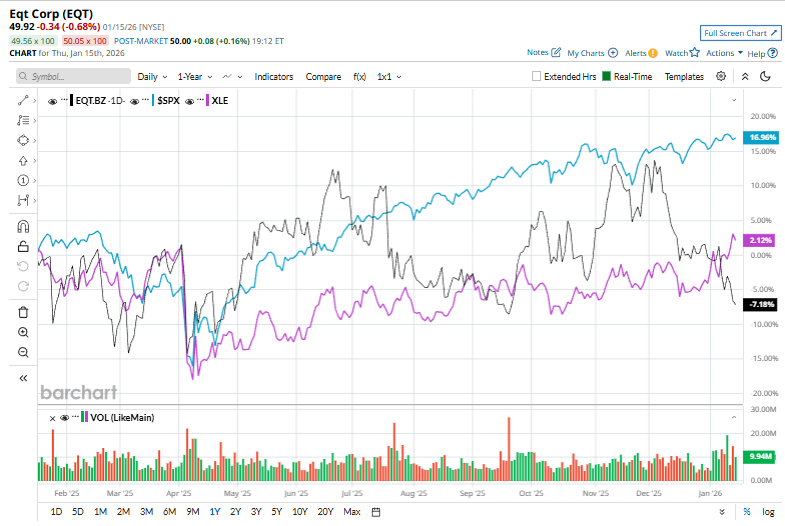

EQT has dipped 4.8% over the past 52 weeks, trailing both the S&P 500 Index's ($SPX) 16.7% uptick and the Energy Select Sector SPDR Fund’s (XLE) 2.9% gain over the same time frame.

Over the past year, EQT has trailed the broader market alongside much of the natural gas and energy sector, reflecting industry-wide headwinds rather than company-specific weakness. The underperformance has been shaped by softer natural gas pricing, sector rotation away from energy stocks, EQT’s measured production strategy, and lingering investor concerns around cyclical risk and balance sheet exposure.

Wall Street analysts are highly optimistic about EQT’s stock, with an overall "Strong Buy" rating. Among 27 analysts covering the stock, 20 recommend "Strong Buy," one indicates a "Moderate Buy,” and six suggest "Hold.” The mean price target for EQT is $65.28, indicating a 30.8% potential upside from the current levels.