/Copart%2C%20Inc_%20app-by%20Premio%20Stock%20via%20Shutterstock.jpg)

Valued at a market cap of $39.7 billion, Copart, Inc. (CPRT) is a Texas-based multinational leader in online vehicle auctions and remarketing services. Copart operates a proprietary, technology-driven platform that connects sellers, primarily insurance companies, fleet operators, rental companies, and financial institutions, with a global base of buyers, including dismantlers, rebuilders, used-vehicle dealers, exporters, and individual consumers.

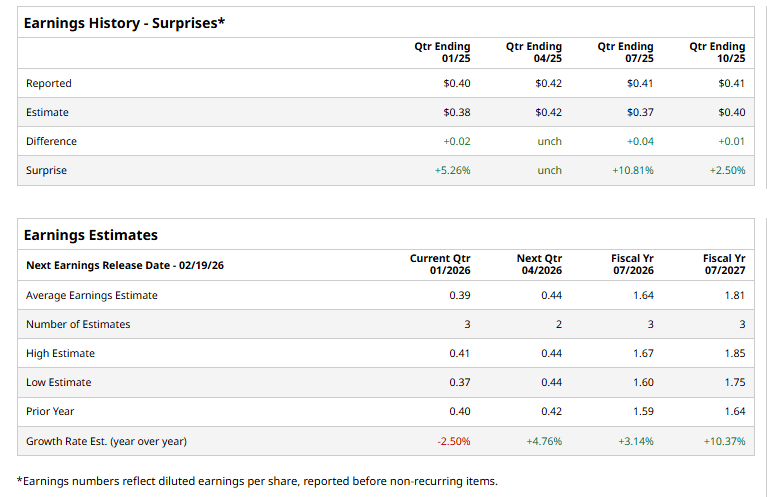

It is expected to announce its fiscal Q2 earnings for 2026 in the near future. Before this event, analysts expect this online car auction company to report a profit of $0.39 per share, down 2.5% from $0.40 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in each of the last four quarters.

For fiscal 2026, analysts expect Copart to report a profit of $1.64 per share, representing a 3.1% increase from $1.59 per share in fiscal 2025. Moreover, its EPS is expected to grow 10.4% year over year to $1.81 in fiscal 2027.

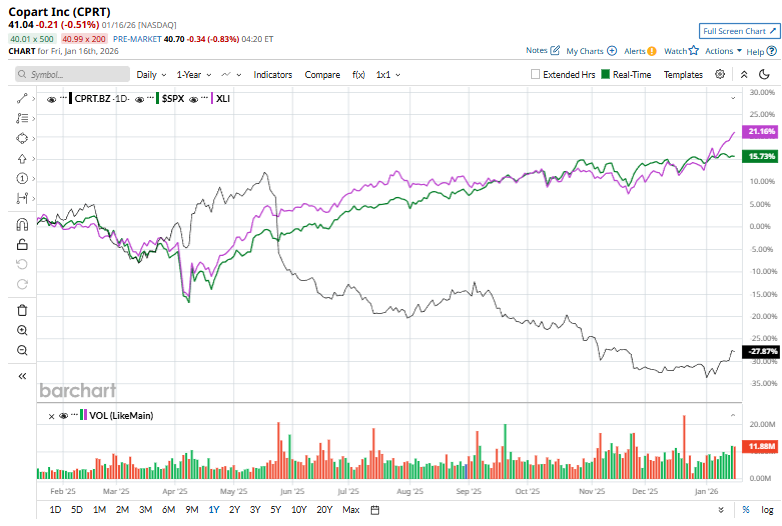

Copart has fallen 27.2% over the past 52 weeks, significantly lagging behind both the S&P 500 Index's ($SPX) 16.9% return and the Industrial Select Sector SPDR Fund’s (XLI) 21.9% uptick over the same time period.

Over the past year, Copart has lagged the broader market, mainly because growth momentum has cooled from prior periods, making the stock less compelling relative to faster-moving sectors. Softer conditions in parts of the used-vehicle market and more moderate auction activity have weighed on near-term revenue and earnings trends, tempering investor enthusiasm.

Wall Street analysts are moderately optimistic about Copart’s stock, with an overall "Moderate Buy" rating. Among 12 analysts covering the stock, five recommend "Strong Buy," six suggest "Hold,” and one “Strong Sell.” The mean price target for CPRT is $52.30, indicating a 27.4% potential upside from the current levels.