At one point, Netflix (NFLX) was the best-performing FAANG stock to own. But with the strong first-quarter rally that we’ve seen, the group has overtaken the streaming major.

For now the champion's title in the group belongs to Meta (META), which is up fully 61% over the past three months. Netflix is the worst performer in that period.

Don't Miss: Cathie Wood's ARKK: Traders Mull Breakout or Breakdown

How interesting is it, though, that Meta and Netflix are the best-performing FAANG stocks over the past 12 months? They're down 3.2% and 4.1% respectively in that span, and many investors would have assumed two things.

First, that the losses would be worse than that; and second, that the other FAANG holdings would have outperformed these names.

At face value, that ignores the fact that Netflix and Meta suffered the largest peak-to-trough declines in the group, falling more than 75%.

Like the others, Netflix stock lately has been trading rather well. Can it continue to push higher?

Trading Netflix Stock

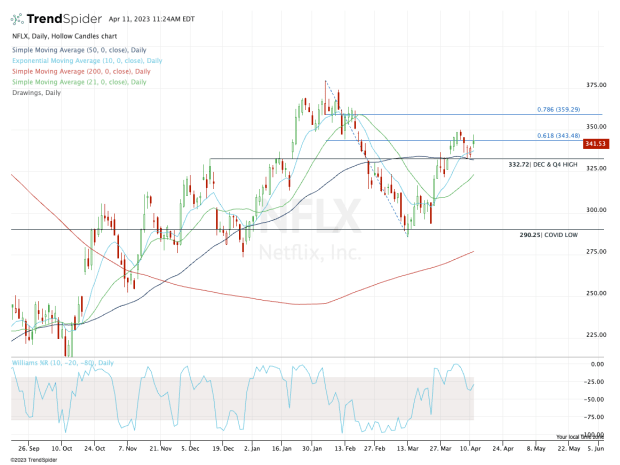

Chart courtesy of TrendSpider.com

Netflix stock posted a powerful rally to start the year -- almost 30% -- then coughed up all those gains and then some. It then bottomed in mid-March and has traded pretty well since.

The recent push helped send Netflix stock over its fourth-quarter high, as well as back above the 10-day, 21-day and 50-day moving averages.

Now it's bouncing off the 10-day and 50-day moving averages and continues to hold the $330 area.

From here, the bulls will want to see the stock continue to hold above this level.

Don't Miss: Anheuser-Busch Stock Charges to New Highs. Here's the Trade.

A break back below it puts Netflix stock below the 10-day and 50-day moving averages, as well as back below a key pivot level.

If Netflix can't hold $325 and the 21-day moving average, then $300 to $310 is a possible landing zone.

On the upside, let’s see whether Netflix can rally back to $350, where it previously stalled out. A move back ,to that level could open the door to the 78.6% retracement near $360.

Above that and the $375 level is within reach, should the bulls maintain momentum.

Obviously, Netflix stock will be susceptible to the overall market, whether bullish or bearish, but these are the levels to know in the short term.