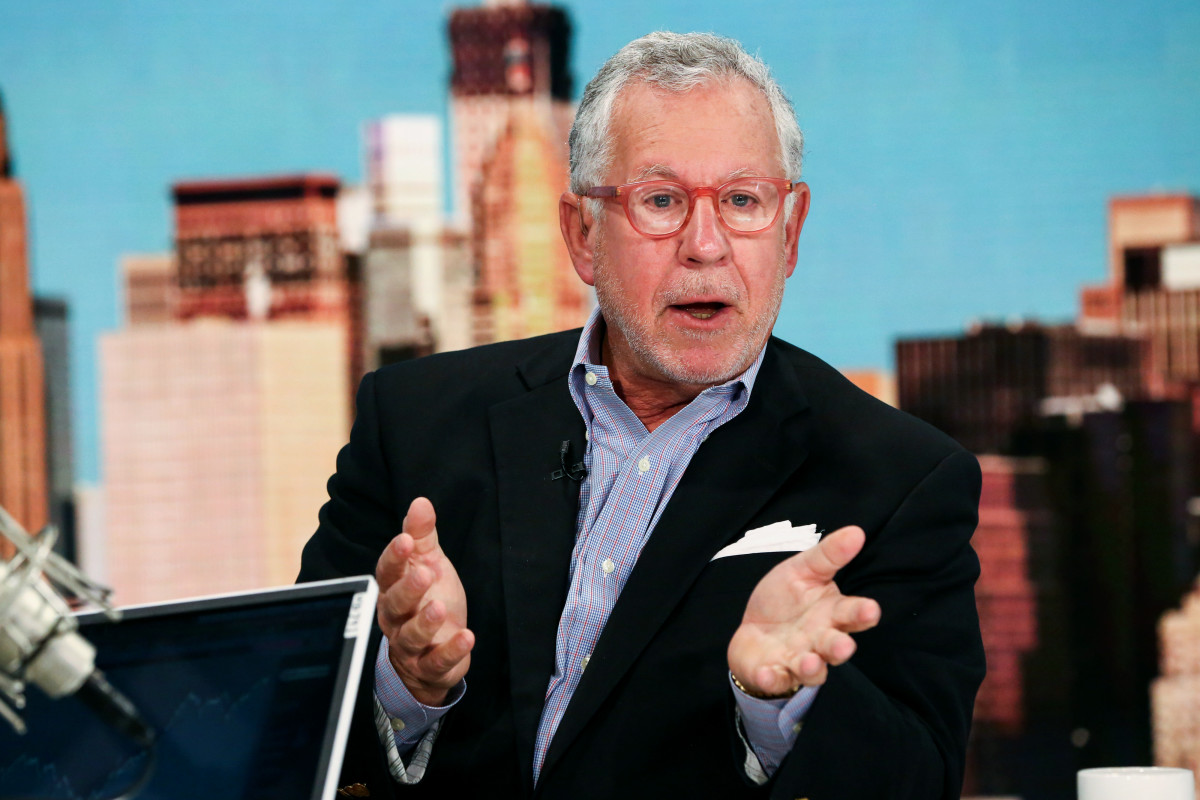

The stock market was up 18% in July when hedge fund manager Doug Kass warned that stocks may have seen their year-to-date highs.

That makes Kass one of the few on Wall Street who correctly pivoted from being bullish (he predicted stocks would rally in the first half of 2023) to bearish.

Given his track record, paying attention to what he’s doing with money now could be smart.

Credit: Abby Nicolas

The summer swoon has taken a toll on stocks

Kass’ Wall Street career began nearly fifty years ago at Putnam. Since then, he’s held various Wall Street positions, including serving as Senior Portfolio Manager at Leon Cooperman’s Omega Advisors, one of the most successful hedge funds on the planet.

Related: Single Best Trade: Hedge fund manager Doug Kass gives his top pick now

His decades of experience, including navigating the tumultuous inflation spiral in the 1970s, means he’s seen plenty of good and bad markets. That helped him correctly predict investors were too bearish last winter and bullish this summer.

His prescient prediction that stocks could be about to drop didn’t come out of thin air. Kass describes himself as a contrarian with a calculator. He’s most comfortable when he’s going against the herd based on facts, rather than fads.

Among Kass’ concerns this summer was how investors seemed to be downplaying the risks associated with higher Treasury yields.

“Equities are particularly overpriced relative to interest rates — the Equity Risk Premium is thin, and bond yields are very high relative to the S&P dividend yield," said Kass in July.

Kass pointed out that short-term Treasuries yielding over 5% are a viable alternative to stocks, likely creating a significant headwind for equities.

"The S&P dividend yield is only 1.50% compared to the yield on the one-year Treasury note of 5.40% — that's the largest gap in decades," said Kass at the time. “The Price Earnings Ratio of the S&P Index (excluding technology/AI) is above 18x, well above the 15.5x-16.0x average over the last five decades.”

More From Wall Street Analysts:

- Tesla analyst who told investors to ‘nail down profits’ in August has a new price target

- Analyst who predicted Nvidia’s rally has a new price target (many investors won’t be happy)

- 'Market Wizard' stock analyst says we've seen the peak in technology stocks this year

Treasury yields have become an even more significant headwind for stocks over the past few months. Surging oil and gas prices caused CPI inflation to reaccelerate to 3.7% in September from 3% in June.

Worry that rebounding inflation would mean the Fed would have to abide by its “higher for longer” mantra caused the 10-year Treasury note to join short-term bills as a high-yield alternative. The 10-year yield reached 5% on Oct. 23, up from below 4% in July.

Since the 10-year yield is commonly used as the risk-free rate in equity valuation models, and higher rates reduce investors' willingness to pay up for future earnings, the S&P 500 has retreated 10% from since mid-July.

Markets don’t go up or down in a straight line

Kass’ approach to volatility this year has been to trade it unemotionally. While he’s still concerned, he’s starting to find more ideas he can buy long than sell short. As a result, Kass has tilted assets at his Seabreeze Partners net long.

“I have built up my long book back to the highest levels since the spring,” wrote Kass in his daily trading diary on Real Money Pro. “Still small-sized but moving towards medium.”

Kass hasn’t forecast if he plans to stay long for days, weeks, or months. What he has said suggests that he’ll continue to trade opportunistically, buying recent weakness, and ostensibly, selling again when things get frothy.

For now, Kass is buying weakness in the S&P 500 and Nasdaq 100. He’s also bought shares in Disney (DIS) -), Warner Brothers (WBD) -), Paramount (PARA) -), and Bank of America (BAC) -), expecting each will benefit short-term as selling gets exhausted and stocks claw back some of their recent losses.

He also covered short positions in a number of stocks, including Starbucks (SBUX) -), electric-vehicle Goliath Tesla (TSLA) -), and homebuilder D.R. Horton (DHI) -).

That’s not the only thing Kass is doing. He’s also established what he describes as a large position in the 20+ year Treasury ETF, a position he recently picked as his “Single Best Trade” for TheStreet.com.