Moderna (MRNA) shares have been bold in the headlines the past few days.

On Wednesday the drugmaker's shares erupted 17% at one point, then closed 8.3% higher. The rally came on news that Moderna and Merck (MRK) would work together to develop and market an mRNA structured cancer vaccine.

It also reflected news that Moderna and Pfizer (PFE) received Food and Drug Administration approval for booster shots in children as young as 5.

MRNA shares are down about 2% at last check, but the fall in the overall market -- which can be attributed to the hotter-than-expected inflation report -- is likely having an outsized effect.

Moderna and the S&P 500 are trying to rally off the morning lows, but investors' bigger question for Moderna is more straightforward: Has the stock bottomed?

Trading Moderna Stock

Chart courtesy of TrendSpider.com

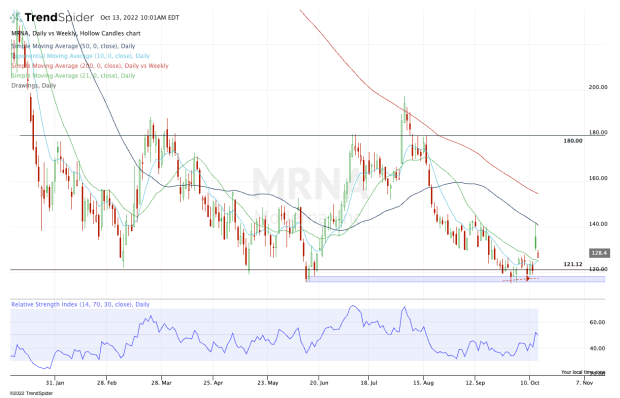

As we look at yesterday’s price action, Moderna stock suffered a clean rejection from the 50-day moving average.

Largely, though, this stock has been range-bound, trading mostly between $180 on the upside and $115 to $120 on the downside.

Amid the latest pullback, Moderna stock may have given bulls a double-bottom to work with, as support came into play in a key zone. Not only was the $115 level the low from June, but it’s also where the newly established 200-week moving average came into play.

The rally out of this zone was impressive, even if it did fail at the 50-day.

From here, Moderna stock would have done well to fill Wednesday’s gap down at $124.78. But for now, it’s holding the 10-day and 21-day moving averages. That's constructive.

Aggressive bulls — and I do mean aggressive, given the current climate — can justify a long trade position in Moderna, so long as the stock remains above the 10-day and 21-day.

If it breaks these measures, then those bulls will have to count on the gap-fill to buoy the stock price, and I just don’t think that’s reliable enough. Instead, it likely opens the door back down to the $115 to $120 area.

On the upside, let’s see if Moderna stock can give bulls another rally back up toward $140 and the 50-day moving average. To get there, it will likely need some cooperation from the broader market, but if we see this area, then it’s likely a spot to book some profits.