Half of UK children will be in families that cannot afford the cost of living by April this year, new analysis warns, and may be forced to sacrifice daily essentials like putting dinner on the table.

The report – by the New Economics Foundation (NEF) – found that by next month, 23.4 million Britons will be short by more than £8,500 a year when it comes to paying for necessities such as heating, food and clothes.

Using the Minimum Income Standard (MIS), which is the UK’s leading approach to measuring living standards based on need, and is used to calculate the “real” Living Wage, researchers estimated that around 43 per cent of families in the northeast of England, 41 per cent in Yorkshire and the Humber, 39 per cent in the West Midlands and 38 per cent in London, will all be living below the MIS threshold in a matter of weeks.

As well as calculating each region’s cost-of-living crisis, the NEF looked at the extent to which people’s incomes within those areas fall short amid increasing prices. In the northeast, Britons are missing out on a “good standard of living” by £8,900 a year. In the West Midlands and London, the figure is slightly higher at £10,100.

Couples with children will also miss out on the same standard of living by £9,600 a year and single parents by £8,700, on average.

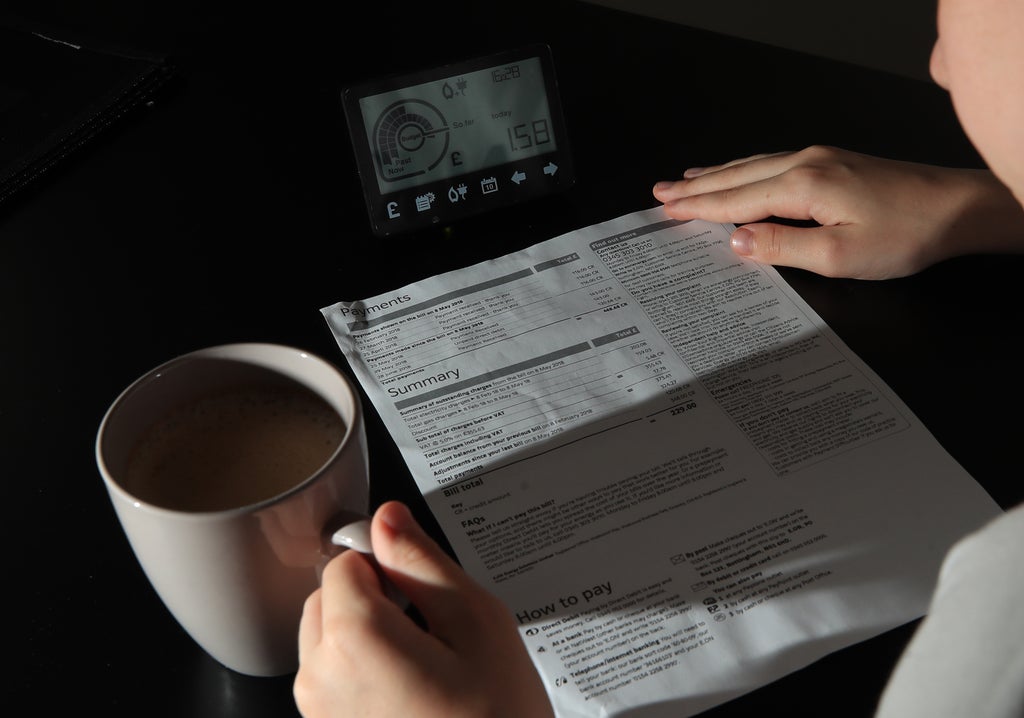

It comes amid a perfect storm of price hikes already affecting families across Britain, ranging from rising energy bills and petrol costs through to Universal Credit cuts and tax hikes set to impact working families the hardest.

Inflation is forecast to surge to eight per cent later this year and households face a big rise to the cost of gas and electricity when Ofgem’s price cap jumps by more than half on 1 April.

Labour leader Keir Starmer said this week that the typical energy bill will increase by £700 due to pressures which existed before Russia’s invasion of Ukraine, as Boris Johnson’s government attempted to blame the conflict in eastern Europe alone for rising oil prices.

Sir Keir called for a “windfall tax” on the profits of gas and oil firms to generate further funds to help working families.

The government will give all 28 million households in Britain a £200 up-front rebate on their energy bills from October, which will be recouped by hiking bills £40 per year from 2023 to 2028.

Meanwhile, with the war in Ukraine continuing to send crude prices rocketing, petrol prices in the UK soared again on Thursday to 161.1p – up from 159.6p a day earlier, according to the data firm Experian Catalist.

Both the US and UK have announced an outright ban on buying Russian oil supplies by the end of the year, as a result of Vladimir Putin’s war – leaving the global market at risk of yet more price rises.

However, an AA fuel price spokesman said on Friday that reductions in wholesale costs this week “offer the hope that pump prices may now level off and hopefully fall”. Luke Bosdet said: “The squeeze on the finances of families with cars continues but the apocalyptic pump price predictions seem much less likely to happen.”

Rishi Sunak, the chancellor, will reportedly not include a new package to help people cope with energy bills in his spring statement and is “highly unlikely” to cut fuel duty, according to The Times, which cited a government source as saying that fuel duty cuts will be considered later in the year.

“Energy bills in April have not changed because Russia has invaded Ukraine ... The price cap was set before then,” the source said.

“There will be another decision to be made in the autumn when we have a clearer picture of the outlook for energy prices.”

The NEF, which conducted the latest research, has called for the creation of a new social security system to set an “income floor” based on the MIS, which no one can fall below whether they are in or out of work.

To achieve this, the foundation laid out three steps for the government follow: auto-enrol everyone in the UK on the Universal Credit system; restore the £20 uplift for Universal Credit and extend to all other means-tested benefits; and invest a further £7-8bn in Universal Credit to reverse all of the cuts since 2010.

“The cost of living is increasing faster than at any point in recent history,” Sam Tims, an economist at the NEF, said. “While all families are set to feel a squeeze come April, the lowest income households will be hit proportionately harder.”

He added: “The cost of living is only a crisis when people cannot afford it and government support must be able to flexibly respond to this. There is little time left for the chancellor to take action to avert the worst real-terms incomes squeeze in 50 years.”