The latest figures are in from the ol' Peddmeister Massive and they show graphics card sales have increased for the third straight quarter. The best news comes from comparing the most recent quarter in these new Jon Peddie Research figures, that of Q4 2023, to the same period in 2022 with a resulting 32% year-on-year increase.

But for AMD the numbers still look grim. Its latest GPU family is also its worst performing in over 20 years when it comes to its impact on market share.

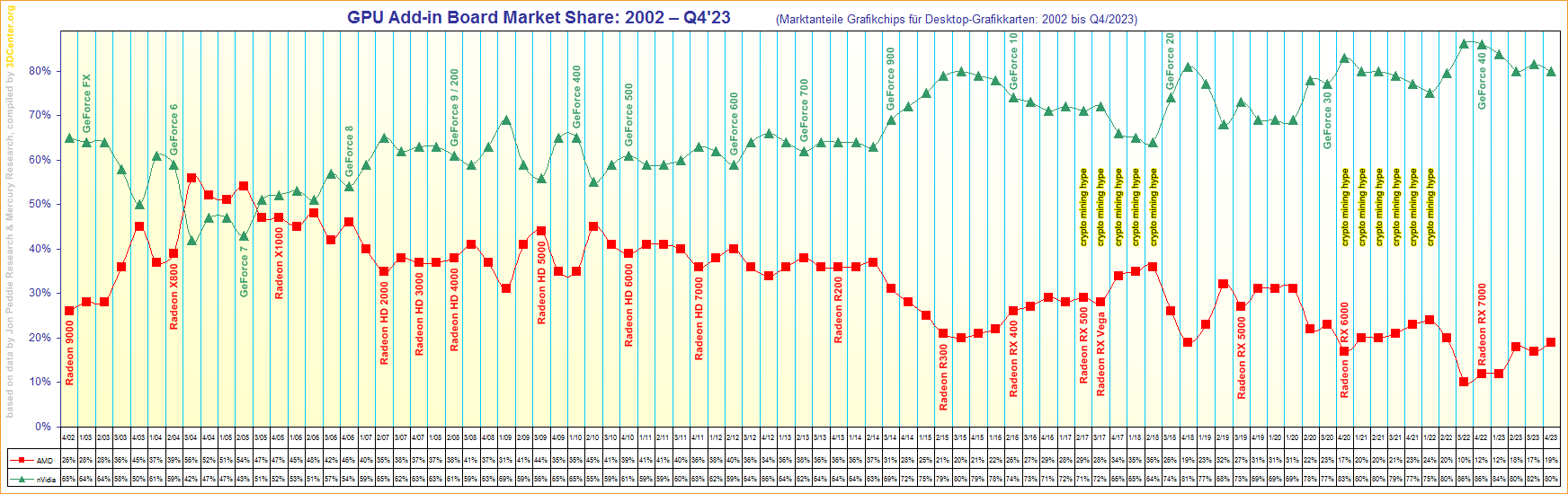

For AMD, the best spin you can put on the figures is that its market share increased from a fairly pitiful 12% in Q4 2022 to a merely mediocre 19% for Q4 2023. Jon Peddie has Intel at just 1% share for the most recent quarter, which sounds about right; Arc graphics are pretty much nowhere.

But there's no getting around the fact that AMD's latest RX 7000 series is its worst-performing family of GPUs in market share terms, since JPR's data began over 20 years ago. Yup, the RX 7000 family has less market share than the RX 6000 achieved, which remarkably has worse market share than AMD managed with the RX 5000 and its limited range of GPUs which topped out with the RX 5700 XT.

And perhaps the fact the RX 5000-series did so well in market share helps explain rumours of AMD not bothering with the high end market with its upcoming next-gen GPUs. If it can achieve over 30% market share with a more limited range of graphics cards, which JPR's numbers indicate for the RX 5000 era, then you can see why AMD might take that approach again. Mostly the same market share but lower capital expenditure on a more limited range of GPUs seems like a strong business case.

This excellent graphic from 3DCenter shows precisely the issue facing AMD over the past 20 years or so.

Moreover you have to go all the way back to 2005 to find a quarter where AMD, or ATI as it was known then, outsold Nvidia. The trendline since then has been all one way and the new RX 7000 does nothing to change that.

Intriguingly, according to JPR's numbers, the real damage was done during the GeForce 900 and Radeon R200 era, when market share split for AMD dipped from about 65-35 in Nvidia's favour to more like 80-20, with AMD's share trending more gradually down to an all time low of 86-10 in Q3 2022.

Getting back to the broader market, JPR says that GPU sales were up by 6% in Q4 over Q3 to 9.5 million units, and thus that's three quarters on the trot of improved volumes.

Best CPU for gaming: The top chips from Intel and AMD.

Best gaming motherboard: The right boards.

Best graphics card: Your perfect pixel-pusher awaits.

Best SSD for gaming: Get into the game ahead of the rest.

However, JPR's numbers also show that sales remain much lower in unit volume terms than during that weird pandemic boom. From Q2 2022 through and including Q2 2022, at least 10 million graphics cards were sold per quarter, with several quarters at or above 12.5 million units.

So, the latest figures remain a long way off the peak and indeed a little below the most recent pre-pandemic quarter.

As a final little snippet of overall context JPR has this intriguing data point. Since 2000, over 2.3 billion graphics cards worth $482 billion have been sold. That's an awful lot of pixel pumping power.