Telsa Inc (NASDAQ:TSLA) CEO Elon Musk offered to buy 100% of Twitter Inc (NYSE:TWTR) for around $43 billion.

What Happened: Musk’s offer to buy the platform for $54.20 per share is a 54% premium over the closing price of Twitter before he began investing in it and a 38% premium over the closing price before his investment was publicly announced.

Twitter’s board is currently reviewing Musk’s offer with Goldman Sachs Group Inc (NYSE:GS) and Wilson Sonsini Goodrich & Rosati, as per a report from Reuters.

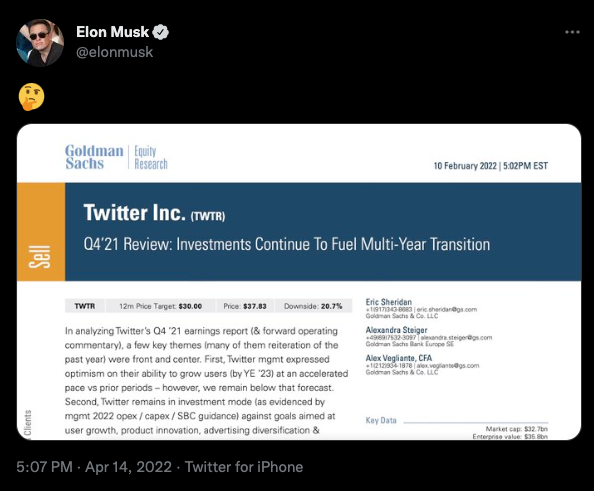

In an equity research report published in February, Goldman Sachs arrived at a 12-month price target of $30 for Twitter.

— Elon Musk (@elonmusk) April 14, 2022

Goldman analysts estimated a 20.7% downside for Twitter which was trading at $37.83 at the time of publishing the report. Analysts expressed a lack of confidence in Twitter’s ability to grow its userbase at an accelerated pace vs. prior periods.

Musk shared an excerpt from the report on Twitter, seemingly to highlight Goldman’s low forecast for Twitter.

He’s attacking them because they advised Twitter to not sell to musk today because they thought the offer was too low while in reality they have a sell rating. That’s what he is alluding to.

— HWZ Investments (@HwzStock) April 14, 2022

The Tesla CEO also stated that “it would be utterly indefensible” for the board of directors to arrive at a decision without putting the offer to a shareholder vote.

Absolutely. It would be utterly indefensible not to put this offer to a shareholder vote. They own the company, not the board of directors.

— Elon Musk (@elonmusk) April 14, 2022